How Will the EU Respond to American Protectionism?

New tax breaks and subsidies for green investments in the U.S. may lure companies to heavily invest or even move to the U.S., prompting some in Europe to question whether EU institutions will match the U.S.'s generous legislation incentives.

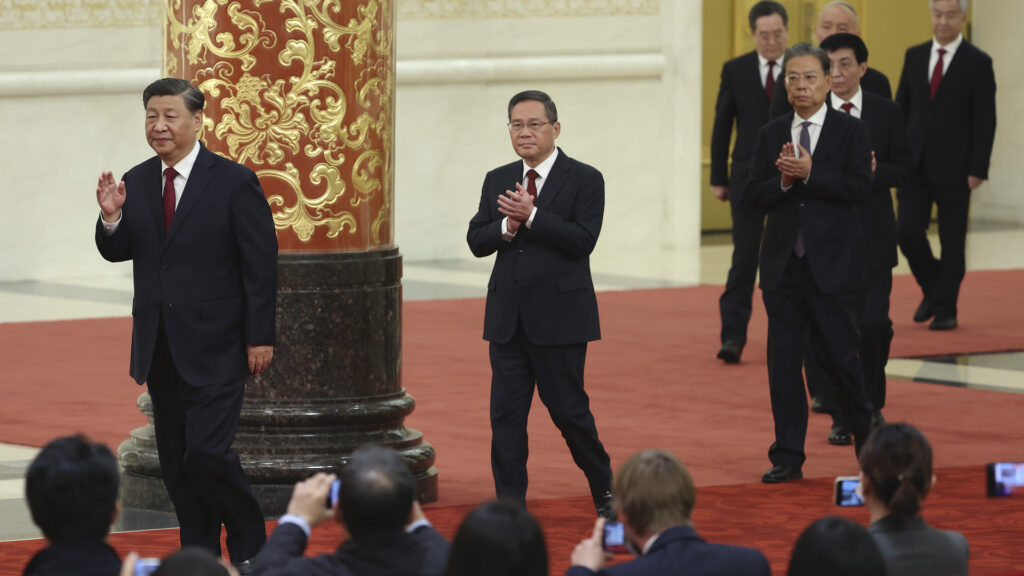

Photo: Getty Images

The tax breaks and subsidies for green investments contained in the U.S. Inflation Reduction Act have thrown the European Union into a state of confusion and alarm. The $369 billion program of green subsidies lures companies to heavily invest, or, in some instances, move to the U.S. European officials are warning of the growing danger of European de-industrialization if companies heed the American sirens’ call.

However, generally, EU corporates have welcomed the U.S. approach toward the green transition as it appears to put a premium on carrots rather than sticks. The question is whether EU institutions will match the U.S.’s generous legislation carrots. Corporate Europe is pressing the bloc to at least abandon some of the more punitive elements of its green legislative agenda. But the public debate is filled with dire warnings and calls to action.

Europe’s Vulnerability to Trade Wars

According to the president of the European Central Bank, Christine Lagarde, “The global economy finds itself at a crucial turning point. Last year, we began to see the emergence of a “new global map” of economic relationships — one in which geopolitics is increasingly influencing the global economy.”

Responding to the new challenge seems particularly difficult because two disruptive structural trends meet, namely the green transition and a more fragmented geoeconomic reality.

Europe’s fear is that it will be squeezed between the U.S. and China, as both countries “increasingly use trade to limit the ambitions of geopolitical rivals.” Indeed, fragmentation of world trade could reduce global output by roughly 7%, according to the IMF. The head of the ECB recently stressed that Europe is particularly vulnerable to geopolitical headwinds, as more than one-third of its manufacturing output is absorbed outside the EU, much more than for the United States or China.

To avoid such a dire scenario, EU officials have stressed for weeks that they are determined to increase the resilience of the bloc. The COVID pandemic as well the energy crisis triggered by the conflict in Ukraine demonstrated Europe can respond effectively to economic shocks. However, Europe’s latest “angst” appears to go deeper. Responding to the new challenge seems particularly difficult because two disruptive structural trends meet, namely the green transition and a more fragmented geoeconomic reality.

It Has Exposed Questions of EU’s Free Trade

Agreeing there is a problem, of course, does not mean Europe’s leaders are anywhere close to finding a common approach. The summit meeting scheduled for the first half of February is unlikely to provide exhaustive answers, as the challenge has exposed fundamentally different interpretations of free trade and the essence of the EU’s single market.

The ideas currently discussed all have serious shortfalls. First on the list, relaxing state aid rules, albeit temporarily, to allow member countries to provide more support for their industries.

This is probably the most problematic. In an interview with politico.eu, former EU commissioner and prime minister of Italy Mario Monti stressed that this would be the third time in a row the framework would be relaxed, comparing the EU state aid binge to an addiction: “The longer a drug addiction phase is allowed to last, the more difficult it will be to deprive the subject of it. … There is no point in keeping the single market free of anticompetitive distortions by firms … if countries can then distort that single market.”

Margrethe Vestager, the vice president of the EU commission, has similar concerns, given the widely different financial firepower individual member states can bring to bear to support their industries. Senior EU officials are examining ways to make it easier for member states with less fiscal space to tap existing EU funds.

The Risk of Reopening Old Scars

The EU Commission is also considering the possibility of setting up new facilities or increasing the firepower of already available pots of money and could tap debt markets to fund them. However, these ideas continue to be politically controversial. They risk opening old wounds between fiscally conservative member states, such as the Netherlands and high public debt countries. Holland’s prime minister Mark Rutte believes Next Generation EU still has ample untapped resources.

The recovery fund allocates more than one-third of its money, more than 250 billion euros ($272 billion), to green investments. Prime Minister Rutte says he would agree to small tweaks to existing tools but would resist any new programs. Recent increases in the EU’s cost of borrowing may also pour cold water on the idea, since for most EU countries, it is currently cheaper to tap debt markets directly, rather than indirectly via the EU commission.

The absence of a sizable permanent EU stabilization fund leaves member states with some unpalatable choices. Any further relaxation of state aid rules, coupled with fiscal largesse at the national level, risks fragmenting the single market even before the impact of the ongoing partial fragmentation of the global economy is fully felt in Europe.

Germany and France are looking for an elusive compromise. Berlin is alarmed by the state of the global economy and has lost some of its instinctive trust in open trade and markets. Paris is pushing its traditional agenda of robust industrial policies and soft protectionism. It is important that France and Germany pull in the same direction, especially given the recent cooling of the relationship.

The Elusive Compromise

However, protecting the single market is a priority that should not be sacrificed because of the current need to move in tandem. German chancellor Olaf Scholz recently said he was open to the idea of new EU funding tools. At the same time, he expressed confidence that a compromise can be found eventually with the American counterparts to mitigate the impact of the U.S.’s subsidy program on EU industries.

The most likely scenario is that many little steps will be discussed and announced in the coming weeks, but mostly to allow EU leaders to avoid looking paralyzed. Whether that will be enough to effectively support European companies and the EU’s green transition is another matter altogether.