America’s $1 Trillion Infrastructure Push — and What It Means for Global Investors

In an aerial view, cars pass over Big Tujunga Canyon in Los Angeles on November 18, 2022. President Biden plans to spend $550 billion on infrastructure over the next 5 years.

Photo: David McNew/Getty Images

The famous Build Back Better slogan, a staple of the Biden presidential campaign (coming as it did against turmoil wrought by COVID), serves to underscore how fundamental the incumbent president sees infrastructure investment to his legacy.

His original, massively ambitious plan was for two major pieces of legislation: the Build Back Better Act (BBB) (focused on investment in social infrastructure) and the Infrastructure Investment and Jobs Act (IIJA) (focused on investment in physical infrastructure).

Both were introduced into the House of Representatives this time last year, but only the IIJA has since been signed into law, ushering in $550 billion of additional infrastructure spend across the U.S. over the next five years, on top of existing commitments.

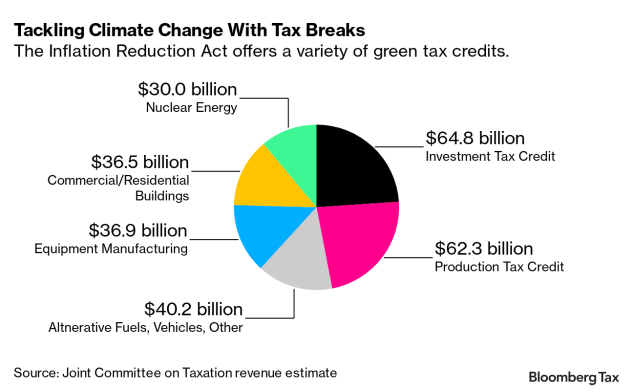

While the BBB is still held up in the Senate, the social spirit of the legislation has since resurfaced in the Inflation Reduction Act, which contains $369 billion in federal commitments to energy security and climate change. These encompass sizeable tax credits and incentives for investment in clean energy generation and emerging tech.

With energy prices surging amid conflict in Europe, and with targets for decarbonization rapidly closing in, securing a sustainable, domestic energy supply is a key aim of these two complementary acts.

Source: Bloomberg Tax

What Does It All Mean for Infrastructure Investors?

First off, it’s clear that these legislative moves will cause a massive uplift in economic activity.

Analysts at Moody’s estimate that the IIJA could raise near-term GDP growth in the U.S. by 3.5%, resulting in additional output of more than $700 billion over the next decade. Commentators at Credit Suisse, meanwhile, have stated, with regard to the Inflation Reduction Act, that considering “the multiplier effect on federal grants/loans, the total public plus financing could reach $1.7 trillion over 10 years.”

The risk with these kinds of interventions is that they crowd-out the private capital needed to make the transition to net zero a reality.

Fortunately, with the IIJA’s prioritization of harder-to-reach communities over several years, and with the Inflation Reduction Act’s prioritization of tax credits and incentives (as opposed to additional funding), the two are poised to deliver a much-needed “crowding-in” of private finance and business investment.

Pulling in Foreign Direct Investment to the US

Our latest Pulse survey shows the U.S. is already streets ahead of the wider Americas and Europe in terms of investor appeal. More and more examples of where these new laws are spurring action are emerging by the day. At the end of last month, South Korean outfit G Chem outlined plans to build a $3.2 billion battery cathode facility in Tennessee, a move set to double U.S. production in five years.

These two pieces of legislation are a reminder of the old adage that, while the federal government spends, state governments build. Take the near $60 billion released by central government for road and bridge infrastructure last month — The Department for Transportation set the parameters for spending, but says “the funds go directly to all 50 States.” For investors wanting to follow the money, they should be mindful that delivery strategies, procurement plans and timelines will be developed at a local level.

Politics will matter, too, where achievement of outcomes is concerned. These two acts were, however, passed prior to the midterms. That won’t stop challenges from Republican officials as minds are cast to the next presidential run off, but the money has already started to flow.

Global Repercussions

Moves of this magnitude in the biggest economy in the world will also have global repercussions. This is especially true given that the IIJA was accompanied by the Build America, Buy America Act, which, in essence, means projects stemming from the legislation must source delivery materials from U.S. providers.

The protectionist move has set hares running, not least in the EU where French and German leaders are now said to be coalescing around the notion of a Buy European Act. That said, EU Trade Ministers have collectively stressed in recent weeks that it is “necessary to avoid a subsidy race that would disrupt our relationship.”

While it’s a positive that America has thrown down the gauntlet to other nations with regard to infra-investment incentives, what we need now is global collaboration, rather than competition.

In an already fraught geopolitical landscape, protectionist moves risk additional friction and complexity for investors just at a moment when we need global collaboration and streamlined project signoffs to reach net zero goals.

The Need for Greater Harmonization

In an ideal world, there would be much greater uniformity and stability around incentives across markets.

By comparison, while President Biden has been rolling out ambitious five-year plans, chopping and changing around incentives here in the U.K. has culminated in a new tax regime that will punish producers of renewable electricity, hampering future investment. The journey to universal incentives for best practice is far from complete.

Infra investors should also note the wider implications of the BBB’s fate. Fundamentally, the original Build Back Better Act failed to pass because of concerns about extending public spending so dramatically post-COVID.

This sentiment will be shared around the globe, especially as higher interest rates make it harder for governments to raise debt in a recessionary climate. As such, the role for private infrastructure investors and lenders is set to grow, with policymakers seeking to deliver projects without adding more weight to balance sheets.

The agreements reached with regard to international collaboration around financing for net zero at COP27 have been met with skepticism. Private investors will, it seems, increasingly have to lead the charge.

“Generations from now,” President Biden said as the IIJA started its journey to becoming law, “people will look back and know this is when America won the economic competition for the 21st Century.”

While it’s a positive that America has thrown down the gauntlet to other nations with regard to infra-investment incentives, what we need now is global collaboration, rather than competition, to achieve the universal net zero goal.