Employee Stress Levels Hitting New Highs Due to Coronavirus

Source: MetLife, U.S. Employee Benefit Navigating Together: Trends Study 2020

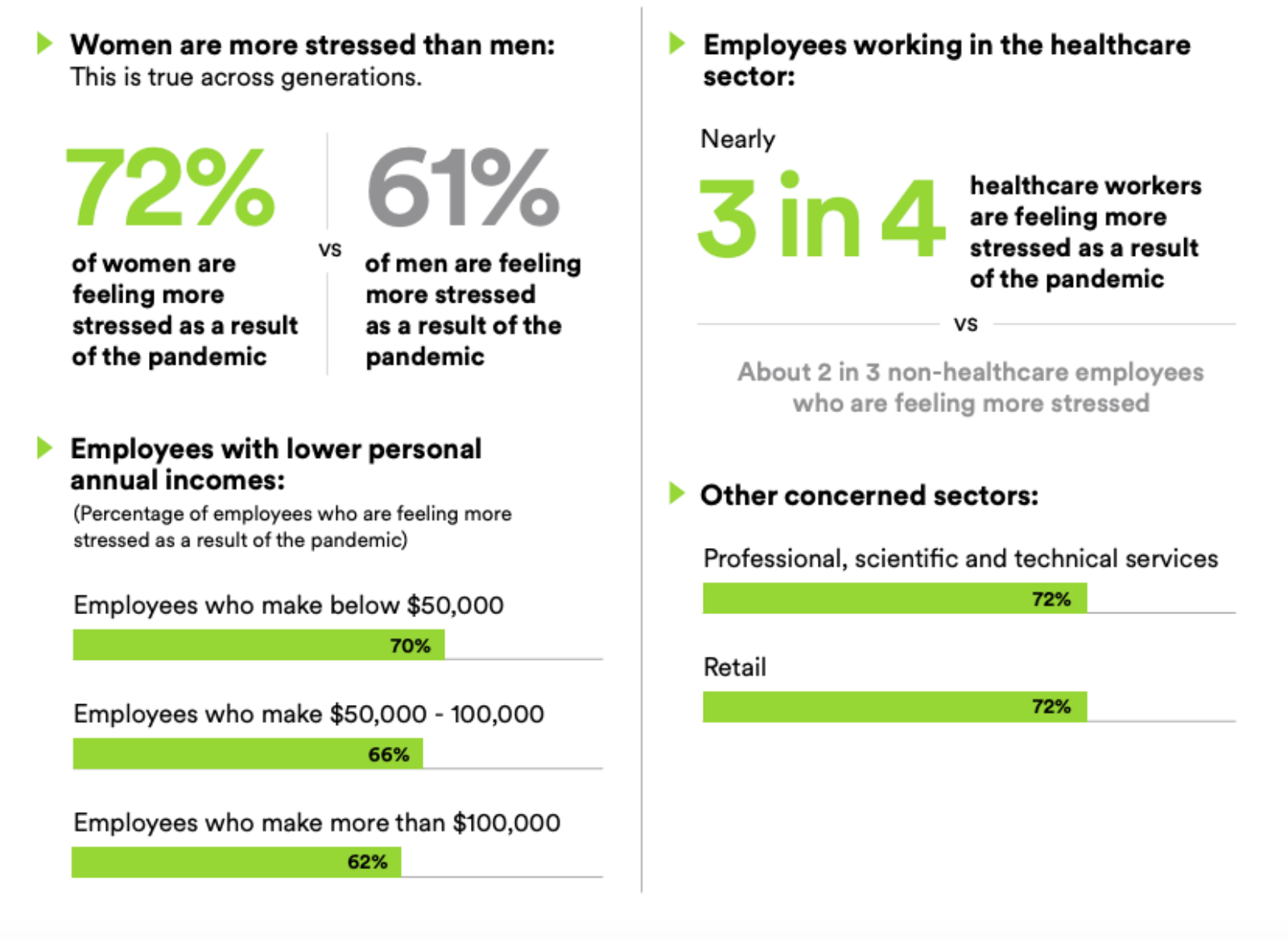

Sixty-seven percent of employees are experiencing higher levels of stress due to COVID-19 — with work and finances being their biggest concerns. Not surprisingly, a larger proportion of health care workers and women, many of whom have taken on child care and schooling duties in addition to their careers, are reporting heightened stress levels, a study from MetLife reports.

The findings come as employers grapple with providing conducive working environments for employees in these unprecedented conditions. Data from before and during the crisis show that greater support from employers results in more successful employees. Research from 2019 shows that 67% of successful employees reported having the necessary flexibility in work policies to manage work and life.

Understanding employees’ experiences and needs has never been more paramount for organizations. This “new normal” necessitates enhanced employee emotional wellness support and financial wellness initiatives for managing work-life stress. Employers who lead with empathy will have a “more engaged, productive and successful workforce.”