Global Trade Is Battling Demand and Price Shocks

Global trade will take a hit, particularly in Europe, as the conflict in Ukraine continues.

Photo: Unsplash

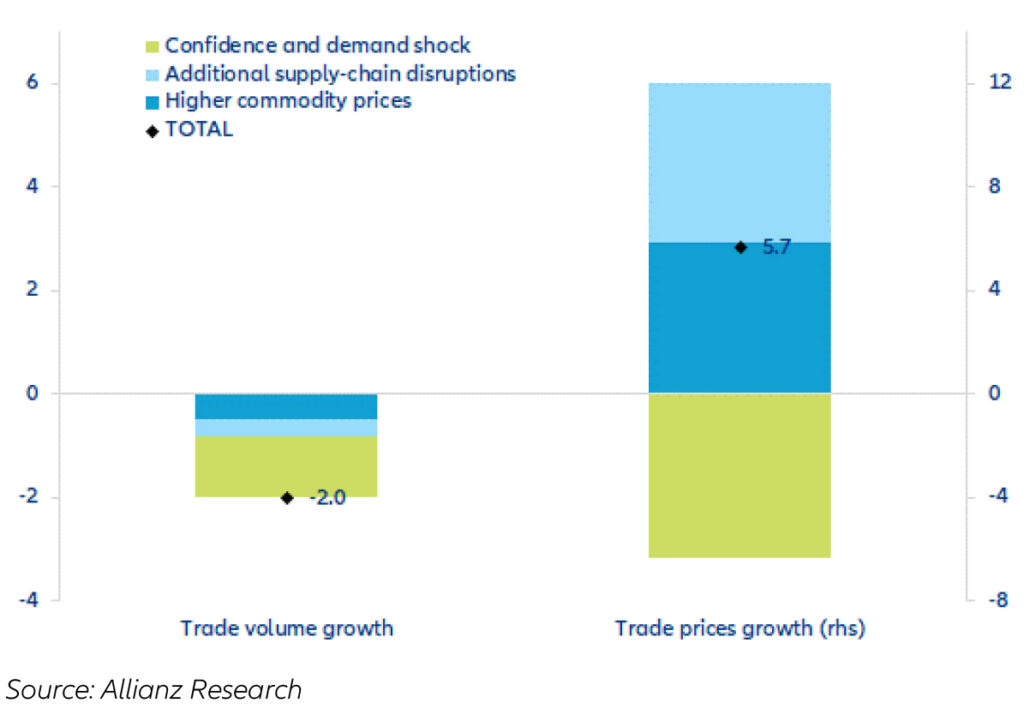

The invasion of Ukraine and renewed COVID-19 outbreaks in China will hit global trade with a double whammy in 2022: lower volumes and higher prices. We now expect trade to grow by 4.0% in volume terms in 2022 (2 percentage points lower than expected before the crisis), while trade in value terms surges by 10.9% (vs. 7.2% previously expected).

After the contraction in Q3 2021, the risk of a double-dip in global trade volume in H1 2022 has increased further – not only due to supply-chain bottlenecks, but also because of lower demand. The economic consequences of Russia’s invasion of Ukraine will slow GDP growth around the world, especially for economies in Europe. The resulting confidence and demand shock explains more than half of the downward revision in our forecast for trade growth in volume in 2022 (see Exhibit 1). Conversely, trade prices growth has been revised upwards by 5.7 percentage points, with commodity prices and additional supply chain disruptions contributing roughly equally.

Exhibit 1: Breakdown of 2022 trade growth forecast revisions (percentage points)

The Demand Shock

The confidence and demand shock will result in a loss of $480 billion in exports to Russia and Eurozone countries in 2022 (roughly evenly split between the two destinations), with companies in Eastern Europe the most exposed. While Russia as an end-demand market is not systemic at the global level (representing just 1.2% of global imports on average in 2015-2019), the multi-year recession it is likely to face could lead to losses in the region.

The most exposed countries are Moldova, Slovakia, Serbia, Slovenia and Czech Republic, where exports exceed 1.5% of GDP. Among the biggest Eurozone exporters, Germany and Italy are among the top 20 most exposed, with potential losses of up to 0.6% ($21 billion) and 0.5% of GDP ($90 billion) respectively, in the worst-case scenario where relationships with Russia are completely frozen.

