Robo Advisers: Why No Mass Adoption Yet?

Investors look at an electronic board showing stock information at a brokerage house in Shanghai. Robo advisers have not yet effectively succeeded in getting consumers to start saving.

Photo: Johannes Eisele/AFP/Getty Images

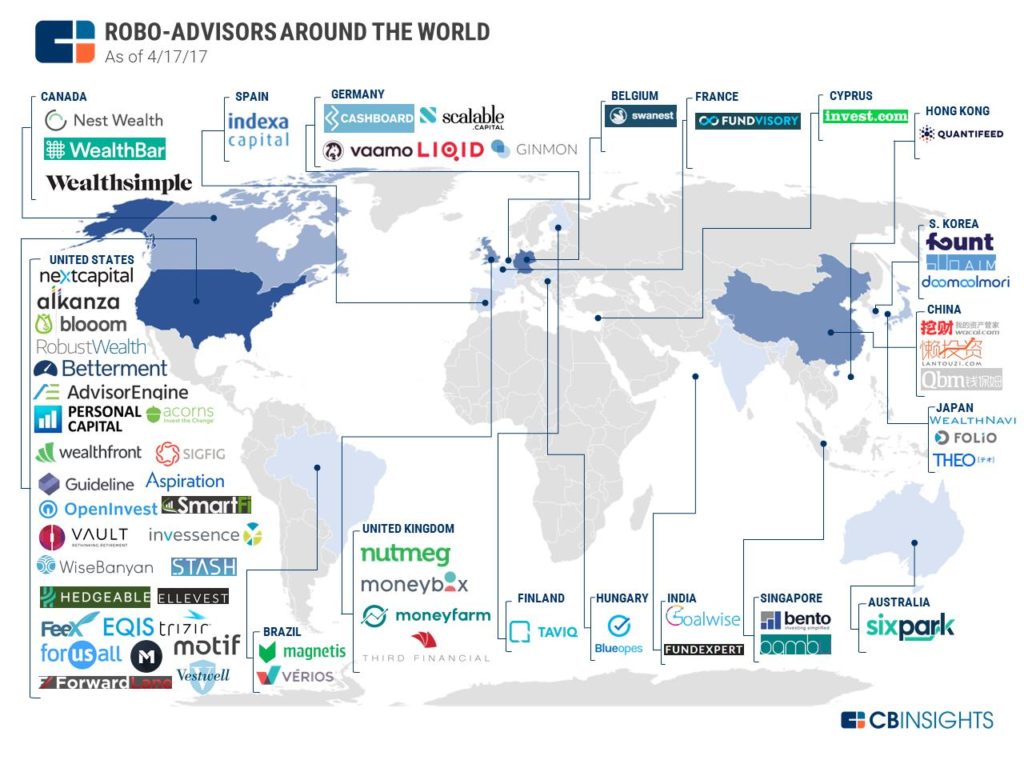

There are now several robo advisers around the world and particularly in the U.S., where the trend started. Increasingly, we are seeing robo advisory firms pop up in Asia (see Exhibit 1) as the region’s startups and financial institutions start jumping on to the fintech bandwagon.

Many see robo advisory as an industry with the promise of bringing about a change not just in terms of how wealth is managed, but also behavioral change in terms of getting erstwhile non-investors to start investing, perceivably at the proverbial click of a button. Yet, collectively, how effective have all these robo advisers been in this regard over the past decade?

Exhibit 1: Robo advisers around the world

The effectiveness of robo advisers should be measured by the number of new consumers who have started long-term investment portfolios for savings and who previously didn’t invest anywhere.

Proxy data points on the amounts saved in 401(k) accounts do not point toward a bright inference. In total, the three top robo advisers in U.S.—Betterment, Wealthfront and Charles Schwab—have about $35 billion in total assets under management, and their year-on-year increase is dwarfed by the year-on-year increase in the amount of 401(k) contributions. A possible inference from this data point is that robo advisers have not led to drastic behavior change and have not effectively got consumers to start saving.

The Research

Why haven’t robo advisers gained mass adoption? A series of 40 one-on-one interviews conducted by the author with consumers in India revealed some interesting insights.

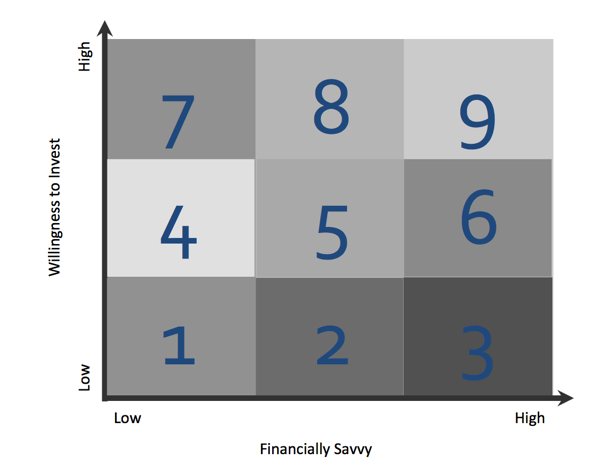

Based on the interviews, a new framework (Exhibit 2) was developed to assess consumers. An average consumer can be placed on a scale of financial savviness vis-à-vis willingness to invest.

