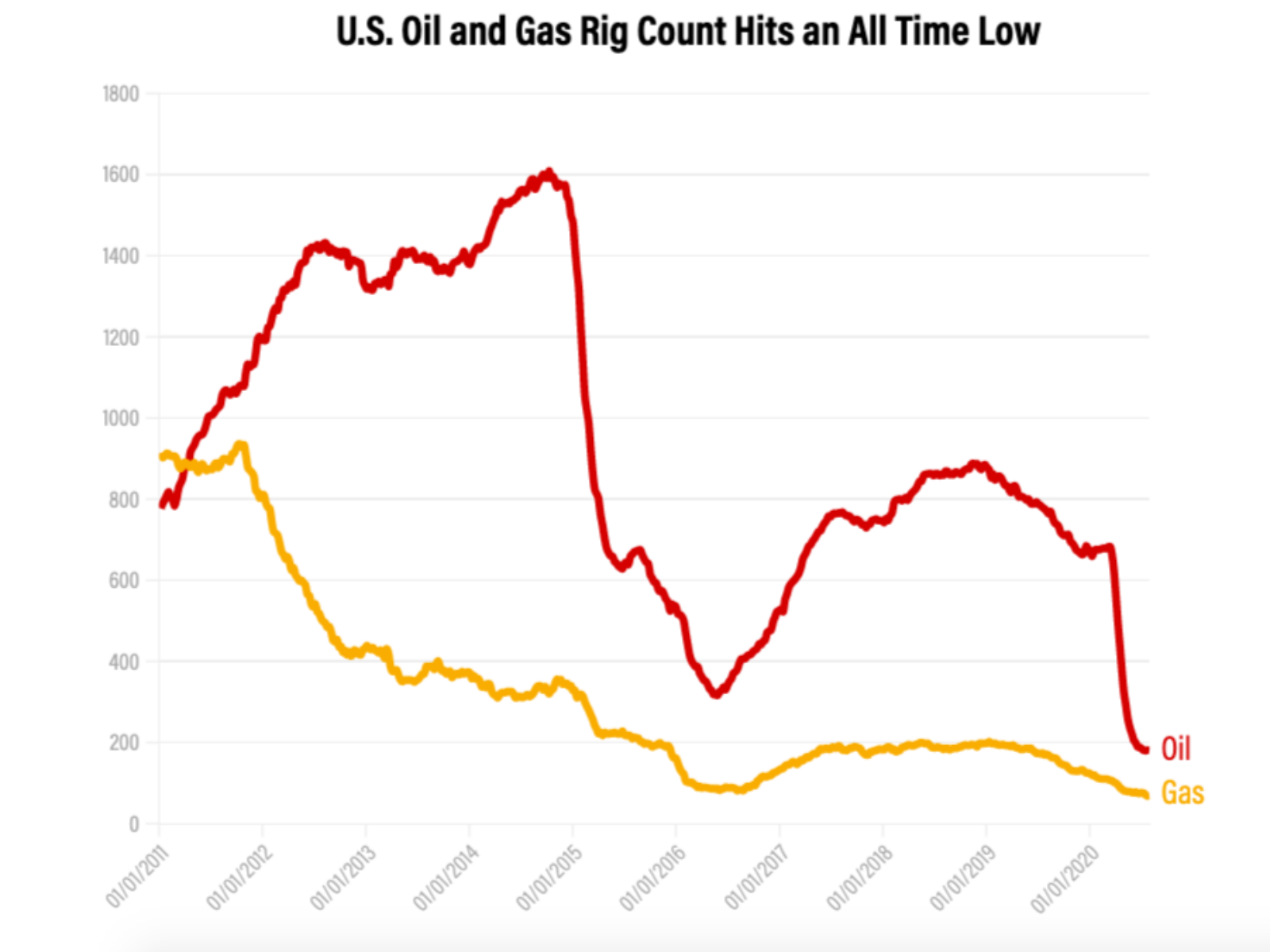

US Active Oil Rig Count Collapses From COVID-19

Source: Baker Hughes, North America Rig Count

The U.S. active oil and gas rig count hit a record low of 251 in July due to the economic damage caused by the COVID-19 pandemic — the year started with the rig count at 796. Prior to COVID-19, the lowest rig count was 404 during the oil crash of 2014.

Texas, the largest oil-producing state in the U.S., lost 336 land rigs this year. Each of these rigs creates an estimated 31 jobs immediately and more than 300 in the long term.

The pandemic first majorly impacted the oil industry at the beginning of March 2020 when oil prices plummeted. By August, the oil industry had lost more than 100,000 jobs. Although the U.S. administration implemented measures to bail out big oil companies, thousands of workers are still struggling financially. Devashree Saha of The World Resources Institute states that government responses need to prioritize workers and communities to ensure they “are not collateral damage in the pandemic-fed downturn or during the longer-term energy transition.”