Is the Risk of Crime Against Businesses Greater in More Unequal Countries?

The owner of an electronics shop stands outside his store after rioters broke his front door on May 13, 2021 in Haifa, Israel.

Photo by Daniel Rolider/Getty Images

Rising inequality is one of the most pressing societal challenges of our time. According to data from the World Inequality Database, the past two decades saw an increase in the overall income share of the richest 10% of the population in all but two of the world’s 10 largest economies (the exceptions are France and the United Kingdom). In the world’s largest economies, the average income share of the richest 10% of the population increased from 37.5% in 2001 to 41.3% in 2021. This is often attributed to rapid technological change and competition from international trade, although the magnitude of change in inequality, as well as its underlying explanations, are potentially different between advanced and emerging economies.

In addition to evaluating broader ethical considerations, academic research has started to unpack the many perverse ways in which rising inequality shapes societies: from lower economic growth to reduced subjective well-being and political polarization. Researchers have also explored how corporations are implicated in rising inequality within countries, triggering a debate around the role of corporations in spurring or deterring it. An important issue that has not received much attention, however, is the reverse effect — i.e., the potential cost that income inequality imposes on businesses.

The results indicate that a one-decile increase of the Gini coefficient is associated with a 4 % increase of crime risk. This is a large increase compared to the 20% average crime risk in the sample.

