Biggest Potential to Lower Emissions Lies With China and the Power Sector

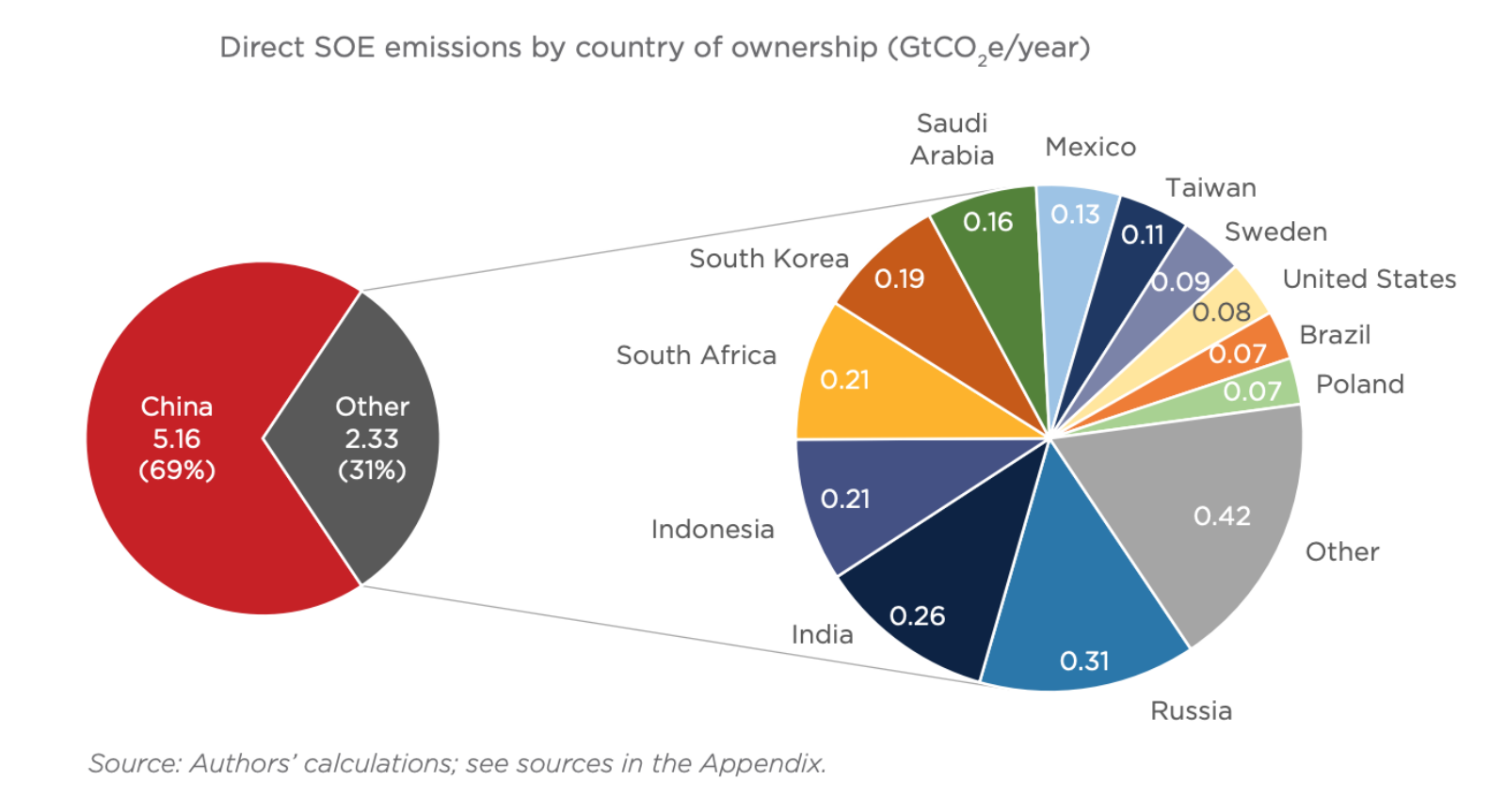

China emits 70% of the emissions that come from state-owned enterprises across the world, according to a report from Columbia’s Center on Global Energy Policy, followed by Russia and India, both of which emit 4% of total emissions annually.

A combination of factors contribute to China’s dominance in carbon dioxide emissions: “China alone may have up to 150,000 SOEs,” the report’s authors say, along with the most high-emitting SOEs compared to other countries. Coal-fired electricity also contributes to a large portion of China’s SOE emissions.

On an industry level, 85% (6.4 GtCO2e) of total SOE emissions come from the power sector, followed by oil and gas at 10%. But the countries in the study are also signatories to the Paris Agreement, the report’s authors also note, and many have committed to net-zero-emission economies by 2050. BRINK has explored various solutions to carbon dioxide emissions and alternative sources of energy in its coverage of carbon sequestration, battery technology, hydrogen power and wind energy.