India: Russian Oil Imports Will Only Provide Marginal External Relief

A motorist carries a plastic gas tank to refuel at a gas station in Kathmandu, Nepal, on Thursday, Jan. 5, 2012. As sanctions reduce or ban Russian oil into Western countries, India is growing its imports of Russian oil.

Photo: Kuni Takahashi/Getty Images

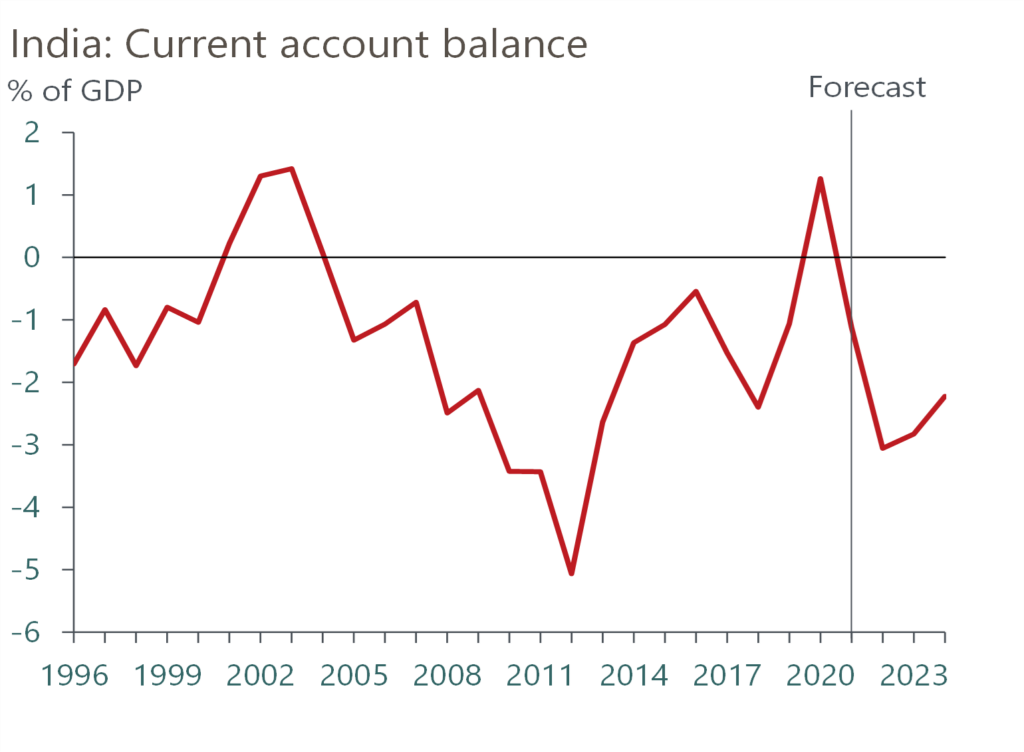

India’s current account deficit is expected to widen substantially to 3% of GDP in 2022 and hamper growth, despite the increase in cheaper crude oil imports from Russia.

Crude oil typically accounts for 30% of India’s imports and global oil price shocks have historically led to a substantial increase in India’s import bill. But since the onset of the [conflict] in Ukraine in late February, India’s oil imports have been surprisingly stable. After an initial jump in March, the monthly oil bill has held around $20 billion, even as the average Brent oil price has increased from $94 per barrel in February to $117 per barrel in June.