Those ranked low on the “financial savviness” spectrum (x-axis in Exhibit 2) have little to no idea about investment avenues such as stocks/equities and bonds, for example. Those at the middle of the band may know what equities are, but their understanding of investment avenues such as exchange-traded funds is low to nonexistent. And finally, those who rank high along this spectrum (zones 3, 6 and 9) have a thorough understanding of ETFs, fixed income and equity indices. Their understanding of personal money management—for example, how much of their savings should be held for emergencies, residential mortgages, and fixed income and equities, is high.

Exhibit 2: Consumers’ willingness to invest vis-à-vis financial savviness

Similarly, those at the lower end of the “willingness to invest” spectrum (y-axis in Exhibit 2) will only put money in the bank and not into anything else. Being safe is their main mantra. Move upward along the scale, and there are consumers who are ready to allocate money to somewhat riskier assets such as real estate and gold. And finally, those who are already investing in riskier assets lie further along the spectrum (zones 7, 8 and 9).

The Findings

Consumers in zone 9 just want to maximize returns on their investments. They either manage their own finances or work with trusted financial advisers. They tend to be in the early to middle parts of their careers. If they are young (early 20s), then they come from a family whereby investing is a part of the family’s history, and hence they are comfortable with investments and have been financially aware since their teenage years. There are a sufficient number of services within existing banks and brokerage companies to cater to their needs. Innovation in this zone is centered on helping these people make better investment decisions through comparison websites such as MarketWatch, crowdsourcing research such as ZeroHedge, crowdsourcing trades such as eToro, or through lower costs (ETFs).

At the other end of the spectrum, those in zone 1 are both not very financially savvy and have a low willingness to invest. The research found the reasons for this can be manifold—bad experiences with investments among family members leading to the perception that risky investments are “bad,” possibly the lack of adequate disposable income, the wrong perception of high capital requirements to start investing, or the lack of a willingness to know or find out more to invest.

The inability of robo advisers to move consumers from zone 1 to zone 9 is what is resulting in the lack of mass adoption of robo advisory in Asia and around the world. One of the key factors that can lead the move of people from low financial savviness to high financial savviness is education.

That said, there are sufficient means—including friends, families, colleagues, financial advisers, the Internet—to help people increase awareness of investment options and to understand personal money management. Yet, the move toward becoming more financially savvy is slow. This could simply be a matter of intent. It must be borne in mind, however, that a move along the x-axis is also dependent on a consumer’s position on the y-axis.

Challenges in Moving Up the ‘Willingness to Invest’ Axis

There are a variety of reasons consumers are not willing to invest:

Category 1. They feel they don’t have enough capital to start investing. Sometimes this is correct, but often this is a misplaced notion.

Category 2. Individuals have a negative emotional bias owing to the poor experiences of family and friends who may have lost significant savings in the stock market, for example.

Category 3. They feel that they are not ready yet.

Category 4. A lack of interest or desire to know more.

There are many solutions to help people in category 1. For example, among the consumers we interviewed, some thought that one needs a minimum balance of capital to begin with, but that is not true anymore.

Converting people in category 2 is difficult, given that subconscious biases can only be addressed through data. There is a possibility of change when they see friends or families getting good returns from their investments, and that can trigger a change in view.

People in category 1 and category 2 usually do not move along the axes of financial savviness because they don’t feel the need to do so unless they overcome their misconceptions and/or biases.

To cater to people in category 3, there are a lot of mock trading/investing apps that can help people feel comfortable trading with mock money and live market data, with the hope of getting them to move up the axes.

The Opportunity

In my view, the big area where innovation is lacking and where we could see a real change is in category 4.

Here, firms need to help potential customers shake off their ambivalence and get them to take the first step toward investing. Doing so can help robo advisers become more effective, where effectiveness is measured not in terms of returns or the amount of capital managed, but in terms of actually growing the universe of individuals who are investing.

The expectation that making investing possible with the proverbial “click of a button” will result in more people investing has not really come to fruition. Rather, behavioral change is required for this category of consumers, and bringing that about is challenging. But robo advisory firms need to find triggers that can get individuals to start investing. Owing to the lack of a sense of urgency and consumer bias for instant gratification, it is hard to find such triggers.

The robo adviser who finds a trigger to change behavior will unearth the holy grail of robo advisory business models.