Move Over Nat Cats, Kitty Cats Are Riling the Insurance Marketplace

People stand on storm debris washed up on the beach on January 10, 2022 in Aptos, California. The San Francisco Bay Area and much of Northern California continue to get drenched by powerful atmospheric river events that have brought high winds and flooding rains. The storms have toppled trees, flooded roads and cut power to tens of thousands.

Photo by Mario Tama/Getty Images

With spring rapidly approaching, many municipalities, homeowners and business dwellers alike will be preparing for potentially dangerous weather from convective storms. With a record hard property market, policyholders are no stranger to feeling pain in their pocketbook come renewal time. To combat these turbulent times in the marketplace, insurers and reinsurers across the globe are taking a variety of steps to adequately prepare themselves for the evolving risk associated with severe thunderstorms. The large “main event” storms can and do wreak havoc, but lots of damage can follow from residual storms. Think of a large-scale tornado outbreak being a main catastrophe event and the additional, smaller but non-negligible thunderstorms that happen during the remainder of the season as “kitty-cats” that can compound carrier and policyholder losses.

Follow the Models

For the past few decades, models assessing catastrophe risk have been at the forefront of the re(insurance) industry. These tools provide a baseline view of peril risk, combining hazard, vulnerability, and financial information to give an end user a variety of portfolio specific output. End users of these models leverage this to help support reinsurance transactions, make underwriting decisions, and even improve data standards. This hopefully leads to better forecasting of potential risk and therefore less unknown around potential losses. With better accuracy of forecasts, this can improve the quality of exposures carriers write. With properties that are deemed “at risk,” enhancements can be made via the models making communities more resilient overall. The increasing severity and particularly frequency of storms has riled the insurance marketplace. While catastrophe models have their place in the industry, there are known limitations, especially as they relate to capturing the accumulation of high frequency events, which can take a toll on insurance carrier’s profitability. We often think of large-scale catastrophes, or cats, driving losses within the (re)insurance industry. Traditionally, severe thunderstorm catastrophe models are well suited to capture severe thunderstorm tail risk brought on by these cat events, such as tornado outbreaks, derechos, and large hail events.

Sweat the Small Stuff

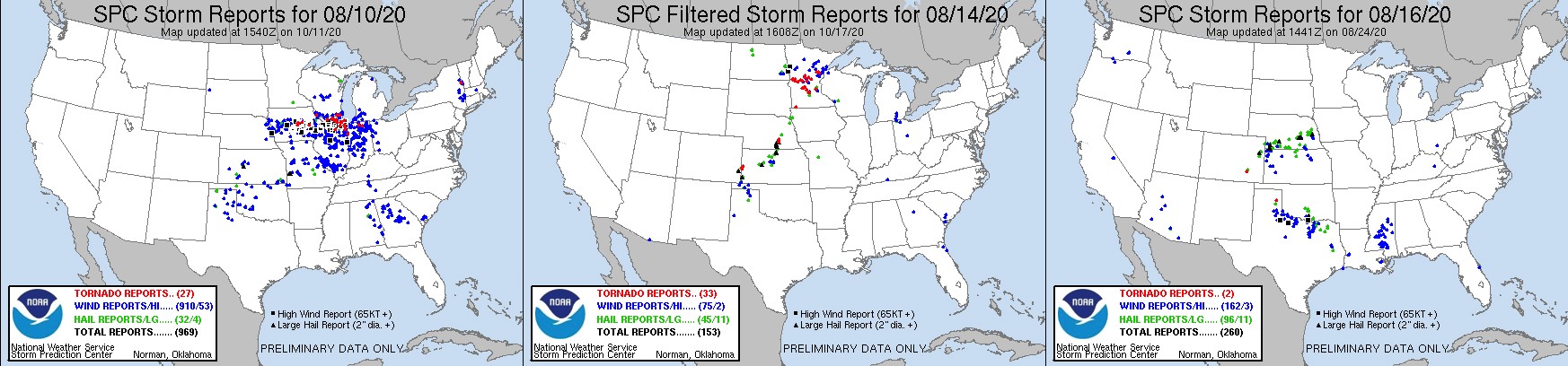

In recent years, however, the compounding of high frequency events, or “kitty-cats,” has played a large role in the industry, with the overall loss from the aggregation of high frequency events surpassing that of severe thunderstorm cat events over the past few years. As a result of higher weather-related losses and strains on reinsurance capacity, many carriers, especially those in the Midwest, were forced to overcome a number of hurdles at the time of renewals. One consequence is raised retentions, forcing carriers to retain more and more loss on their balance sheets. The Midwest (Iowa) derecho of August 2020 was one of the costliest severe convective thunderstorm losses for the industry. While time seemed to stop dead in its tracks after that event, mother nature did not — multiple bouts of severe weather across the Midwest occurred within just one week prior to the significant derecho. These events were not major/catastrophic compared to that of the derecho, but likely impacted many of the carriers that experienced losses from the derecho. Below are a few storm report maps — the first for the derecho 8/10 then 8/14, as well as 8/16. These “events” on 8/14 and 8/16 were likely kitty-cat in nature, not meeting a significant industry threshold, but in aggregate adding to losses and compounding perhaps a poor year given the derecho.

Sun On the Horizon

Fortunately, there are a number of ways carriers can create custom views of risk to provide a leg up on their holistic risk assessment for severe thunderstorm. Just as catastrophe models continue to get updated and introduce new technology and scientific findings, the recent trends in weather patterns are being addressed by the emergence of other tools. SToRMi, a proprietary risk score developed by Guy Carpenter, is a tool that allows for a more granular and transparent view of risk. Powered by up-to-date weather observations and advanced analytics, SToRMi has already helped a number of carriers tackle the growing challenges within the marketplace. One carrier stated: “The increasing climate trends for hail and tornado risks, shaped our new risk zones. These analytics enhanced our profitability and led to our largest surplus growth in company history.” Goes to show the proof is definitely in the numbers.