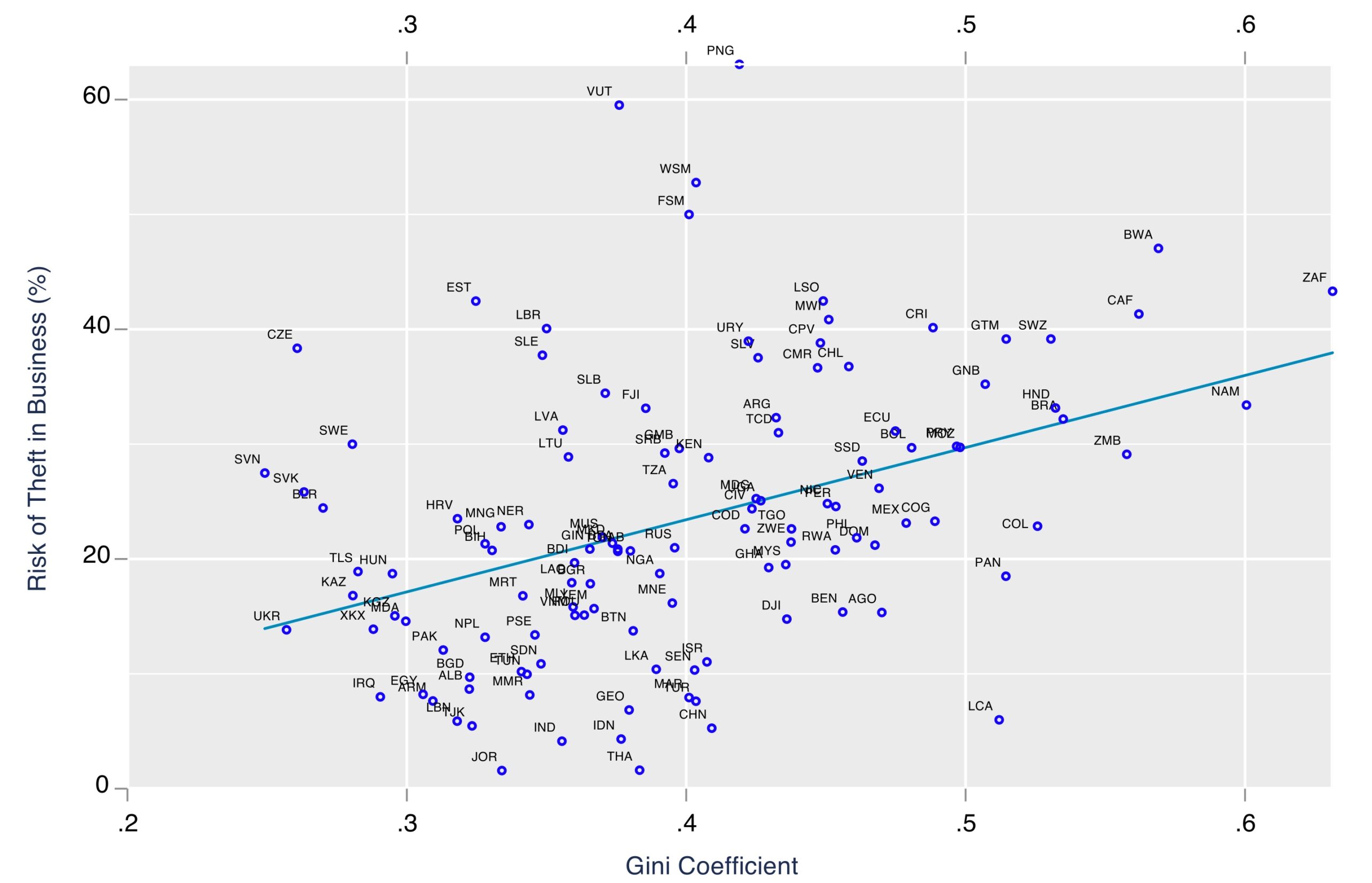

In a recently published study, we shed light on one of the channels through which inequality affects businesses — namely, crime risk — and the role of social cohesion in mitigating its deleterious effects. Our analysis draws on the World Bank’s Enterprises Survey, which provides rich data on crime exposure and losses among businesses. Figure 1 provides a scatter plot of inequality, measured using the Gini coefficient, against crime exposure among businesses (i.e., the average probability of theft incidence over 2006-2018). The plot, which is based on 122 countries covered in our dataset, reveals a clear positive association between crime and inequality with a correlation coefficient of 0.40. In South Africa, the most unequal country in the world with a Gini of 0.63, the chance that a firm will experience crime in a given year was 43.3%. In Kazakhstan, where inequality is moderate with a Gini of 0.28, the crime risk of businesses was just 17%.

Figure 1: The relationship between crime and inequality

We confirmed this positive association through a more systematic regression analysis that accounted for different country and firm effects. The results indicate that a one-decile increase of the Gini coefficient is associated with a 4% increase of crime risk. This is a large increase compared to the 20% average crime risk in the sample.

Three Explanations

There are at least three sets of explanations for this strong positive association between inequality and crime: economic, sociological and institutional.

- Gary Becker, who won the 1992 Nobel prize in economics, has popularized the rationalist view of crime, contending that agents choose to engage in criminal activities by weighing between the expected payoffs of criminal activities vis-à-vis legal work. According to this view, inequality increases the economic appeal of criminal acts by dimming the prospects of the poor to secure legal employment and achieve upward mobility.

- Second, sociological theories, such as Robert Merton’s strain theory, contend that the poor become more resentful of the rich when their hopes of improving their status become untenable in the face of growing income and wealth disparities. In tandem, the ability of societies to regulate the behavior of their members diminishes, which allows economic and social grievances to fester into violence and crime.

- Finally, institutional theory suggests that inequality tends to erode the social fabric that binds communities, thus weakening institutions that support the legitimacy of business activities. In some cases, businesses could gradually lose their “license to operate” as their legitimacy slowly fades. In others, inequalities could lead to violent protests or radical social movements that demand redistribution of wealth and directly incriminate the rich and their businesses. In our analysis, we emphasize this latter explanation.

Together, these economic, social, and institutional forces could end up making businesses in unequal countries legitimate targets of criminal activities.

One Antidote: Social Cohesion

Does stronger social cohesion mitigate the adverse effects of inequality? To answer this question, we considered the potential role of social trust and fractionalization to moderate the link between inequality and crime. Social trust reflects the extent to which members of society believe in the honesty, integrity, and reliability of other (random) individuals. Prior research has underscored that generalized trust is a crucial element of social cohesion that enables collective action. We also expect that high-trust societies will have higher moral standards, which would dilute the relationship between inequality and crime by reducing the likelihood of inequalities fueling widespread resentment against the rich. Trust also has an “ecological” effect that facilitates interaction and interdependence among community members with different levels of social status. It can thus serve as an informal regulatory mechanism that compensates for the weakening of formal institutions in unequal societies.

Besides trust, social cohesion has other elements reflected in cognitive and cultural commonalities that create a shared sense of identity. Ethnolinguistic fractionalization, which captures cognitive and cultural divergences, can be taken as an inverse measure of social cohesion that shapes the relationship between inequality and crime. First, the economic mechanism linking inequality and crime could be stronger in countries with greater ethnolinguistic fractionalization since inequality in these countries will likely reinforce economic organization and resource allocation along ethnic or racial lines. Excluded groups could be further disenfranchised, which could fuel hate crime directed toward businesses owned by ethnic groups that are considered privileged. An example can be attacks by the poor on minority-owned businesses in South Africa during the 2021 protests. There is also a large body of evidence that ethnolinguistic fractionalization tends to undermine the development of democratic and inclusive institutions. Highly fractionalized countries, therefore, will not be well-positioned to devise sound policies that can mitigate the adverse effects of inequality, especially redistributive ones that transfer wealth across racial groups.

Our analysis confirmed that social cohesion, measured using social trust and ethnolinguistic fractionization, had a significant moderating role. The inequality-crime link declines sharply as levels of trust increase, becoming insignificant as trust reaches the levels seen in Armenia and Thailand (where slightly more than one-third the population trusts other random people). The strong link between inequality and crime thus seems to be mainly confined to low-trust countries.

The link between inequality and crime is greater at higher levels of ethno-linguistic fractionalization. In China, where fractionalization is very low, the association between inequality and crime is only half as large as the level in Burkina Faso, where fractionalization is far greater.

Inequality does not just increase the risk of crime in businesses; it is also associated with greater losses from crime (measured as a share of revenues). These results, which are robust to a wide array of sensitivity tests, highlight how inequality can constitute an important hidden operational cost for businesses, including multinational enterprises. The results suggest that crime risks attributable to inequality could shape foreign market entry and capital allocation decisions of corporations.

A version of this article originally appeared in Brookings.