What Have Treasury Professionals Learned From the Pandemic?

Skyscrapers, including One World Trade Center, loom over the 9/11 Memorial and Museum site in New York City. The majority of risk managers cited strategic risks as having the greatest impact on earnings in the next three years.

Photo: Chip Somodevilla/Getty Images

In May 2021, as the dust was beginning to settle from a worldwide shutdown and some semblance of “normalcy” had been reestablished in parts of the world, AFP spoke with 272 treasury practitioners to gauge their learnings from the challenges that came with the coronavirus pandemic.

Across nearly every industry, both public and private, and from every area of the world, we received responses. The result is the AFP 2021 Risk Survey: Post Crisis and Preparation for the Future, supported by Marsh McLennan.

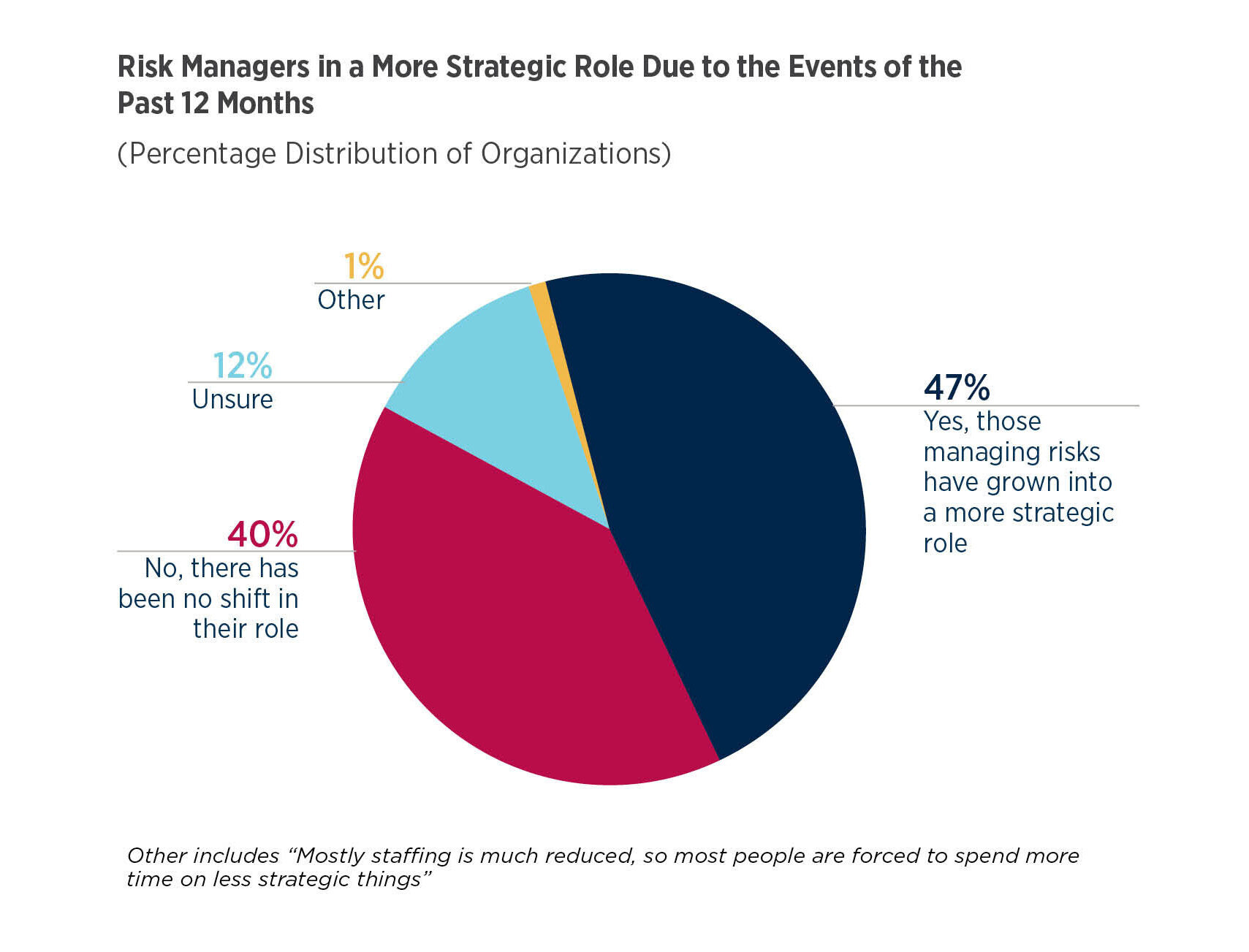

Risk Managers Have Moved Into a More Strategic Role

Over the past year, 47% of respondents feel that the risk manager in their organization has grown into a more strategic role. The importance of the contribution of treasury professionals who manage macroeconomic risk, technology risk and financial risk has increased significantly.

Senior management at organizations have responded to the recent crisis by beefing up cybersecurity teams with seasoned professionals, implementing collaborations across teams to achieve strategic goals and seeking advice and guidance from content experts.

