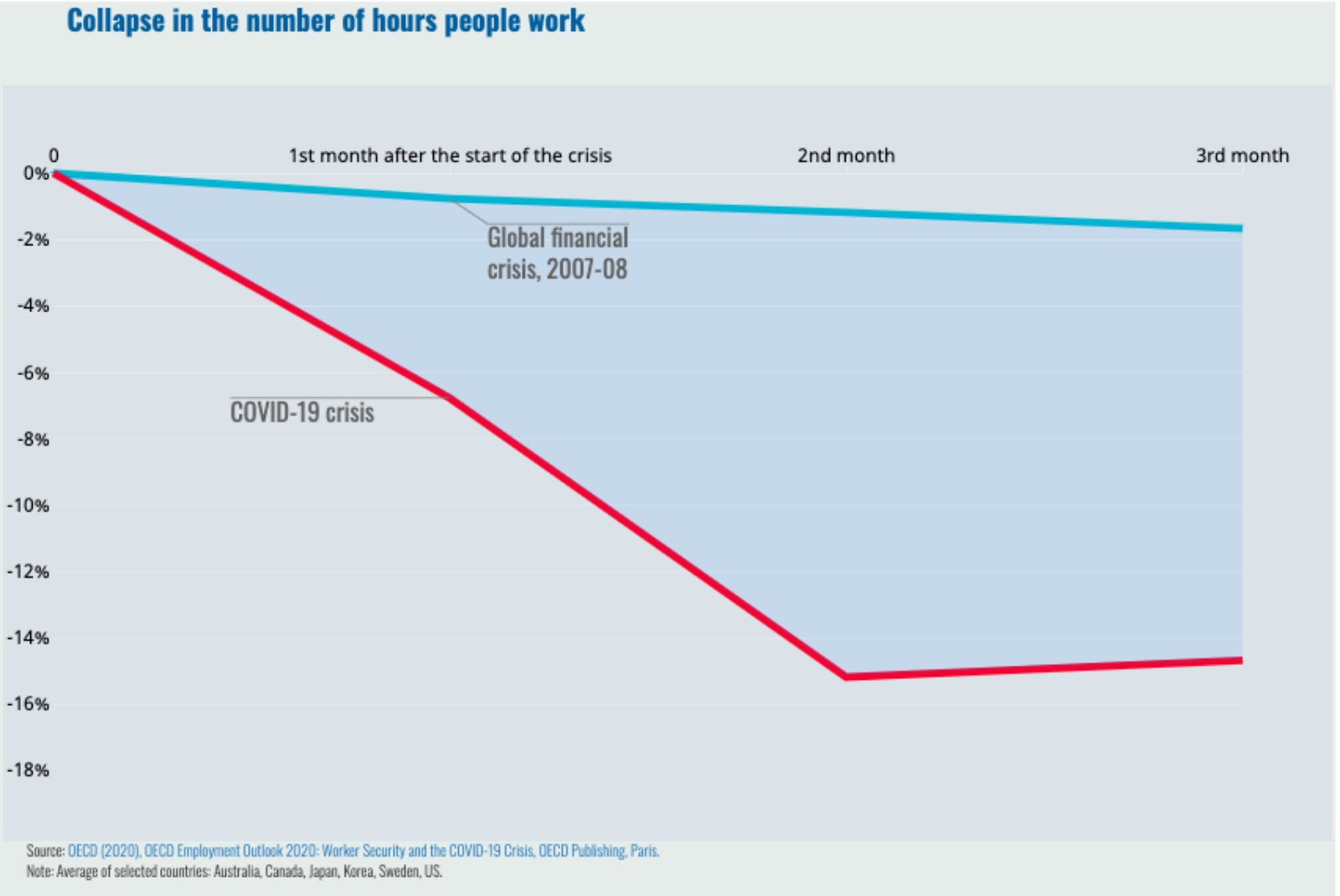

Working Hours Lost at 10 Times the Rate of the 2008 Crisis During COVID-19

Source: Organization for Economic Co-operation and Development (OECD)

The impact of job hours lost during the coronavirus pandemic is already 10 times greater compared to the early months of the 2008 Great Recession. The economy is not expected to bounce back to its pre-pandemic levels until after 2021, according to the OECD.

COVID-19 has seen a steeper rise in unemployment and a broader reach among the population compared to the Great Recession. The Great Recession reached its unemployment peak in January 2010 at 10.6% — a rate that we surpassed in May 2020 at 13.0% (and it’s still rising). Almost every age group has been economically affected by the COVID-19 outbreak, while during the Great Recession, parts of the older generations were relatively more insulated from the economic fallout.

This drastic job loss could further expand the poverty-wealth gap and backtrack both progress toward gender equality and the ability of younger generations to be financially independent, purchase a home or pay off student loans. The effects of unemployment on mental health are substantial as well and will likely continue increasing during this crisis.