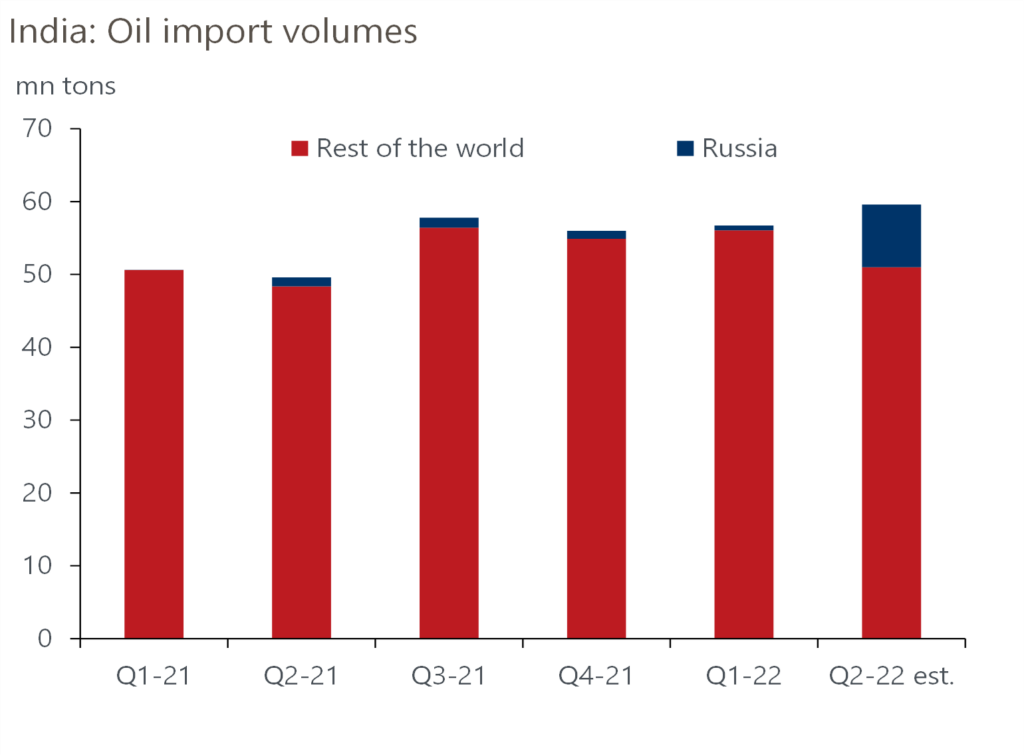

This is partly because of the country’s rising oil trade with Russia (Exhibit 1). Russia became India’s fourth-largest oil import destination in April, accounting for 8% of imports in nominal and real terms. This compares with just 1.2% of real oil imports and 1.4% of nominal oil imports from Russia in the first quarter of 2022. Based on the monthly data, we estimate India imported 12 million barrels of oil from Russia, up from just 2 million in March. According to Refinitiv Eikon, this number jumped to 24 million in May and could have reached 28 million in June.

Russia’s Ural crude has traded at a steep discount of more than $30 per barrel to the Brent price since April and by importing more from Russia, India has managed to substantially limit the impact of the global surge in oil prices on its import bill so far. This has also buffered the Indian rupee (INR). Our modeling shows the Indian rupee has weakened less against the US dollar than a terms of trade shock based on benchmark global commodity prices would predict.

Exhibit 1: Oil Imports From Russia Have Jumped Sharply Since April

Source: Oxford Economics/Haver Analytics

Russia’s Share in India’s Crude Mix Likely Close to Peak

The key question is whether India can maintain its growing take-up of Russian oil supply. So far, the country has avoided running into any legal hurdles. But it is walking a fine line. Any signs that Russia-India trade is circumventing the U.S. dollar-based global payment mechanisms in a significant manner may lead Washington to sanction Indian companies directly. At the same time, there’s growing concern that India is becoming a backdoor conduit for Russian oil into Europe through export of refined products.

A sharp widening in the current account deficit is still expected this year — to close to 3% of GDP in 2022 from 1% in 2021.

In a bid to dampen Russian exports to Asia, the EU floated a plan to deny European insurance to vessels carrying Russian oil shipments in early June. This has now been superseded by the G-7 proposal to impose a price ceiling on imports of Russian oil in exchange for continued insurance cover and shipping services from Europe or other G-7 countries. The new plan may work in India’s favor. India was reportedly already in talks with Russia to negotiate a lower oil price, and participation in the price cap plan may allow it to preserve its growing engagement with Moscow without further pushback from the West. However, it remains to be seen whether Russia will agree to such a plan. The West will likely push for a steeper discount on the Urals than what the two countries are negotiating.

Geopolitics aside, there is also the matter of Indian refiners’ capacity to process Ural crude. The crude diet of most refineries is geared toward the sour crude produced by the Middle Eastern countries, and refiners are bound by annual contracts to import committed amounts from these countries. As such, following the substantial jump already seen in Russian oil’s share of India’s crude mix — from less than 2% in 2021 to around 20% in June 2022 — we see limited scope for it to rise further.

Current Account Deficit Still Expected to Widen Substantially

We estimate that if monthly oil import volumes are stable at around 20 million metric tons going forward, and India imports around 20% of this from Russia at an average price of $70 per barrel, then the total fuel bill for 2022 will be $8 billion lower than our current baseline, and the current account deficit will be at 2.8% of GDP, rather than our forecast of 3.1%. The benefits could be larger if there are broader ramifications for benchmark oil prices. The recent correction in Brent prices was largely attributed to continued supplies of Russian oil to Asian economies, which lessened concerns of a global energy supply crunch.

However, we note that the monthly trade deficit widened to an all-time high of $25.6 billion in June, despite oil imports staying stable. This was driven by weaker exports and elevated non-oil imports. While the recently announced hike in gold import duty may help at the margin, we think the total import bill will stay elevated in the coming months as India is a major importer of commodities affected by the [conflict] in Ukraine.

We also look for further deceleration in export growth due to the export taxes imposed on petroleum products and a weak external environment. As such, a sharp widening in the current account deficit is still expected this year — to close to 3% of GDP in 2022 from 1% in 2021 (Exhibit 2).

Exhibit 2: We Continue to Look for a Substantial Widening in the Current Account Deficit

Source: Oxford Economics

This will not only directly subtract from GDP growth, but also have ramifications on the broader economy that will further pressure growth lower. Both household and business spending will feel the impact of the sharp increase in import prices, through the PPI and the CPI. With real income growth likely to slow to a trickle and manufacturing recovery still lacking steam, this is yet another setback to India’s post-COVID recovery.

A version of this piece originally appeared on Unravel.