Every Company Needs to Assess Its Nature-Related Risk

Workers clean up an oil spill. The potential collapse of ecosystems is threatening to cause a $2.7 trillion decline in global GDP annually by 2030.

Photo: Pixnio

More than half of the world’s GDP is dependent on nature. The potential collapse of ecosystem services such as pollination and water-based food is threatening to cause a $2.7 trillion decline in global GDP annually by 2030.

Not surprisingly, regulators and investors are urgently calling for more transparency around exposure to these nature-related financial risks. The Taskforce on Nature-Related Financial Disclosures (TNFD) is a market-led initiative (of which the WWF is a co-founder and knowledge partner) that seeks to integrate nature into financial and business decision-making and shift global financial flows toward nature-positive outcomes.

Nature Loss and Climate Change Are Two Sides of the Same Coin

In a piece of good news, the TNFD has released its first beta framework for managing and disclosing nature-related risk, offering highly practical “how to” guidance for nature-related risk and opportunity analysis.

Nature loss and climate change are two sides of the same coin, and the TNFD recommendations align with the now well-established Task Force on Climate-Related Financial Disclosures (TCFD).

Organizations taking climate action can align with the Paris Agreement 1.5 degree Celsius threshold for global heating, but there is no similar yardstick for nature.

The framework encourages companies and financial institutions to begin by taking a location-first approach. As vital a compass as a global goal for nature akin to the Paris Agreement 1.5 degree Celsius target would be for action on nature, dependencies and impacts on nature are inherently local, and conservation ultimately relies on local delivery — including through operations, value chains and portfolios.

Mirroring TCFD guidance, the TNFD expects organizations to disclose material nature-related risks and opportunities related to impacts and dependencies in assets and direct operations and upstream and downstream value chains.

Location Is a Critical Factor

For financial institutions, for example, this means disclosing nature-related risks in financing activities such as lending, investing and insuring, as well as all other advisory activities — a task that is likely to be extremely complex. While carbon dioxide emissions contribute to global impact regardless of where they occur, dependencies and impacts on nature, such as land or water use, can be benign or calamitous depending on context.

This is why the emphasis of the TNFD’s stepwise Locate, Evaluate, Assess, Prepare (LEAP) guidance on a science-based, location-first approach to incorporating nature into enterprise and portfolio risk management is so important. Inviting organizations first to look carefully into which “biomes” their operations and value chains are situated before assessing how they affect environmental assets and ecosystem services, such as water supply and flood mitigation, will ensure risks and opportunities are properly identified and quantified.

