Finding Answers to Asia’s $26 Trillion Infrastructure Needs

Motorists drive on an interchange in Chongqing, southwest China, on June 3, 2017. The interchange is made up of five layers, 20 ramps and goes in eight different directions. China accounts for over half of Asia's total spend on infrastructure.

Photo: Fred Dufour/AFP/Getty Images

Asia is sitting on a $26 trillion infrastructure financing bill, owing in large part to the region’s booming economy in which developing Asia is currently driving 60 percent of global growth.

For example, Southeast Asia will see the fastest growth in vehicle ownership globally in 2017, and the broader Asia region as a whole leads in air passenger growth. Average GDP growth in developing Asia is expected to be 5.7 percent in 2017 and 2018, compared to just 1.9 percent in the Euro area, the U.S. and Japan.

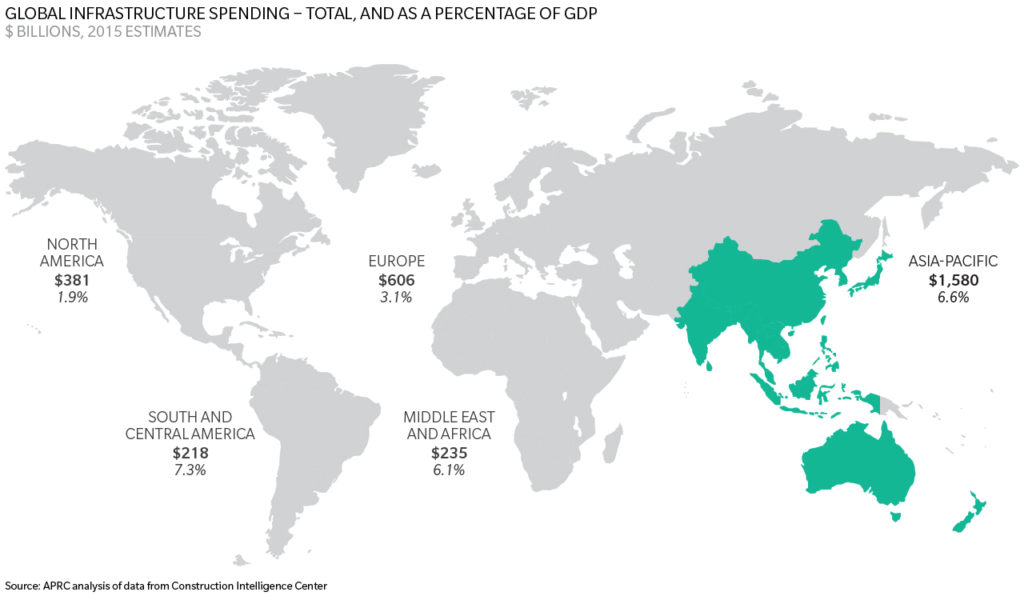

Asia Driving Global Infrastructure Spend

Given this overall boom, unsurprisingly the Asian Development Bank forecasts that the region will require up to $26 trillion of investment in infrastructure over the period 2016-2030. This requirement will see Asia grow further in its role as the global leader in infrastructure investment. In 2015 it accounted for over 52 percent of global infrastructure spend.

China already accounts for over half the region’s total spend on infrastructure, and its Belt and Road Initiative, a global trade project that will see the country refocus its infrastructure investment internationally in the coming years, will ensure that there is no let-up in this global leadership role.

Japan and India contribute notably to the region’s infrastructure spend, though based on 2015 figures they are a distant second (14.4 percent) and third (11.5 percent) respectively. Many Southeast Asian economies such as Indonesia, Thailand, the Philippines, and Vietnam, where infrastructure spend is still relatively small, have all announced ambitious plans to enable further economic development via greater infrastructure investment.

Attracting Global Institutional Investors is a Must

Infrastructure investment clearly presents a significant opportunity for Asia. However, this expected demand for infrastructure is tempered by a reality in which there are significant uncertainties over where the money to fund this development will come from. The financing requirements are so large that a fundamental shift will be needed in how infrastructure projects are financed. This is particularly so in a region where the public sector has historically covered over 90 percent of the needs. Countries that want to meet their required investment needs over the next decade and beyond will have to attract funds from global institutional investors who, to date, have generally been wary of infrastructure investment in emerging markets.

