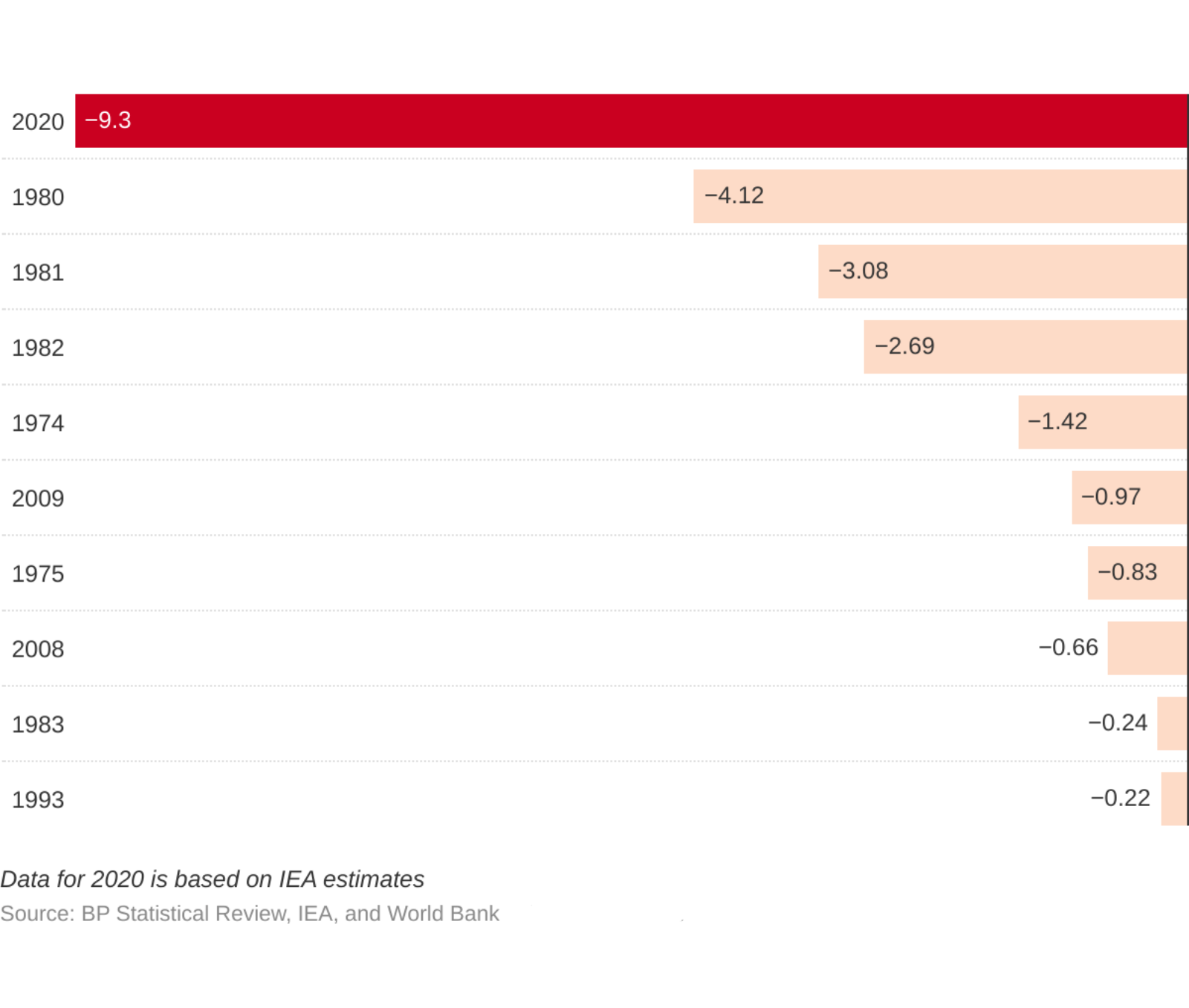

Plunge in Oil Demand Far Worse Than Previous Recessions

Source: BP Statistical Review, IEA, and World Bank

The severe shock to the oil industry caused by the COVID-19 pandemic is far worse than previous recessions, World Bank data shows. Reflecting the steep drop in prices, demand for oil has dropped markedly by 9.3%. By comparison, the Great Recession of 2008 only saw a demand drop of 0.66%.

The sharp drop in demand is owed to global social distancing measures, which have essentially cut excess need for electricity and fuel for transportation. But the world had seen an oversupply of oil even prior to the pandemic, largely due to stiff competition between Saudi Arabia and Russia for increased market share. The International Energy Agency says the plunge in oil demand is “staggering”, with renewable energy set to make up 30% of this year’s demand for electricity.

Oil prices are now expected to average $35 per barrel in 2020 — a huge decrease from the October 2019 forecast of $58 per barrel and a 43% drop from the 2019 average of $61 per barrel. The U.S. administration is weighing possible bailout options, but so far Congress has declined this option. The pinch has been felt by major oil companies, with reported staff layoffs and a 25%-35% reduction in spending on new production.