The Chinese Medtech Market: Plenty to Play For

A woman pushes a wheelchair-bound elderly man down a street in Shanghai. The Chinese population is aging and chronic diseases are becoming more prevalent.

Photo: Johannes Eisele/AFP/Getty Images

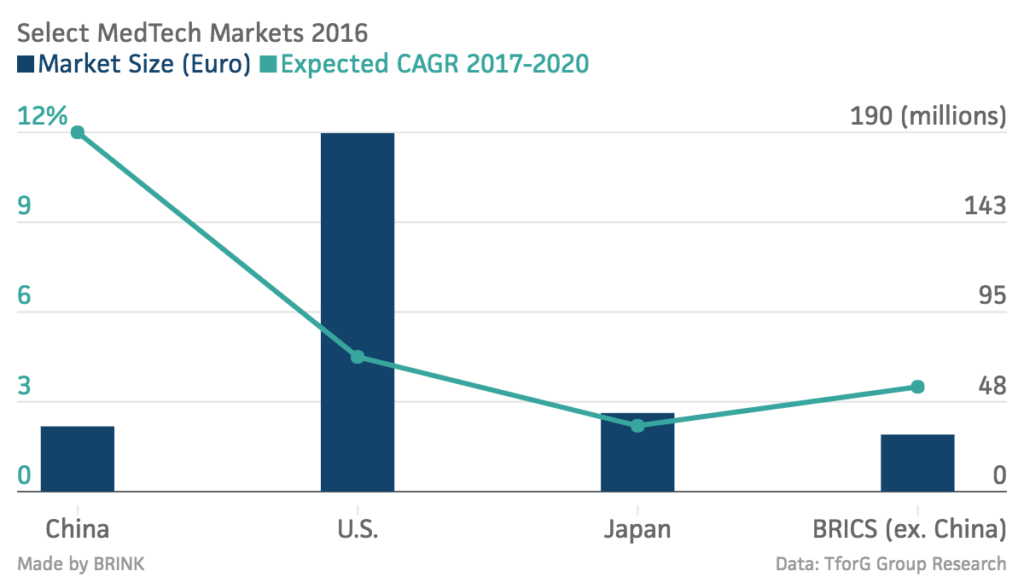

The Chinese medical technology (medtech) market is the third largest in the world, and expected to be the second largest worldwide by 2020, with steady growth of more than 10 percent expected in the coming years.

In 2016, the size of the Chinese medtech market was estimated at almost 35 million euros ($39.75 million), ranking just behind global leaders the U.S. and Japan. Although the growth of the Chinese medtech segment has slowed from almost 18 percent to 11-13 percent in recent years, China remains one of the most attractive markets.*

Traditionally, Chinese companies have dominated the low end of the markets, but a few years ago, the government started to launch a number of initiatives promoting innovation in the local medtech industry and changed the industry’s dynamic.

The Innovative Medical Device Assessment office (part of the Chinese Food and Drug Administration) provides grants and loans to local companies to support R&D in segments such as diagnostic imaging and cardiovascular implants, to name a few. These initiatives, together with reforms in reimbursement and tendering processes, have strengthened the competitive position of local companies. Today, this is reflected in an increasing share in the growing mid-portion of the market.

The Chinese Health Care System in Numbers

In 2016, China spent 5.88 percent of GDP on health care, of which 3.28 percent came from public sources. Health care expenditures are expected to increase annually by approximately 3 percent leading up to 2020.

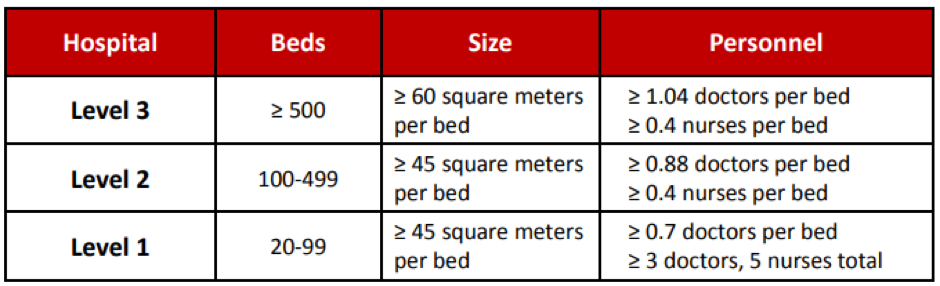

In total, there are 8,512 acute care hospitals in China (where patients are treated for brief but severe episodes of illness), of which 1,558 are level 2 hospitals and 6,954 are level 3 hospitals (level 1 hospitals are not acute care hospitals). Together these hospitals represent 3,543,443 acute care beds.