Looking at Russia as a supplier in global and regional value-chains, Eastern Europe remains the most at risk, while a complete cut-off of relations would mean the Eurozone’s largest four economies losing up to 0.4% of their GDPs and 1.1% of their exports.

Focus on Commodities

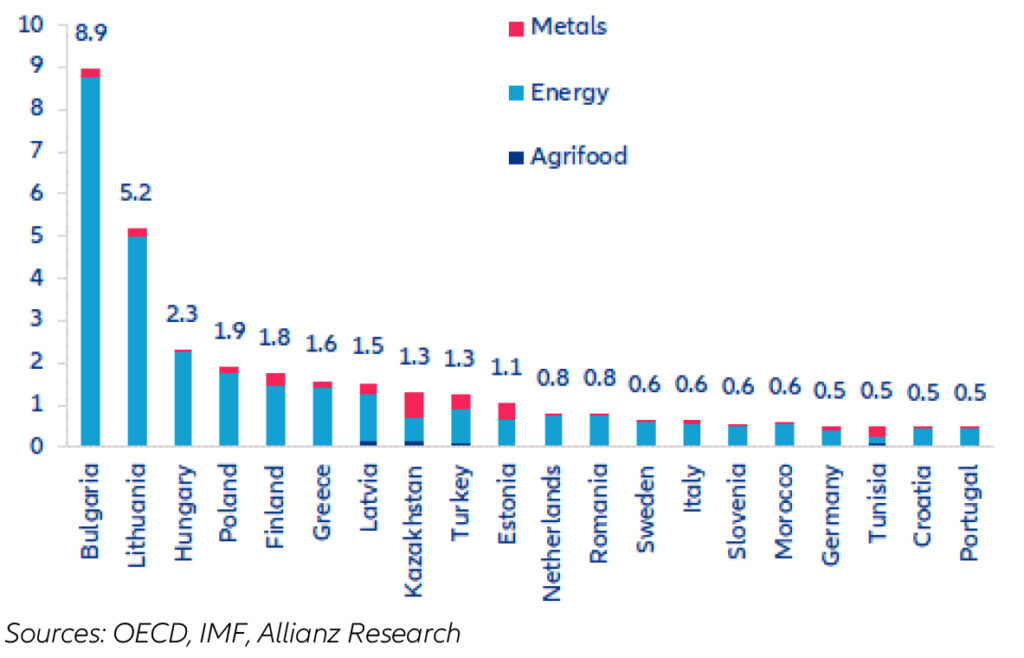

Looking at the world’s exposure to goods produced in Russia, the sectors of focus are energy (e.g., oil, gas), metals (e.g., aluminum, palladium, nickel) and agrifood (e.g., wheat, corn) as Russia respectively represents around 9%, 3% and 2% of each sector’s global exports. By looking precisely at the amount of energy, metals and agrifood inputs produced in Russia that end up in other countries’ outputs (through direct and indirect trade linkages), we find that Bulgaria (close to 9% of GDP), Lithuania (more than 5% of GDP) and Hungary (more than 2% of GDP) are the most exposed (see Exhibit 2).

Some Western and Northern European countries are also among the top 20 most exposed, including the Netherlands (0.8% of GDP), Sweden (0.6%), Italy (0.6%) and Germany (0.5%). This compares with 0.3% of Chinese GDP depending on Russian inputs, and 0.1% for the US. Looking at how much Russian value-added is used in other countries’ exports yields similar results, with Eastern European economies the most exposed, while up to 1.1% of exports from the largest four economies of the Eurozone could be at risk (compared with 0.7% for China and 0.2% for the US).

Exhibit 2: Russian energy, metals and agrifood inputs used in respective countries’ output (% of GDP), top 20 exposed in relative terms

Supply Chain Bottlenecks

Europe is thus by far the most at risk of supply-chain disruptions caused by the Russian invasion of Ukraine and ensuing sanctions. Beyond food and energy commodities, which can be easily substituted with other suppliers, metals are actually more sensitive products. Indeed, they are often part of an industrial process that has been designed to take into account the particularities of a certain supplier. As such, changing suppliers, even when possible, is not an easy task as it might require industrial adjustments. Based on the critical materials analysis from the European Commission, we observe that Russia represents over 10% of imports for about 20 metals, with key applications in transport equipment, high-end electronics (batteries, semiconductors, smartphones), construction and automotive.