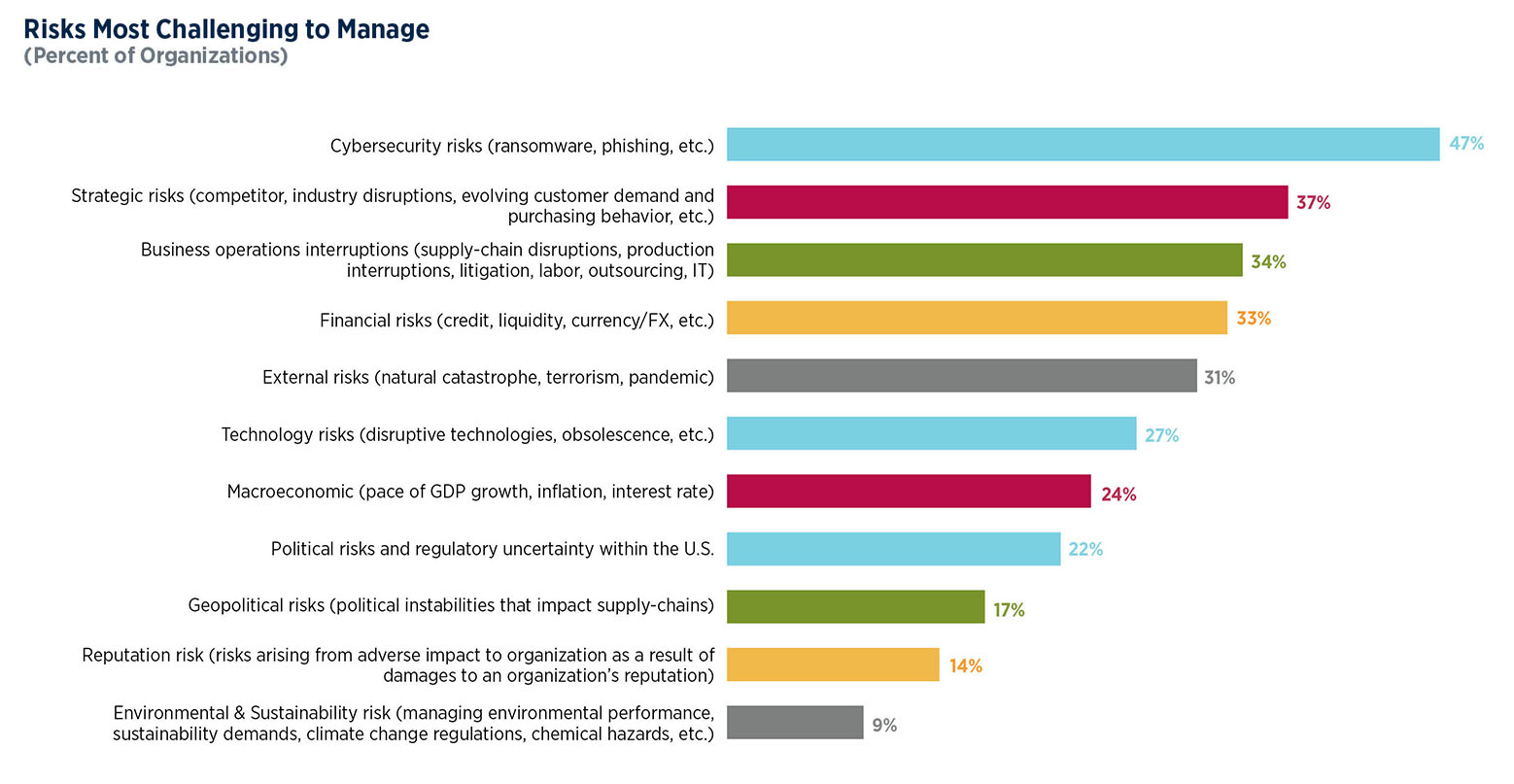

Cybersecurity Remains Biggest Risk for Treasury

In spite of the pandemic, cybersecurity risks such as ransomware and phishing continue to be, for nearly half (47%) of treasury professionals, the biggest challenge. This number has increased in the past 11 years — up 35% since the 2010 survey. It’s also worth noting that this statistic holds weight across the board, regardless of an organization’s annual revenue or ownership.

That said, while cybersecurity continues to be on the “risk radar,” the year-over-year comparisons suggest fewer practitioners regard it as significant. This could be due to organizations having stepped up their cybersecurity protocols during the pandemic.

Cash Flow Is King

Cash flow was another area of overwhelming agreement: 79% of respondents feel that, in order to manage future risks, treasury teams need to focus on managing cash flow, working capital and liquidity. This reflects the challenges organizations have faced in the past year managing liquidity and cash flow during a pandemic.

While these are core functions of treasury teams, they were also key concerns during the crisis. In order to remain viable, organizations were compelled to manage cash flow and liquidity effectively. But it goes beyond management to communication.

Treasury professionals need to be able to understand and communicate the importance of these functions to executive management, something they had to quickly become proficient at over the past year. Managing these functions well requires collaboration with other stakeholders and taking actions that enhance organizational resilience, allowing for rapid adaptation to future risks

Business Operations Interruption Jumps Up the Risk Register

The majority (60%) of risk managers cited strategic risks as having the greatest impact on earnings in the next three years.

Specifically cited were evolving customer demand and purchasing behaviors (49%), business operations interruptions (39%), macroeconomic risks (36%) and financial risks (30%).

In comparison to last year, the number who believe strategic risks will have the greatest impact on earnings has risen 9%, while the number who believe business operations interruptions will have the biggest impact has risen 20%.

Ultimately, successful risk management comes down to the ability of leadership to make smart, informed and timely decisions. When this survey was conducted, treasury professionals were dealing with risks for which they had no prior experience. From this crisis came an opportunity for treasury departments to focus on business interruption planning, which will be key in the future.

In many parts of the world, macroeconomic risks will continue to have an impact on earnings. Some countries are still being challenged by their ability to acquire COVID-19 vaccines, which in turn, has slowed their economic recovery. Additionally, the emergence of COVID variants and surges in the number of cases continue to block our way to a full global recovery.

