The US Doesn’t Have Enough EV Charging Stations

More than 50% of the world wants to buy electric cars, but there may not be enough charging stations to meet demand, MIT Technology Review reports.

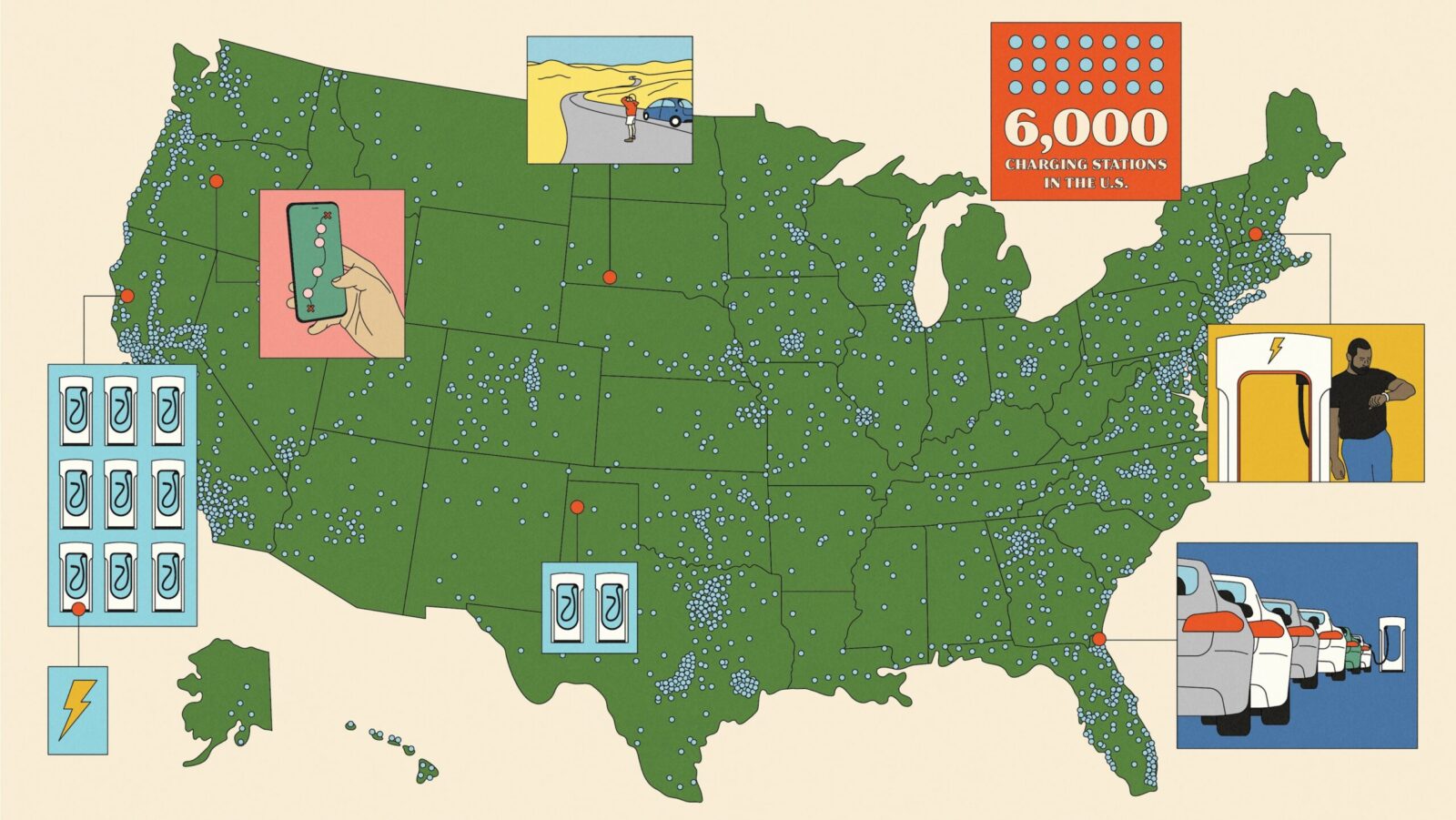

The U.S. sold 400,000 electric vehicles (EV) last year, but has only 48,000 EV charging stations across the country — compared to 150,000 gas stations for gas-powered cars. There are even fewer DC fast electric charging stations (6,000), which can recharge an EV battery in minutes instead of hours. Most charging stations are located in large cities or spaced along interstate highways, but much of the country has wide swaths of charging deserts.

The U.S. administration has promised to increase EV infrastructure by adding a half million chargers by 2030. In contrast, there could be 5 million EV battery charging stations across the EU by 2030 — and double that by 2035, according to a report from Transport and Environment.