Infusing Product Production with Transparency, Accountability

Dock workers in Port Sudan prepare bales of cotton for loading onto a ship for export.

Photo: STR-/AFP/Getty Images

After nearly 200 years, the commodity trading system needs an upgrade. It needs to keep up with changing markets and provide information that is increasingly deemed essential. Although we can’t afford to tinker too much with the commodity trading system—we still need everything it has done so efficiently—we need to infuse it with more traceability and transparency about how products are produced.

Modern commodity trading was invented in the early 19th century right after interchangeable parts were invented. At that time, trade was standardized so that a ton of a globally traded goods such as wheat, sugar, corn or cotton was just like any other ton from another location. They were interchangeable.

This made global trade easier and more efficient for both buyer and seller. Sellers were able to aggregate similar producers and develop a scale in operations that had never been seen before. Purchasers could buy products sight unseen. A ton of sugar equaled any other ton of sugar so long as they both met a set of consistent physical properties: foreign matter, weights, volumes, color and moisture content.

The system allowed, and even encouraged, scale in the supply chain. Today, it remains one of most efficient economic systems on the planet, but to make commodity trading so efficient, traders had to discard a lot of information: things such as who produced it, where, how and with what impacts. Now production could be mixed from vast areas, even from around the world. Today, it is that kind of information that retailers, brands and consumers often want.

Consumers also want to know whether the product is organic or not, GMO or not and whether it is free of slave or child labor; they can’t tell any of these things using today’s system. While these things are external to current commodity trading information, they are increasingly relevant in a global economy where social media and risk go hand in hand.

Traceability and Transparency

In the 21st century, there is pressure for more traceability and transparency along the whole supply chain. With the spread of smartphones and social media, brands and retailers today are being held accountable by consumers and investors for social and environmental issues that are beyond their control, but that pose significant risk to their bottom line and reputations.

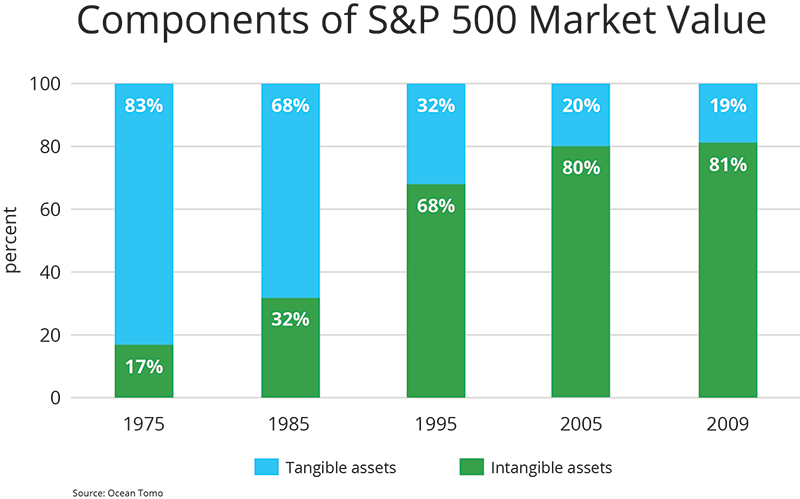

This has occurred with the rise of social media. In 1976, the asset value of S&P 500 companies was 83 percent based on tangible assets, but by 2009, it had shifted to 81 percent, based on intangible assets. That is because company valuations now rely more on brand value and reputation, license to operate, market access and long-term access to raw materials.

As a result, many companies are beginning to care much more about supply chain risk. Companies are getting more informed about the realities and then getting more involved in ways to change them. In the past, retailers and brands depended on traders to provide the products they needed through just-in-time delivery with few questions asked. Increasingly, though, companies are realizing that this is just too important an issue to leave entirely to the traders. Companies are pivoting away from spot market and more adversarial purchasing arrangements to longer-term partnerships with contracts to match. Most are becoming more aware of, if not engaged directly with, the primary producers all the way upstream and turning away from a sight-unseen transaction model.

Brands are now pushing the accountability expected of them up the supply chain.

