Cell and Gene Therapy Is Getting Popular. How Will Employers Manage Costs?

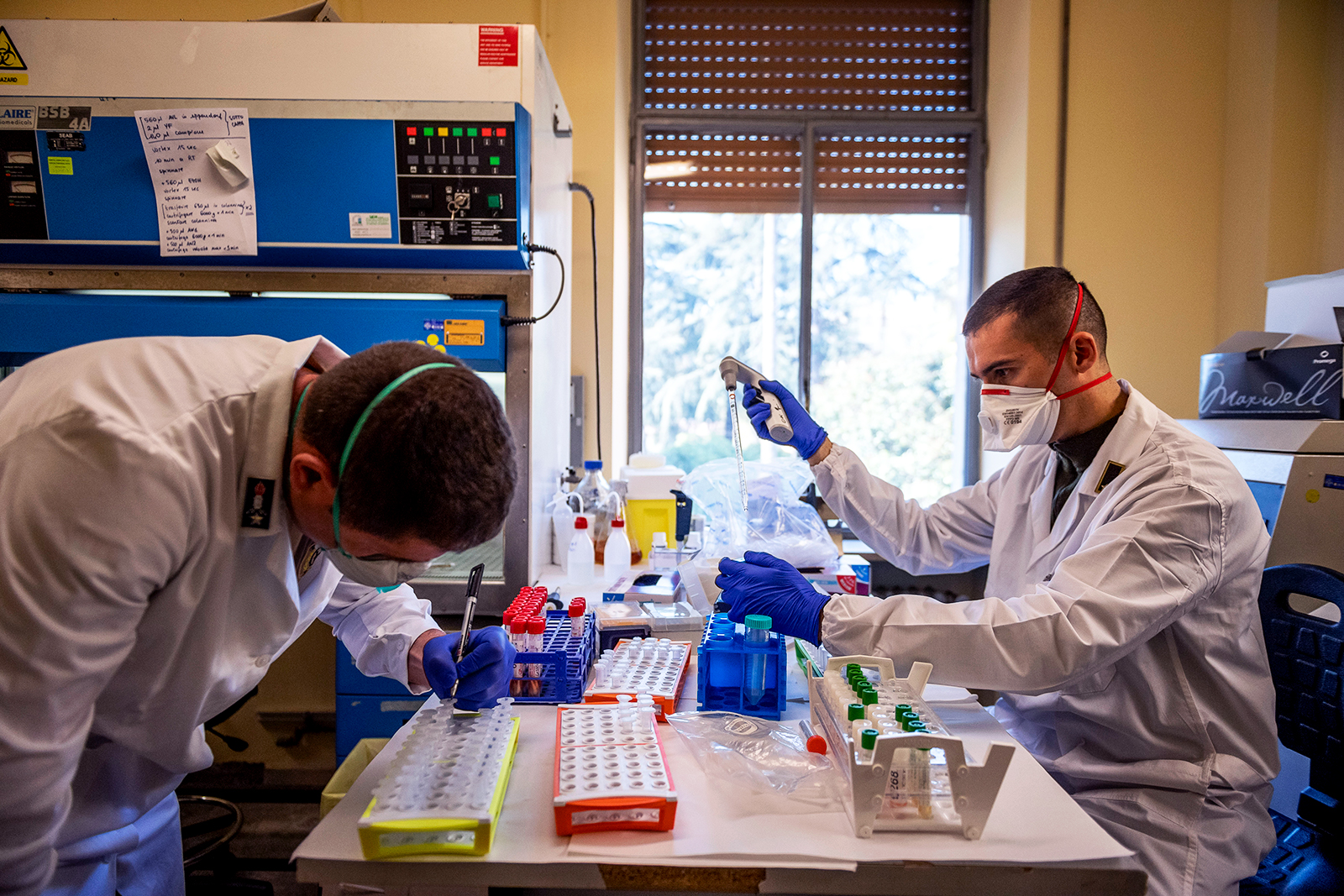

Doctors work at the chemical analysis laboratory on April 1, 2020, in Rome, Italy. The overall costs of cell and gene therapy will continue to grow as more come onto the market, meaning employers and health insurers will be more likely to find themselves responsible for extreme medical costs.

Photo: Antonio Masiello/Getty Images

New cell and gene therapies are revolutionizing disease treatment options. These sophisticated therapies, which involve technologies that can alter patients’ gene expression or introduce altered cells into their bodies represent new ways to treat previously debilitating, deadly, or incurable diseases and promise to improve the length and quality of many lives. For example, an infusion of Zolegensma can change the life of a child with spinal muscular atrophy, Luxturna can restore sight, and CAR T cell therapy can fight cancers other treatments are ineffective against. Therapies current in clinical trials promise to address hundreds of other conditions.

