Surprising ‘Baby Bump’ Boosts Hope of Fertility Rate Improvement

Source: NBER

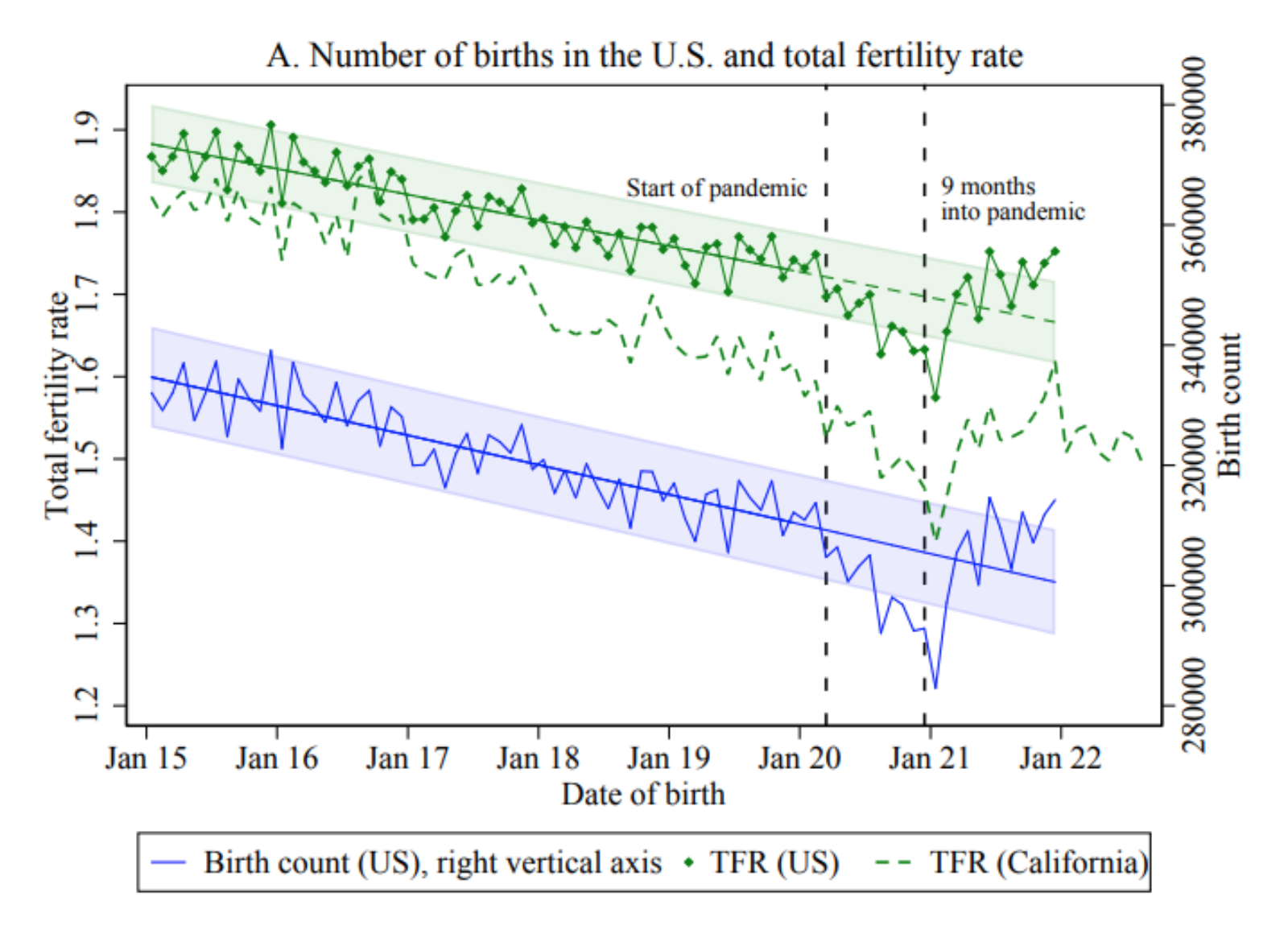

Despite strong predictions that the COVID-19 pandemic would lead to a “baby bust,” new data demonstrates a more optimistic outlook. A new report from the National Bureau of Economic Research notes that an increase in births in 2021 represents “the first major reversal in declining U.S. fertility rates since 2007.”

During the first year of the pandemic in 2020, official data showed U.S. births declining by 4%, hitting their lowest level since 1979. Combined with the impact of travel lockdowns on foreign-born mothers — who accounted for 23% of U.S. births in 2019 — researchers anticipated that as many as half a million fewer babies would be born in the U.S. as a result of the pandemic. However, U.S.-born mothers — particularly those aged 25 and younger and college-educated women aged 30-34 — ended up raising the total fertility rate for 2021 by 6.2% over the pre-pandemic trend.

Such findings, while they are focused on the United States, are heartening short-term news for social scientists who have spent most of this year projecting that the global population will peak later this century. A rebound in fertility rates may potentially have a positive effect on connected social metrics such as school enrollment, labor force participation and entitlement viability.