US Women Bear the Burden of Child Care and Home Schooling

Source: The United States Census Bureau

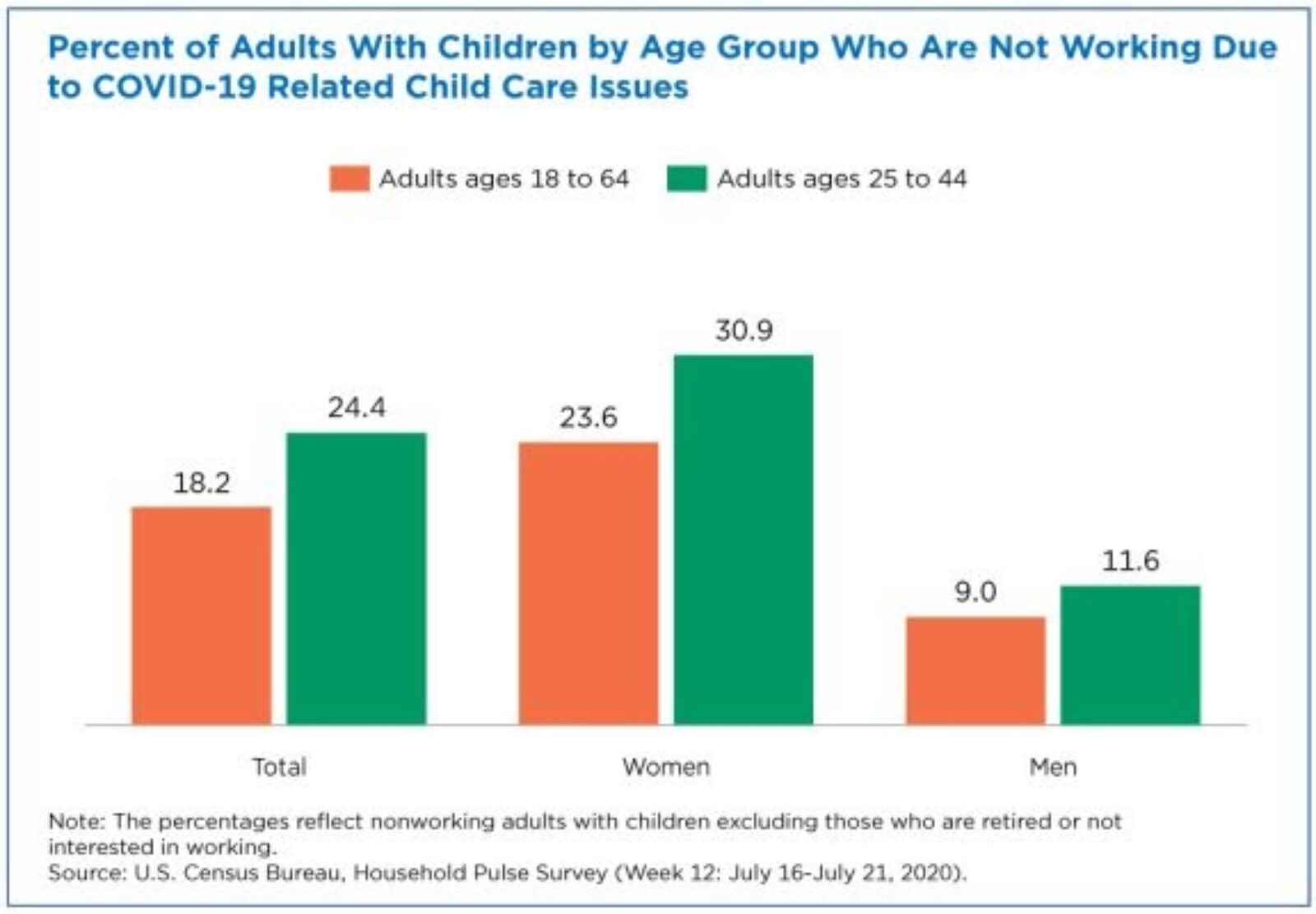

One in five working-age adults in the United States say they are not working because the pandemic disrupted their child care arrangements. New data from the U.S. Census Bureau shows women are nearly three times as likely as men to leave their job due to child care and home-schooling demands.

The burden of child care disproportionately falling on women reveals the persistence of prohibitive expectations for women’s roles in society. Since the pandemic hit, many men have been “encouraged to enhance productivity with flexible working and reap the rewards for such,” while, generally, women have been expected to “increase their unpaid labor capacity — more family and home responsibilities,” according to Michelle Mielly, business ethics expert, and Lena Kurban Rouhana, a researcher on flexible work and the career trajectories of women.

Many are questioning what long-term effects this will have on women’s careers as they face setbacks in their incomes and career progression and slowing momentum toward gender equality. Now, businesses are in the midst of determining how best to support their employees who are also parents, while it remains unclear whether schools will reopen in the fall.