Exhibit 1: Requirements for public hospital classification

Source: NHFPC, China Health Statistical Yearbook 2008, in Global Hospital Management Survey – China: Management in Healthcare Report

Medtech Market Drivers in China

Demographics: The size of the Chinese market is the primary factor driving China’s health care market. Effective control, far-reaching mechanisms, and Chinese government regulations for domestic and foreign business activities to create structural improvements and change are in many aspects unique to China’s size.

The Chinese population is aging and chronic diseases are becoming more prevalent. In fact, 330 million Chinese citizens currently have chronic diseases. The Chinese middle class exceeds the population of the U.S. or Western Europe and is facing more lifestyle related diseases. They are also expecting more and better health care services.

Health care reforms and new policies: The share of health care expenses covered by the government will increase from 30 percent in 2010 to 40 percent in 2020. Nevertheless, regional inequalities in access to and quality of care will remain. Other changes include cost control through packaged pricing policy, for example, allowing hospitals to charge a fixed amount for a specific procedure. This reimbursement policy results in using fewer and lower cost products. Limited channel markup intends to limit the markup added by distributors, which will affect the partner strategy for many medtech manufacturers.

Shift in provider landscape: The government wants to boost the role of local hospitals (level 1 hospitals) in low- and mid-range care. They also intend to reroute part of the patient referrals from reference centers (level 3 hospitals) in tier I cities to level 2, and 3 hospitals in tier 2 or 3 cities. Different reimbursement tariffs for the respective types of hospitals have to manage the patient streams. This will challenge the efficiency and profile of the sales and distribution resources of medtech companies.

Separately, the private sector is expected to play a larger role in acute care. Despite the fact that this process is proceeding slower than expected—since no specific action plans have been put into place—the number of private hospitals and clinics is increasing rapidly. Today we see an increasing presence of Chinese private investors in local (level 1 and 2) hospitals that are operating in a difficult financial context, as well as an increase in military hospitals.

Steps for Medtech Businesses in China

Keeping in mind China’s quintessential vastness of stakeholders, and its large and intricate social and organizational character, its complexity is what typifies it. Accordingly, the reimbursement system that it has developed is appropriate to its profile and is relatively functional and adequate.

With the appropriate insights and market expertise of Chinese policies and market regulations, medtech businesses can perform well in China and both parties can benefit.

Key success factors include:

Prepare. China requires a different preparation and form of operation; companies should be aware of and prepared for this before marketing their product locally.

Build real partnerships. Find local partner and/or staff who can be trusted, and who trusts you, to bridge language barriers, to tap into regional networks and contacts, and to facilitate an understanding and entry into the national/regional business culture.

Understand. Grasp the complexity of the differences in reimbursement, tendering and bidding, buying power, local competition and the like in the different segments in order to optimize pricing and marketing strategy and the adoption/integration of the product into the treatment protocols of Chinese medical practices.

Set priorities. It requires a much more rigorous prioritization of resources and a specific, dedicated, new and improved sales process.

In addition, new medtech businesses intending to enter the Chinese market must be aware of the market’s unique characteristics and must be cognizant that setting up for commercialization in China requires a strategy and business model that covers various market segments, regions and types of hospitals.

Moreover, there are other more general aspects such as a rigorous prioritization of resources and solid sales processes that are important as well. And finally, those entering the market need to have a thorough understanding of the purchase policies of hospitals linked to the acquired technology, the types of treatments offered and the coverage available for those types of treatments.

*This data has been gathered through desk-research and limited primary-data investigations, performed by TforG’s Shanghai-based Greater China regional office and their principal EU headquarter field research team.

A second piece focused on the regulatory developments in the health care space will appear on BRINK Asia in two weeks.