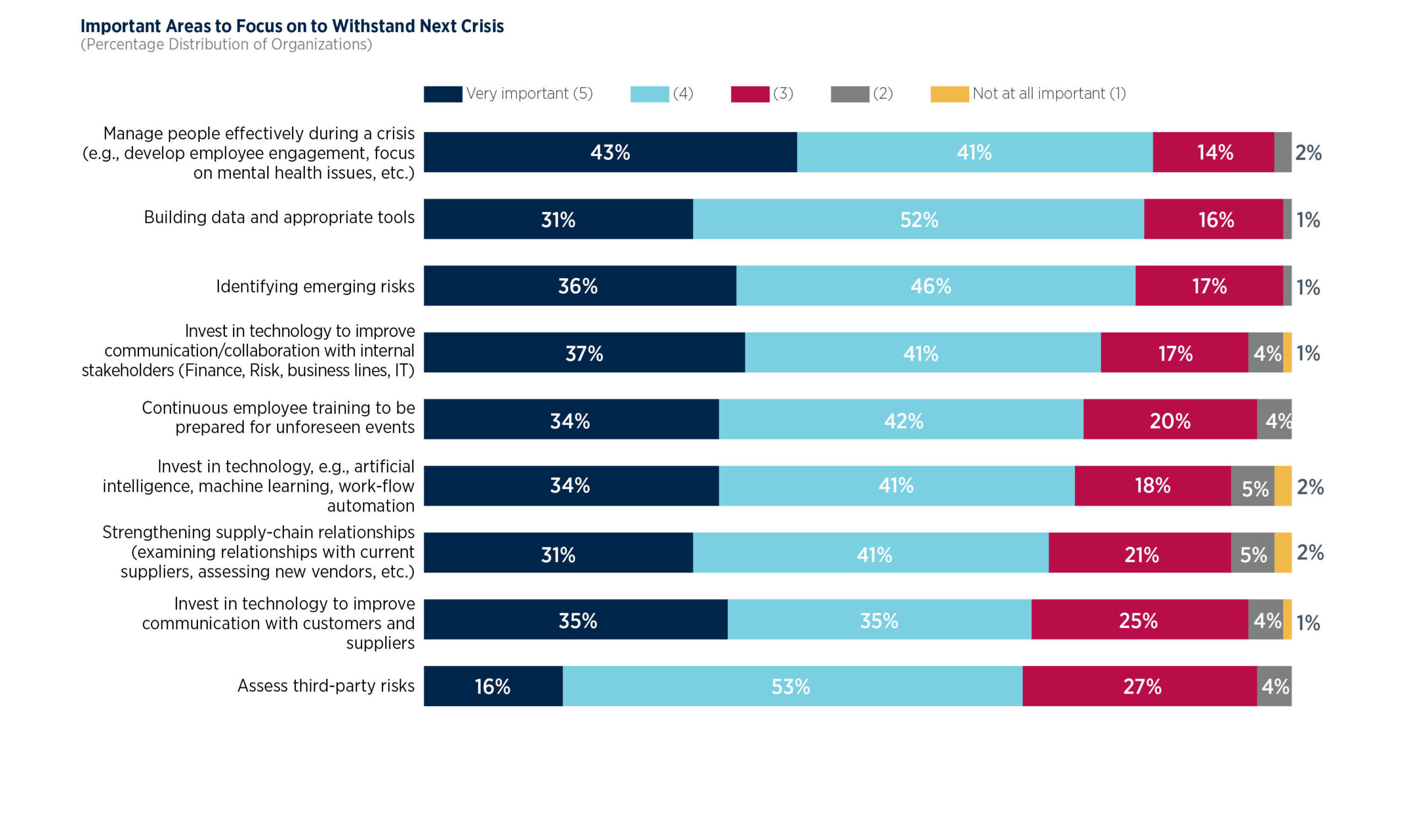

Focus On the People

While two-thirds of respondents indicate their organizations are placing a greater emphasis on risk management technology, the majority of practitioners are not fully confident that they are equipped with the necessary analytical tools and methodologies that allow them to forecast current and future risks. This is concerning.

It seems business leaders are finally waking up to the fact that managing their people effectively is crucial. Overwhelmingly (84%), respondents felt that people management was key to withstanding future crises. They’re not wrong.

What this translates to is a focus on employee engagement, assisting staff in adapting to alternative work environments, allowing flexibility, and providing help with mental health issues.

We don’t know what will come next, but what leadership everywhere now realizes is that effective people management — taking care of our people — is critical if we want to still be standing when the dust settles.