There is theoretically ample private capital available globally to meet this demand. Global institutional investors currently manage more than $50 trillion. Investments in infrastructure, with theoretically stable cash yields over time, can often be attractive even to investors with long-term liabilities. In reality however, global investors have global alternatives, and infrastructure projects across much of Asia rarely rank as the most attractive option to deploy capital on a risk adjusted basis—there is simply too much risk and uncertainty over investment returns.

The Importance of Project Bankability

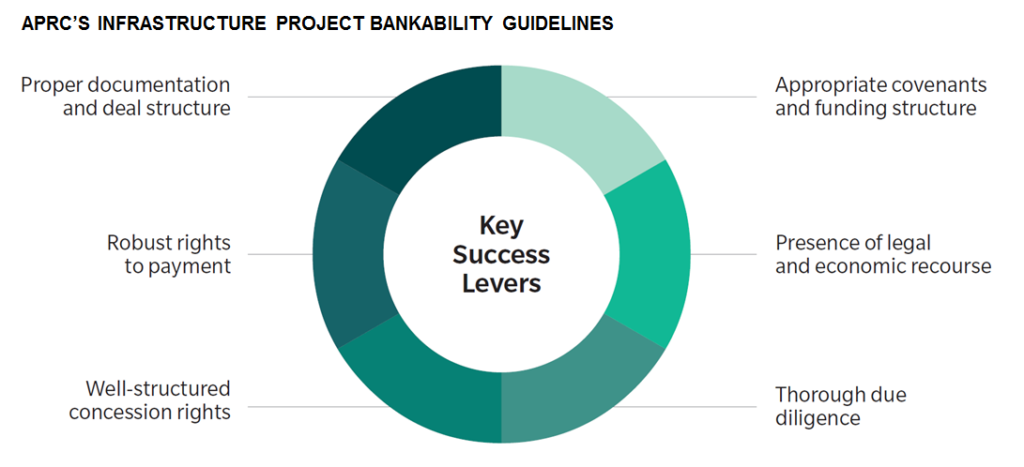

Across much of Asia, there is an insufficient pipeline of infrastructure projects that meet the bankability requirements of international investors. A report from Marsh McLennan Companies’ Asia Pacific Risk Center (APRC) estimates that between 55-65 percent of projects in Asia are not bankable without support from government or multilateral development banks.

This issue is a key driver of the infrastructure-financing gap in the region and needs to be resolved for a meaningful level of international private sector investment to be channeled toward Asia.

The APRC outlines a set of bankability guidelines which, coupled with the deepening of national capital markets, could markedly change the outlook for infrastructure investment in the region by creating a pipeline of bankable projects.

The burden of responsibility to effect change sits with national governments across Asia. While many countries have begun making changes in line with international best practices, neither the volume nor the pace of change has been enough yet.

The Time to Act is Now

It is clear that the expected demand for infrastructure in Asia far exceeds the public sector’s ability to finance them. Private sector investment into infrastructure is as critical an imperative now as it has ever been. If no action is taken, economic growth in the region will stall and the social implications will be profound. Governments in the region must take responsibility to change their local legal, financial and regulatory environments to support fair and transparent infrastructure development. Not surprisingly, it is often the countries with the largest need for foreign investment in infrastructure that have the most work to do to create such an environment.

Well-structured public-private partnerships, with appropriate risk allocation, will generate value from not only the supply of private sector capital, but equally from broader private sector expertise in deal financing and efficiency gains from the improved management of operational assets. Ultimately, projects need to be seen as bankable and able to provide competitive returns on a risk-adjusted basis when compared to global alternatives.

While governments in Asia must take the lead in creating a more transparent and conducive environment for infrastructure investment, other stakeholders should not wait patiently in the background. Those who start building their local knowledge, capabilities and partnerships now will be best placed to benefit from future developments.