Global Insurance Pricing Increases in Fourth Quarter 2021

Property insurance rose around the world in Q4 2021, along with other global commercial insurance prices.

Photo: Unsplash

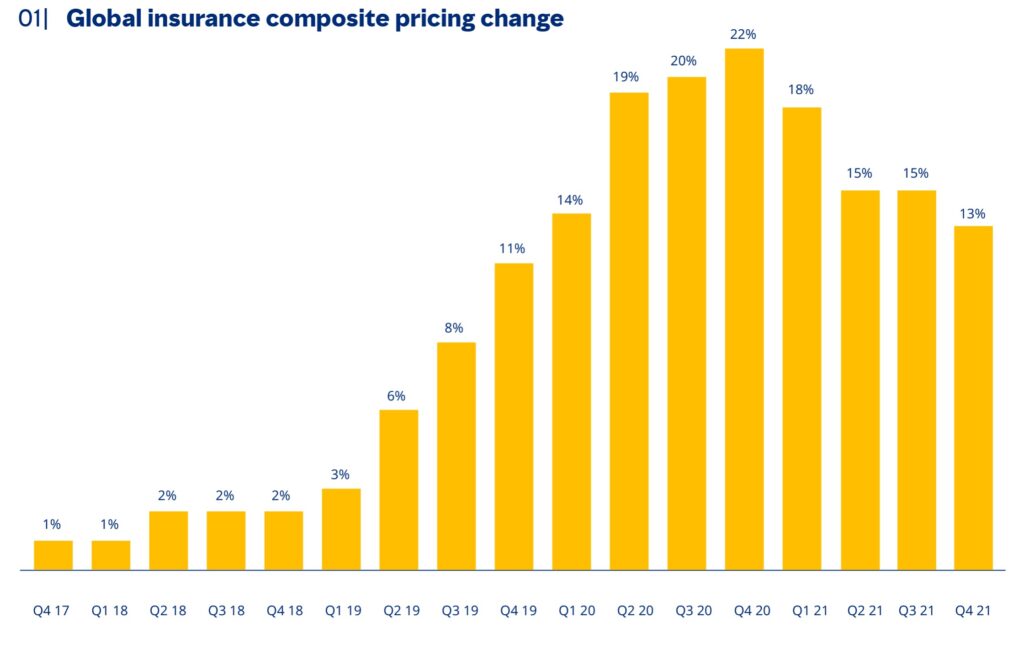

Global commercial insurance prices increased 13%, on average, in the fourth quarter of 2021, a decline from 15% in the third quarter.

It was the seventeenth consecutive quarter of rising average prices in the Marsh Global Insurance Market Index; increases peaked in the fourth quarter of 2020, at 22%, and slowed or remained flat throughout 2021 (see Figure 1).

Cyber insurance continued to go against the overall trend of moderating prices, with average increases in the fourth quarter of 130% in the U.S. and 92% in the U.K. Increases were driven by ransomware claims and the frequency and severity of losses.

The U.K. and U.S. had the highest average increases. Composite insurance pricing increased by 22% in the U.K., compared to 27% in the third quarter, while the U.S. rate of increase stayed the same, at 14%.

Average pricing increases in Continental Europe (9%) and Asia (6%) were lower than in the prior quarter; the Latin America and Caribbean region increased slightly (4%).

All three major product lines showed increases in average pricing globally, though less than the prior quarter: financial and professional lines (31%), property (8%) and casualty (5%).

In US, Cyber Claims Put Pressure on Financial and Professional Lines

The rate of price increases in the U.S. in the fourth quarter was 14%, the same as in the third quarter. This largely was due to the increase in cyber insurance pricing.

Average property insurance pricing in the U.S. increased 7% in the quarter compared to 10% in the third quarter. Clients with poor risk quality, meaningful losses, or significant exposure to secondary catastrophe (CAT) perils — including wildfire, convective storm and flood — generally experienced above average rate increases.

Financial and professional lines pricing in the U.S. increased an average of 34% in the quarter, up from 27% in the prior quarter, driven by cyber insurance pricing. Directors and officers (D&O) liability insurance pricing for publicly traded companies increased 6%, down from 10% in the prior quarter.

Pricing for cyber insurance increased 130%, on average, affected by the continued increase in frequency and severity of losses. Cyber underwriting continued to focus on a company’s control environment and demonstrated cybersecurity maturity. Business interruption and data exfiltration contributed to the increasing claim pay-outs from ransomware events.

Casualty insurance pricing in the US increased 4% on average in the fourth quarter, down from 7% in the third quarter.

UK Pricing Increases Moderating

Overall, insurance pricing in the third quarter of 2021 in the U.K. increased 22%, compared to a 27% increase in the prior quarter.

Financial and professional lines increased an average of 43%, compared to 54% in the third quarter, driven by cyber pricing. Average D&O rate increases declined to 24% in the fourth quarter from 61% in the third quarter as available capacity continued to increase.

As elsewhere, cyber insurance rates continued to climb, with an average increase of 92%.

In other lines, property insurance pricing increased 10% on average, down from 11% in the prior quarter; casualty rose an average of 4%, compared to 7% in the third quarter.

Property Insurance Pricing Moderates in Asia

Insurance pricing in the third quarter of 2021 in Asia increased 4%, year-over-year, compared to 6% in the third quarter.

Average property insurance pricing rose 3%, compared to 5% in the third quarter; casualty pricing was up 2%.

Financial and professional lines pricing in the region rose 17%, on average, the same as in the prior quarter. Cyber insurance remained challenging.

Insurance Pricing by Region

Other regional highlights in the third quarter included the following:

In the Pacific region, pricing increased 13% on average, a decline from 17% in the third quarter. It was the first time since 2016 that the global average was higher than composite pricing in the region. Financial and professional lines increased an average of 18%, compared to 25% in the third quarter. Property pricing rose 8% on average, and casualty insurance pricing rose 15%.

Continental Europe experienced a 9% average increase in overall composite insurance pricing. Financial and professional lines pricing increased 13% and property 10%, on average, down from 14% and 12%, respectively, in the prior quarter. Casualty increased 7%, up from 5% in the third quarter.

In the Latin America and Caribbean region, composite pricing rose 4%, on average, up from 2% in the prior quarter. Casualty pricing declined 3% on average, the seventh consecutive quarter of decrease.