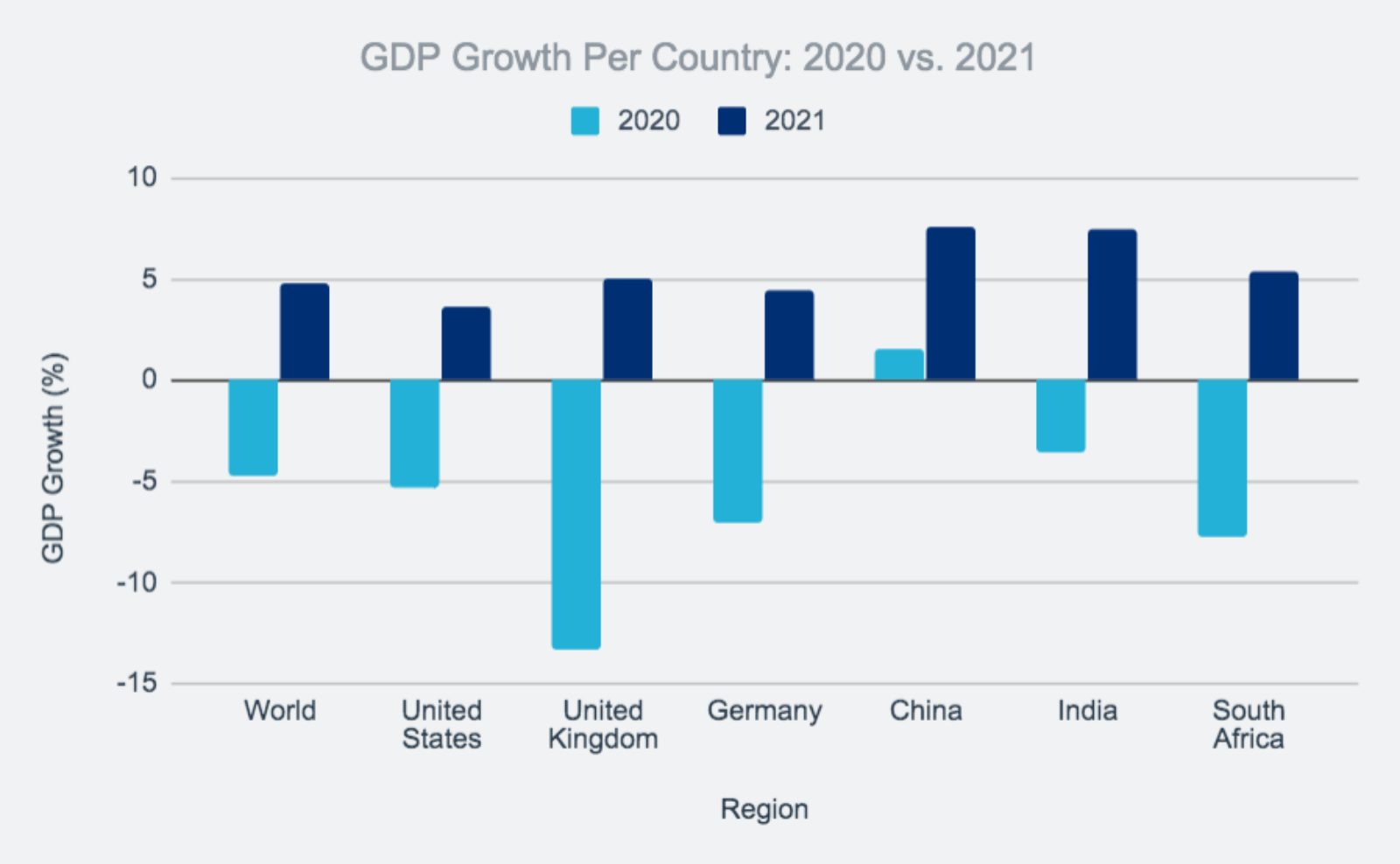

China Is the Only Major Economy Expected to Have GDP in Positive Territory in 2020

Source: Euler Hermes, “Coping With COVID-19 in Differing Ways”

China is tracking toward 1.5% growth in GDP for 2020 (2019: 6.1%) — despite the global disruption coronavirus has inflicted on its economy. It is the only major economy expected to maintain a positive GDP this year, according to research by Euler Hermes.

China’s GDP growth is expected to reach 7.6% in 2021, the highest growth rate among the major economies. The U.K., whose lockdown mandates have been longer and more severe than many other countries, shows a significant drop in GDP for the year — 13.3%, but it is expected to rebound with GDP at rates ahead of Germany and the United States.

The report warns of “false restarts” if second waves crop up and notes that a return to pre-crisis GDP levels should be seen in China and the U.S. by the end of 2021. Due to the extent of the crisis in Europe and the “more limited stimulus response,” Europe isn’t expected to reach its pre-crisis levels until 2022-2023.