Global Insurance Pricing Rises in First Quarter of 2019

A woman leaves an office building in Tokyo, Japan. Global commercial insurance prices rose by 3 percent, on average, in the first quarter of 2019.

Photo: Chris McGrath/Getty Images

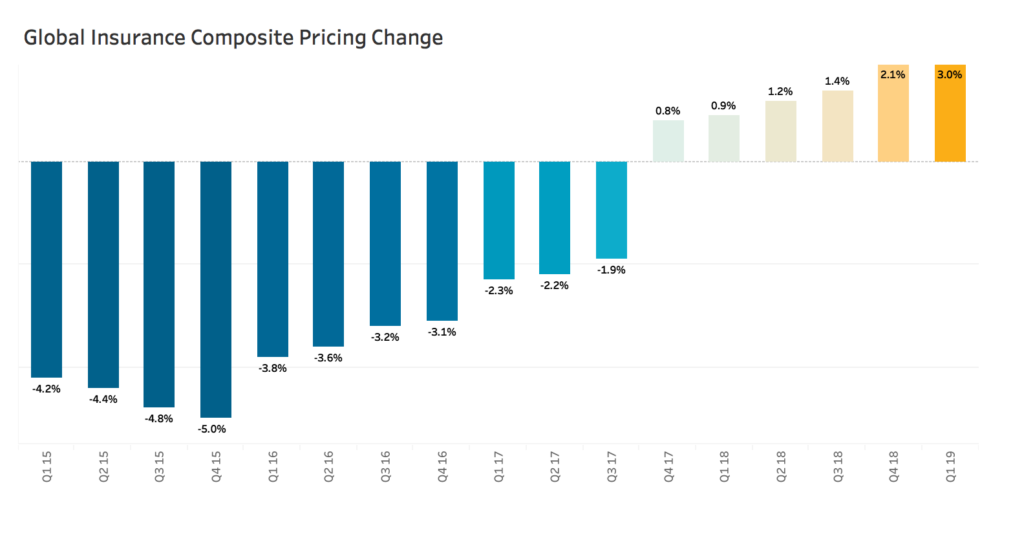

Global commercial insurance prices rose by 3 percent, on average, in the first quarter of 2019, marking the sixth consecutive quarter of increases, according to the Marsh Global Insurance Market Index (see Figure 1). Composite pricing in the first quarter increased in all global regions for the second quarter in a row.

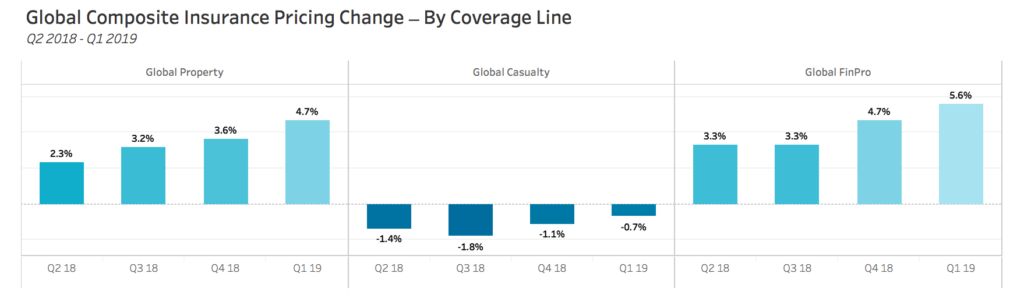

Overall, the insurance market remained stable, with prices increasing or decreasing within a relatively narrow band across most products and regions. Globally, in the first quarter, average pricing changes for the major product lines were as follows:

- Property insurance pricing increased by 4.7 percent.

- Financial and professional liability coverage increased by 5.6 percent.

- Casualty pricing decreased by 0.7 percent.

Figure 1:

U.S. Pricing Increases Led by Property

Average insurance pricing in the first quarter of 2019 in the U.S. increased by 1.1 percent, year over year. Property pricing increased 4 percent and has now increased each quarter since the fourth quarter of 2017, a period marked by catastrophe losses that included an above-average North American hurricane season. Large, multilayered property programs (those with gross written premium greater than $1 million) led the pricing increases, up nearly 7 percent.