As a result, brands are now pushing the accountability expected of them up the supply chain. They are demanding a level of traceability and transparency from suppliers that never existed before. Because child labor or deforestation are not things you can see by looking at a commodity, brands aren’t just interested in tracing a commodity to its origin. They want to know where it was produced, how, by whom and with what impacts before it is allowed in their products or on their shelves.

That is good news for consumers and the planet. The World Wildlife Fund has long said that transparency and traceability are keys to addressing key environmental impacts, and illegality is one of the biggest drivers of biodiversity loss on earth.

But this approach means that commodities will need to be produced and handled differently. Retailers and brands are just one part of the supply chain. A more transparent commodity trading system needs buy-in from both traders and producers. Where do they stand?

For the most part, producers have always been price takers. The customer is always right. If buyers impose conditions, those producing the raw materials will meet the requirements even though they may not like it. I have written previously about how companies can help reduce key impacts such as deforestation, child labor and productivity in sectors such as cocoa in order to make production more sustainable and more transparent.

The traders are different, however. The origins of commodities they sell has not always been any more transparent than their business transactions. They represent the biggest bottleneck in terms of a lack of transparency along the supply chain, but pressure is building on them to change and this may well involve their entire business model.

Buy Low, Sell High

Traders largely created today’s commodities markets. They like to buy low and sell high; it’s in their blood. There’s an old joke about a grandfather talking to a five-year-old to find out whether the child would be a good trader or not: The grandfather asked, “How much is two plus two?” The child looked him in the eye and said, “Are you buying or selling?” Traders sit between producers and downstream users of commodities. They often have access to better information than others along the supply chain, but they also have better information because the system itself is so opaque. This has to change.

The challenge is that traders are not set up for what is being asked of them. Buy low and sell high is a simple proposition. Now, traders are being asked to bring information into the system that they spent 175 years taking out. This adds many new layers of complexity.

Traders are also resistant to new price-finding mechanisms, such as long-term contracts, where the volume and qualities can be agreed on for many years but the prices are determined by a mechanism based on spot market prices at the time of the sale. Long-term contracts are a critical tool to create partnerships across the value chain, remove uncertainty and buy down the risk of investing in more sustainable production. What traders don’t like is that long-term contracts can remove their upside. What they lose sight of, however, is that they reduce the downside as well.

Brands Won’t Be Denied

Brands won’t be denied on this; the risk is simply too great. If traders want to continue doing business, they must address transparency and traceability. They need to reduce retailers’ and brands’ risk of buying commodities that are produced with unacceptable impacts. Business as usual for traders and for commodities is no longer acceptable.

The first response of traders who are used to being in the driver’s seat is to resist; however, it seems that traders are beginning to move from resisting this change entirely to trying to find ways to accommodate it.

Most have made time-bound commitments regarding specific products or issues, deforestation being a good example. While that is great, it is not nearly enough; deforestation is just one of many issues consumers are concerned about that traders will eventually need to address.

With more retailers and brands making their own time-bound public commitments to source legal and more sustainable commodities, the first traders to address this new market reality will gain market share. If we can link time-bound commitments for commodities produced with fewer impacts to long-term contracts, then we have the potential to use existing market transactions to buy down the risk of investing in more sustainable production. Traders already finance a significant part of production themselves. This creates real opportunity to figure out how to use the demand from retailers and brands with these conditions, to actually leverage investments in more sustainable supply—in short, use the system to change it.

Differentiating commodities has been done before. As more people bought products based on flavor and quality profiles (coffee, cocoa, etc.), producers were paid premiums for the commodities with those traits. The system adapted; it incorporated enough complexity and transparency for value chains to differentiate good from bad and better from worse. This didn’t disrupt the business model. What comes next for commodities is just differentiating commodities based on how they are produced.

Moving forward, none of us can afford to keep acting like one ton of sugar still equals another ton of sugar. If one of them was produced by child labor or through deforestation, then they are not equal, period. It’s time for the commodity trading system to reflect that reality. There is some momentum behind this, but everyone along the supply chain will need to work together to make this a reality.