However, these treatments come at significant cost: Zolgensma costs $2 million for a single dose, Luxturna costs $425K per eye, and a course of CAR T therapy can also top $1 million.

Without a plan to manage the financial implications of these treatments, the story of cell and gene therapies risks shifting from one of universal benefit to one of scarcity and inequality, in which only those with means, or who are lucky enough to be employed by certain businesses, have access.

To date, the employers and health insurers who bear the bulk of the cost of cell and gene therapies have had few difficult decisions to make. The associated cost has remained manageable — an estimated $5 billion was spent on these therapies in the U.S. in 2020 — and willingness has remained from stop-loss and reinsurance markets to mitigate the risks of isolated spend spikes. However, there are indications that this comfortable situation is coming to an end.

The Threat of Extreme Medical Costs

The overall costs of these therapies will continue to grow as more come onto the market, meaning employers and health insurers will be more likely to find themselves responsible for extreme medical costs. According to epidemiological analysis and tracking pharmaceutical trials, Marsh McLennan Agency estimates that in 2022, 75,000 patients will be eligible for some type of cell and gene therapy with an expected cost of over $15 billion — and that by 2025, nearly 100,000 patients in the U.S. will be eligible for cell and gene therapy, at a total cost of $25 billion.

The traditional backstops for these costs in the stop-loss and reinsurance markets may begin to withdraw coverage for cell and gene therapy or apply prohibitive premiums as early as 2022 renewals and likely no later than 2023. Failing to prepare for this can mean financial catastrophe. Simply refusing to cover such therapies can come with its own reputational and regulatory risks. Employers and insurers need to start building a comprehensive plan now for how to manage cell and gene therapy costs.

Taking Inventory of Risks and Costs

The first thing these organizations must do is quantify the costs they are likely to see. This is not simple; it requires an understanding of current and developing therapies, the specific demographics of the organization’s employee or beneficiary population, and the insurance and regulatory contexts in which they operate.

Employers, insurers, governments and other stakeholders need to start planning now to determine how they’ll cover the costs of cell and gene therapy.

Employers and insurers also need to understand how they are currently protected from the level of risk they have identified. Organizations should examine what their current policies protect against now from a cell and gene therapy perspective, how that is likely to change in the future and how reasonable the cost of coverage is relative to the risk mitigation it provides.

Take a Note From Previous Events

Once businesses understand the size of the issue they are facing, it is time to plot the path forward. Though cell and gene therapies are new, there are parallels between the concept and other large, complex, and ultimately inevitable risks such as climate change, terrorist attacks, flood, high-cost medical procedures and pandemics.

Considering how these parallel risks have been managed can be helpful in determining next steps for cell and gene therapy. When risks are difficult for individual actors to quantify, they are often underestimated, and when underinsurance is associated with broad societal implications, a public-private partnership approach is often called for.

Terrorism, flood, and pandemic risks, for example, are managed through public-private partnerships in the U.S. and U.K. This can come in several flavors: a government-managed pooling mechanism funded by carrier assessments may be one approach, or governments may provide funds that private insurers pay back over time, or governments may become directly involved in insuring specific risks.

In other situations, the private reinsurance market has been an effective mechanism to manage risk. Employers may consider sponsoring captive insurers that pre-fund cell and gene therapy costs. In addition, more advanced risk-sharing agreements can be built with stakeholders across the value chain, from pharmaceutical manufacturers, to PBMs, providers, and employers. Or, new specialized reinsurance entities may arise that can effectively manage even the extremely high costs of cell and gene therapies, similar to what has occurred in the organ transplant space.

Which of these two broad solution categories, and which specific variations within them makes the most sense for cell and gene therapy remains an open question.

A Collective Opportunity

Regardless, these are not solutions that will appear overnight; they will take time to develop and debug. Employers, insurers, governments and other stakeholders need to start planning now to put the right portfolio of solutions in place. These are not simple tasks. They require navigating both the mathematical complexities of risk management and financing with the political complexities of involving the public sector. Experience from other sectors, however, demonstrates that solutions are possible when the right expertise is brought to bear.

The time for procrastinating on finding a solution to cell and gene therapy costs has passed, and it is the rare business that can find a solution alone. This is a collective problem — and a collective opportunity.

Joana Fenning Nassa, Partner and East Market Pharmacy Leader at Mercer, also contributed to this article.