To account for second-round supply-chain effects of ongoing events, value-added that needs to transit via Russia before reaching its final destination also needs to be taken into consideration, on top of that directly produced in Russia. We find that the latter has a much larger impact than the former, which is even negligible outside Europe. This confirms Russia’s limited role in global and regional supply chain logistics. Indeed, even if high-frequency data show that the number of tankers moving in the Black Sea and Baltic Sea, and the number of container vessels anchored in Russian ports, have declined since the start of the conflict, it is important to keep in mind that Russia represents just around 2-3% of the global tanker fleet and containerized trade.

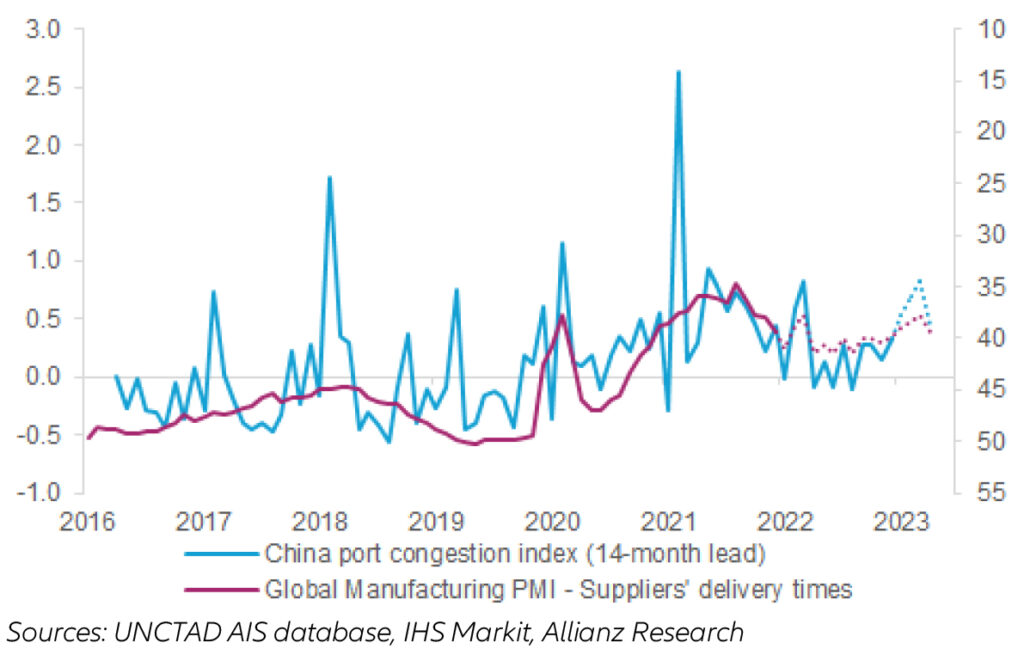

New COVID-19 outbreaks in China are the larger issue for global supply chains as the sustained zero-COVID policy is likely to keep delivery times elevated throughout 2022. Local lockdowns and more restrictions in response to rising infections in cities such as Shenzhen and Shanghai are likely to impact production and logistics in China. Data show that congestion waiting times and anchorage outside the Yantian port and the outer Pearl River Delta have risen over the past few weeks. For now, they remain below the levels seen during summer 2021, when outbreaks led to temporary port closures.

However, this new bottleneck comes at a time when the global maritime shipping industry is still fragile. A repeat of the temporary port closures in China could have ripple effects on global logistics: The historical relationship between our proprietary China port congestion index and the global manufacturing PMI suppliers’ delivery times index (see Exhibit 3) suggests that delivery times are likely to remain above the pre-pandemic average for most of 2022, and even lengthen slightly at the start of 2023 – though remaining below 2021 peaks.

Exhibit 3: China port congestion index and global manufacturing sector delivery times

A version of this article originally appeared in Unravel.