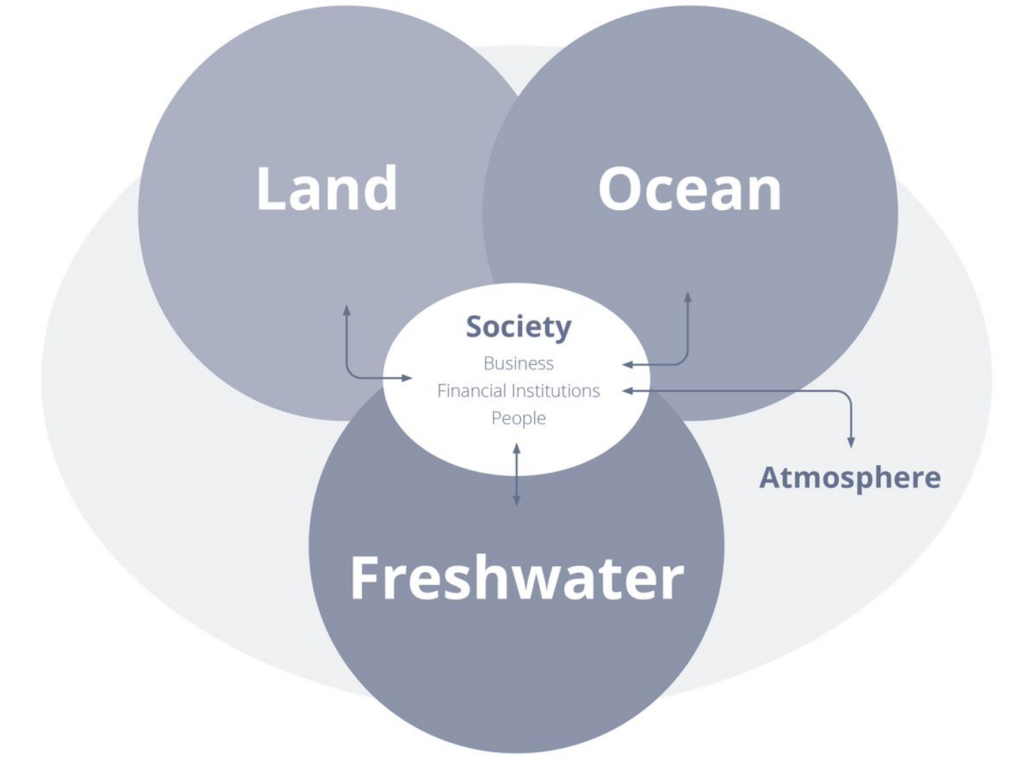

Nature can be understood through a construct of four realms: Land, Ocean, Freshwater and Atmosphere. These are major components of the natural world that differ fundamentally in their organization and function.

As far as possible, the TNFD has adopted the same language and structures as the TCFD, covering governance, strategy, risk management, and metrics and targets.

Whether or not the two frameworks merge in the future is an open question but strong alignment will make it easier for businesses and investors already carrying out climate risk disclosure to embrace the new approach. It would also encourage integrated reporting and alignment with ESG reporting norms emerging from the International Sustainability Standards Board (ISSB). If governments represented on the TNFD Forum choose to make TNFD and TCFD reporting mandatory, integration will only accelerate.

Measure What Matters

Despite the progress that the TNFD framework beta release marks, one of the main challenges ahead is deciding what to measure and how. The TNFD hasn’t yet specified what nature-related information organizations should use and has also identified limitations in current data and metrics.

While many companies involved in the TNFD already gather relevant data, and financial institutions are using models that aggregate data on locations, gaps remain, and data quality and consistency vary considerably across different regions, biomes and ecosystems, with a particular shortage of data in marine and freshwater biomes.

In addition, where data is available, there is often a lack of understanding about how to interpret and use it. Compounding the problem, no globally agreed targets and metrics for nature protection and restoration exist.

Organizations taking climate action can align with the Paris Agreement 1.5 degree Celsius threshold for global heating, but there is no similar yardstick for nature. Many hope a landmark agreement will emerge at COP15 in Kunming, China, later this year and also that major investor backing for the TNFD will encourage ambition. This would help fill the gap and better define nature-positive outcomes.

Disclosure Reporting Could Be Elusive

Meanwhile, other related initiatives, such as the Science-Based Targets Network (SBTN) and tools like the WWF Water Risk Filter, offer detailed guidance on assessing risk and are developing approaches for businesses to set targets. But without clarity of purpose, consistent disclosure reporting will be elusive, and as the popular adage goes, you can’t manage what you can’t measure.

Irrespective of what comes out of COP15, the challenge now for the TNFD is securing decision-useful data at the necessary granularity and identifying a coherent and comprehensive set of metrics and indicators that allow its framework to be put to the test and strengthened. Subsequent beta releases promise further guidance on metrics and targets, including those applicable to any organization and those that are sector-specific.

Over time, data gaps will be filled — but organizations should already start using and improving what is available today. And with data on the location of an organization’s assets and operations arguably the most critical in applying the TNFD framework effectively, the onus is on organizations to create and improve their own data sets.

Start Investing in Nature-Based Solutions Now

What is certain is that companies and financial institutions shouldn’t wait — for better definitions, more data, comprehensive metrics, or agreement on a global goal for nature — before investing in vital nature-based solutions that contribute to climate resilience and adaptation and in business models, products, services, and investments that help restore nature.

Building on existing support for the TNFD, including from 34 investor members collectively responsible for assets worth over $18.3 trillion, and over 350 organizations in its forum, companies and financial institutions should engage wholeheartedly in its open innovation approach as it iterates, pilots and finalizes a potentially game-changing framework over the next 18 months.

The need to tackle nature-based risks and pursue nature-positive outcomes could scarcely be clearer.