Public Views of US Business Sectors Are Plummeting

Americans rated U.S. business industries at their lowest points since 2011 during the COVID-19 pandemic. The average record-low, according to Gallup, was during the 2008 Great Recession at 34% — just five percentage points lower than the current average of 39%.

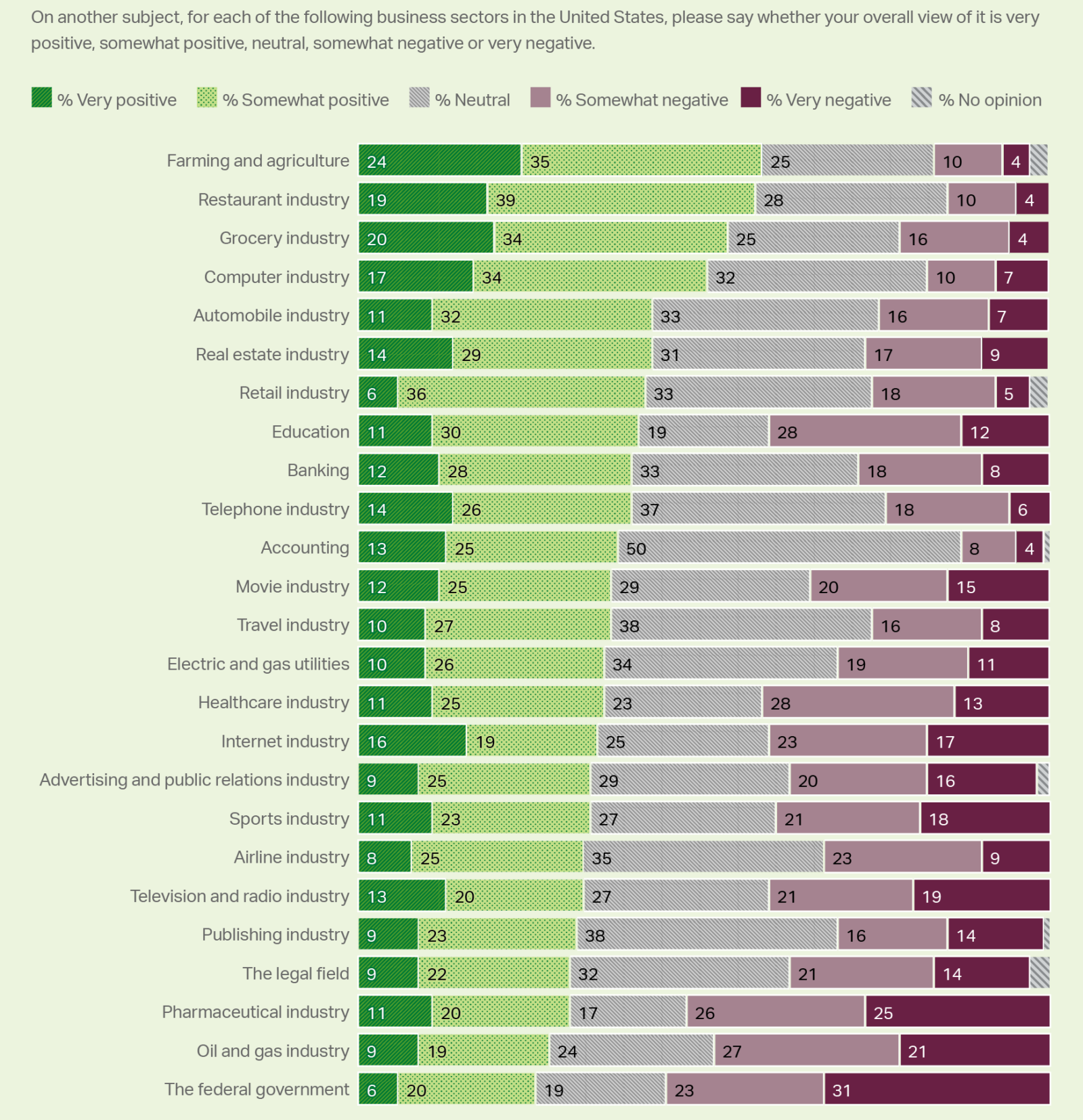

Of the 25 industries ranked, the federal government, the most negatively rated industry since 2014, was again viewed the most negatively by the American public at 31%, followed by the oil and gas and pharmaceutical industries. This year, Americans rated a mere four industries positively — farming and agriculture at 59%, restaurants at 58%, the grocery industry at 54% and the computer industry at 51%. In the past three years, farming and agriculture and the restaurant industry were the top-ranked sectors.

Public sentiment toward certain sectors is related to how they responded to the pandemic, states Gallup. However, as a whole, the public has trusted businesses more than other institutions during the pandemic.