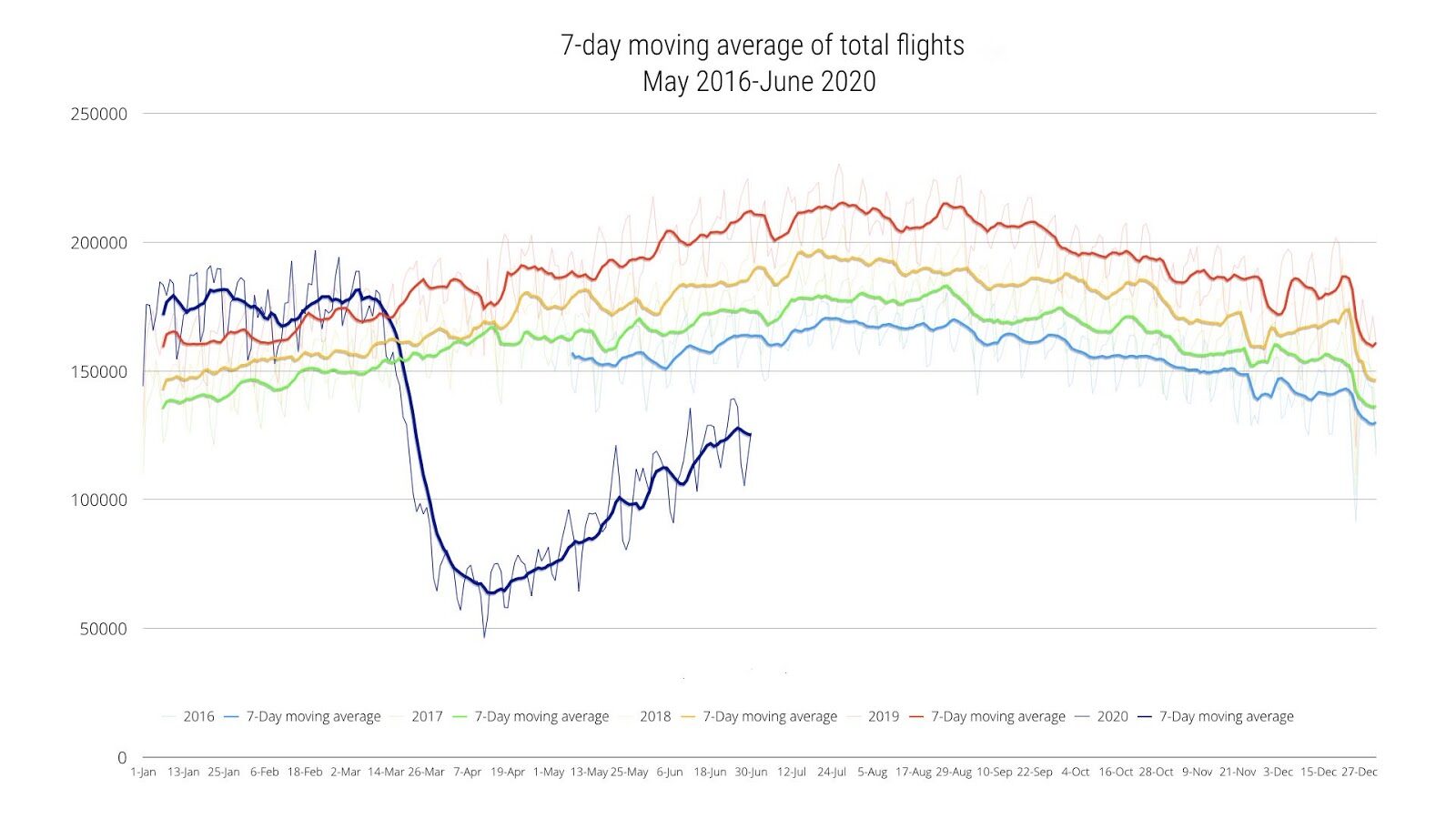

Global Flight Activity Rose in June, But Has a Long Way to Go to Full Recovery

Source: Flightradar24

The global aviation industry saw a rise in activity in June, yet total flights are still down 42% this year compared to 2019, as a result of the coronavirus crisis. Commercial flights are down by 62% compared to last year, however they did increase by 32% in June 2020 compared to May, according to Flightradar24, a global flight tracker.

A recent report by Airlines for America predicts that it will take until 2023 to see a return of pre-COVID passenger volumes within the U.S. The pandemic has already forced the airline industry to cut tens of thousands of jobs — and more layoffs are expected to happen in the upcoming months.

American Airlines plans to add 2,000 flights a day starting in July, while United Airlines will be adding 25,000 flights in August. American Airlines is facing criticism for allowing full-capacity flights, despite the recent uptick in coronavirus cases in the U.S. The U.S. administration has not mandated mask-wearing, social distancing or temperature checks at airports or on flights.