Financial and professional liability insurance rates in the U.S. increased by 2.8 percent in the first quarter, marking the fifth consecutive quarter of increases. This was driven in large part by pricing in directors and officers liability (D&O). Pricing for public company D&O increased nearly 6 percent, with 77 percent of clients experiencing an increase, the highest percentage of increases in several quarters.

Casualty pricing declined 1.7 percent and has decreased in all but one quarter since 2014.

UK Composite Pricing Rises for Sixth Consecutive Quarter

Overall insurance pricing in the first quarter of 2019 in the UK rose by 2.9 percent, the sixth straight quarter of increases. Property pricing in the UK increased 3.0 percent, with large clients typically experiencing higher rates of increase than did small-to-midsize firms.

Casualty pricing in the UK declined 2.7 percent overall, the fifth consecutive quarter of decline. There was some evidence of insurers starting to hold firm on pricing and/or tighten terms.

Financial and professional liability pricing in the UK increased by 6.7 percent, driven by D&O increases on clients with U.S. and/or Australian exposed or listed risks. For clients with a U.S. or Australia listing, D&O increases were generally between 20 percent and 30 percent.

Asia Composite Pricing Increases for Second Consecutive Quarter

In Asia, insurance pricing in the first quarter of 2019 increased by 0.4 percent, the sixth consecutive quarter of minor pricing movements in the region.

Property pricing increased by 0.6 percent, marking only the third quarterly increase in the past four years. Casualty pricing declined 0.4 percent, continuing a trend toward stability following several years of moderate decreases.

Financial and professional liability pricing generally increased, with the composite up 0.2 percent. Although minor, this marked the first back-to-back quarterly increases in more than six years. Financial and professional liability pricing was influenced by the deteriorating global market and a desire by insurers to achieve pricing adequacy while reducing capacity.

Figure 2:

Insurance Pricing by Region

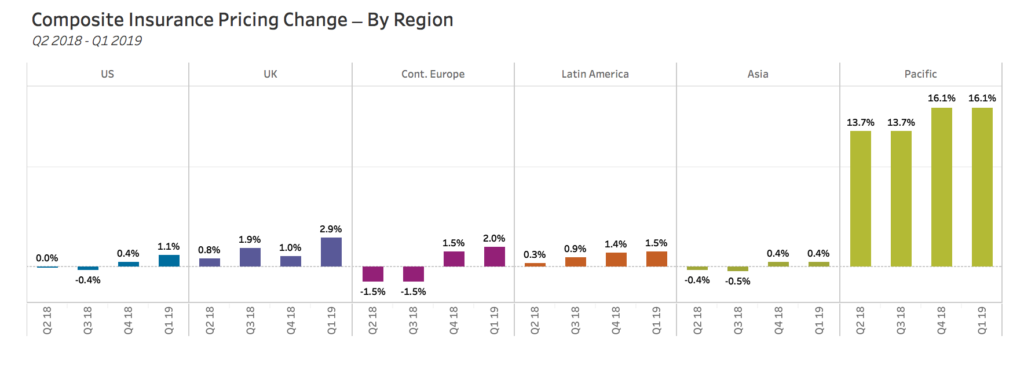

Other regional highlights in the fourth quarter included (see Figure 3):

- In Continental Europe, insurance pricing in the first quarter of 2019 increased by 2.0 percent, the region’s second consecutive quarter of price increases. Property insurance pricing in CE increased by 4.2 percent, marking only the fourth quarter of increases in the last five years and were largely attributed to a reduction in available capacity.

- In Latin America, overall insurance pricing in the first quarter increased by 1.5 percent. Property pricing increased slightly, only the third quarterly increase in the last six years. Property pricing in LAC has essentially been flat during the last year.

- In the Pacific region, overall insurance pricing in the first quarter increased by 16 percent, continuing the region’s steady pricing increases of the last two years. Property insurance pricing increased by 14.5 percent as major insurers reduced capacity and adjusted risk appetites. Financial and professional liability pricing increased by more than 20 percent, continuing a string of double-digit increases over the last seven quarters.

Figure 3: