The Growth of Esports Calls for a Strategic Battle Plan

The start of the 2019 Fortnite World Cup Finals on July 27, 2019, in New York City. When the world turns the corner on COVID-19 and events re-emerge, esports tournaments will face the same risks as do other large gatherings.

Photo: Johannes Eisele/AFP via Getty Images

Game time: Which of the following statements about esports are true?

- The U.S. Army has a team.

- The 2019 Southeast Asian Games awarded 18 medals in esports.

- Denmark’s government has an official esports strategy.

- Esports’ annual revenue will soon top $1.5 billion.

- Geopolitical tensions pose a genuine threat to esports’ growth.

- All of the above.

If you chose “#6,” you win … all of the above.

The Growth of Esports

Not every industry can point to a specific starting date, but most people trace esports history to October 19, 1972, when some Stanford University students met at the school’s Artificial Intelligence Laboratory to compete in the first Intergalactic Spacewar Olympics. The grand prize: A year’s subscription to Rolling Stone magazine.

Cue up today’s prizes: One player from Denmark earned more than $3 million in 2019, according to industry media reports. And the prize money is only likely to grow as the audience increases. Industry experts project the esports audience to close in on 500 million viewers during 2020 and 650 million by 2023, though COVID-19’s role remains to be seen.

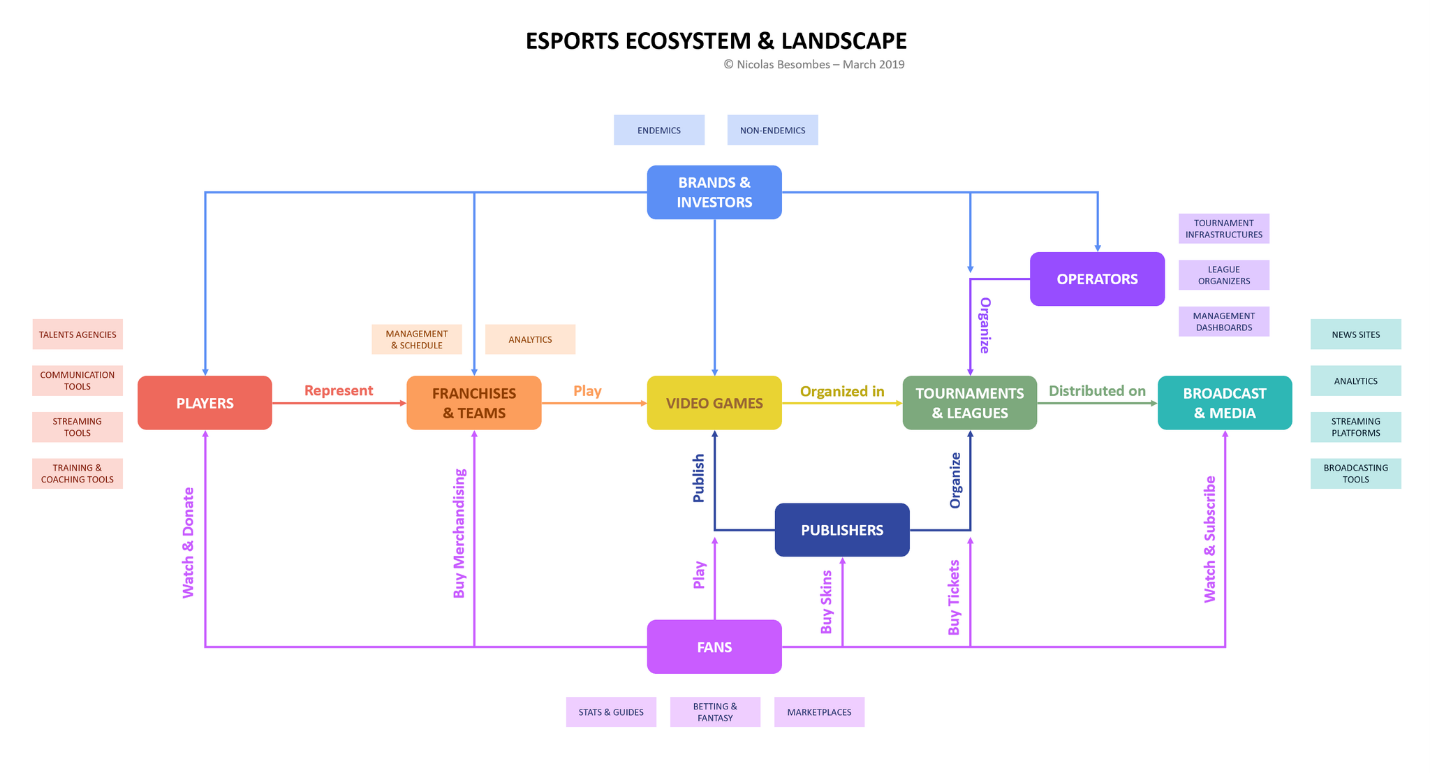

Most of esports revenues derive from sponsorships, followed by media rights, advertising, merchandise and ticket sales, and game publisher fees. Revenues are projected to hit nearly $1.6 billion by 2023, although, again, the pandemic’s ultimate impact is a wild card (see Figure 1).

The Esports Ecosystem

Many people confuse esports with “gaming” — the mere playing of a video game by anyone, anywhere. But there’s been a concerted effort in recent years to define it as a full-fledged sport, with its own stars, teams and sponsors (see Figure 1).

Looking at the growth numbers and projections, it’s easy to understand why so many investors see esports as a strong, emerging industry, ready to join the ranks of other major sports and entertainment segments. Its global appeal is apparent by inclusion in the 2019 Southeast Asia Games; a major push is underway to add it as a featured sport in the upcoming 2022 Asia Games, scheduled for Hangzhou, China. And the Danish government hopes to establish the country as an esports leader and has invested in a strategy to promote the sport.

An ever-expanding range of celebrities are also investing time and money into esports. Bronny James, son of future Hall of Famer LeBron James, made news this summer when he announced he was joining popular esports gaming group FaZe Clan.

Even the U.S. military has taken notice, adding the Army Esports Team in 2018 as both a competitive team and a recruiting tool.

Major pieces of the esports ecosystem include:

Games Publishers/Developers: These companies own the intellectual property on the games, master its variables, control competitions, and, often, provide part or all of the prize money. The combined amount of prize monies reached an estimated $373 million in 2019.

Teams/Franchises: Most professional esports teams evolved from amateur status. If a team has a good business model, is competitive and/or markets itself well, it can attract investors and then generate revenue from partnerships, sponsorships, licensing and tournament prize money.

Investors: Esports teams’ ability to attract investors has accelerated over the past five years, and they are raising substantial capital, creating a training infrastructure and attracting premier players.

Tournament/Event Organizers: A few large companies organize the most prestigious offline (LAN) tournaments, while others organize smaller ones.

Sponsors: Endemic sponsors provide goods or services linked to esport, for example, computer hardware. Non-endemic sponsors have no direct involvement in esport.

Risks Range From Reputation to Pandemic

With investment poised to expand, however, comes a significant increase in risk exposures, including some of the same pandemic risks faced in other sectors. Despite esports’ unique niche, the industry needs to ensure it adopts and continuously adapts comprehensive risk management strategies.

For example, there was some speculation early in 2020 that as COVID-19 stalled traditional sports, esports would see a mini-boom as people looked for both involvement and enjoyment. However, esports has not been spared from COVID-19’s impact. Organizers have canceled and postponed major tournaments, leading to a drop in the number of hours spent streaming for a number of popular games.

When the world turns the corner on COVID-19 and tournaments and other events re-emerge, esports tournaments and events will face the same risks as do other large gatherings: bodily injury, property damage, active shooters, terrorism, cyber hacking and more.

There are also health and safety risks to esports participants. Multi-million dollar prizes at major championships and mega-events make the stakes for esports athletes and their sponsors high. Like their counterparts in other sports, esports athletes face potential health issues, including muscular disorders, carpal tunnel syndrome, tendinitis, neck and lower back pain, vision impairment (blue light syndrome) and burnout. Safety programs to address such issues are a must.

Also, activities that involve residential or prolonged stays of children/teenagers within facilities — and not just in esports settings — are subject to claims of harassment and abuse by adult supervisors. Esports stakeholders who work with children need policies and strategies to ensure youth participants are safe.

Brand and reputation is another area esports stakeholders must be aware of. The partnerships and sponsors that esports stakeholders develop help to grow the brand value. For the industry, it is important to develop governance and best practice standards to protect their investments.

Finally, an acknowledgement of esports’ truly global spread is seen in its exposure to geopolitical risks. For example, as tensions between India and China have mounted in recent months, India has banned certain Chinese software, including several popular esport games. The escalating problems could hinder the industry’s development as consumption slows in the world’s two most populous nations, both of which are hungry for esports content.

Conclusion

The growth of esports mirrors the promise and perils facing many new industries in today’s technology-driven world. From protecting venues against physical damage to protecting brands and reputations, esports stakeholders face familiar challenges, along with unique concerns. This includes planning for events that can emerge quickly, such as pandemics. In the current environment, the social distancing and stay-at-home orders brought about by COVID-19 may actually increase interest in esports, but it also creates new risks and exacerbates existing ones. Just as the top esports players strategize their approach to gaming, the industry itself would be well-served to adopt a strategic approach to risk management.