China Is Set To Become a More Interventionist Economy

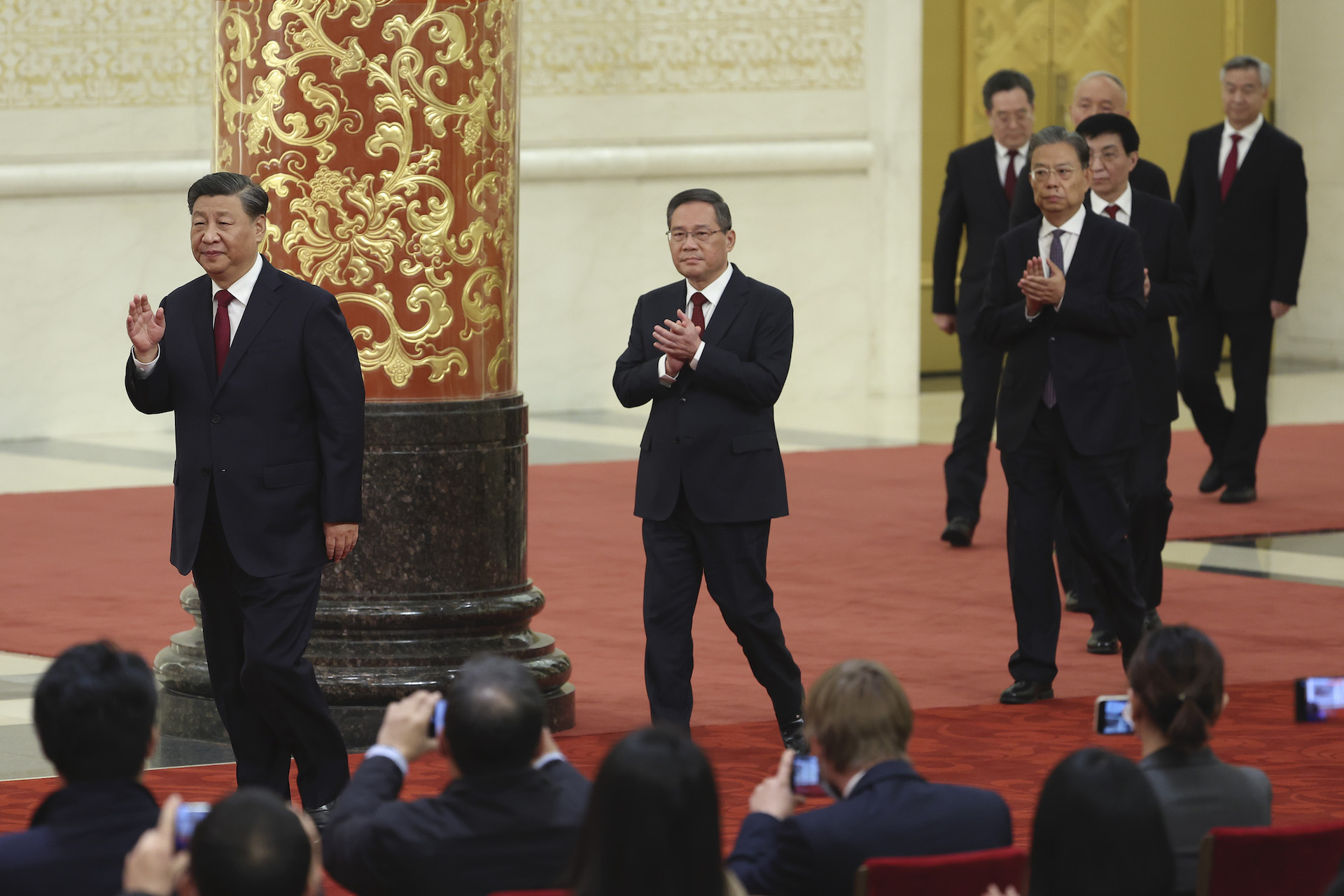

(L-R) Xi Jinping, Li Qiang, Zhao Leji, Wang Huning, Cai Qi, Ding Xuexiang and Li Xi, attend the meeting between members of the standing committee of the Political Bureau of the 20th CPC Central Committee and Chinese and foreign journalists at The Great Hall of People on October 23, 2022 in Beijing, China.

Photo: Lintao Zhang/Getty Images

The recent 20th National Congress in Beijing was an occasion for agenda-setting of China’s future economic policies. Many observers were wondering whether China will change course from pursuing development through reform and opening up — and if so, how much China’s business environment will be altered.

From official documents, we have identified some signs of policy continuity in pursuing growth and development, but also worrying concerns that foreign and domestic non-state firms are being squeezed due to more proactive state intervention.

Development Remains a Top Priority

According to the 20th Party Congress Report, “development is the party’s first priority to govern and rejuvenate the country.” Sustaining healthy growth is vital for the Communist Party of China to demonstrate its ability to lead, especially since the economy faces strong headwinds from recurring COVID outbreaks, a deteriorating external environment, and difficulties in transforming the economy from export-oriented and investment-driven to innovation-driven development.

Continued emphasis on development is evident from the Report, which reaffirms that China will “adhere to the direction of building a socialist market economy through reform and high-level opening.” The report did state that China will “let the market play a decisive role in resource allocation…[and] improve the business environment for non-state enterprises, enhance property right protection, and improve the system of market access and fair competition.”

The report also notes that China “will promote high-level opening to the outside world” by “reasonably shortening its negative list for foreign investment, protecting the rights and interests of foreign investors, and creating a world-class business environment that is market-oriented, rule-based, and internationalized.”

Expect a More Proactive State

However, there are signs of change to economic policy. The most salient changes are a more proactive interventionist state and stronger security-centered thinking in development strategies. Such repositioning is driven by three considerations:

- worsening perception of the external environment,

- growing skepticism on further reforms,

- and a renewed belief that strong state-led efforts are the only option to overcome challenges.

The Report reflects a pessimistic assessment of China’s external environment and an urgent sense of threats to its national security, stating that “repression and containment from outside may escalate at any time.” Such a crisis-like mentality underlines China’s renewed enthusiasm for technological self-sufficiency, through government subsidies and other policy tools.

Second, the Report indicates increasing skepticism on the outcome of economic reforms. While the term “reform” has taken a central position in all CPC’s Reports since the late 1980s, it appears 51 times in the latest Report was 51 times, down from 71 times five years ago. In comparison, the term “security” appears 91 times, up from 55 times in the previous Report.

No Let Up on “Zero-COVID”

The outcome of the Report is a stronger state sector and a stronger presence of the party in various state and non-state organizations. It calls for the strengthening of party leadership in state-owned industrial and financial enterprises (SOEs), while enhancing corporate governance. The Report also commits to “make state-owned capital management firms and SOEs stronger, better, and bigger.” Meanwhile, it explicitly promotes party-building in various non-state firms and various other organizations.

The Report implies a continuation of the current “zero-COVID” policies. Since the start of the pandemic, China has insisted on applying strict measures to contain the outbreak, even when most countries have reopened their borders and relaxed their restrictions. The Report justifies China’s approach for achieving “significant positive outcome for economic and social development,” indicating the economically disruptive measures will continue for an unknown period of time.

Some multinationals foresee that China’s business environment will worsen due to persistent COVID-19 policies, deteriorating China-U.S. relations, and regulatory tightening.

Overall, the Report has mixed messages. Although market and economic development are considered valuable, the importance of the state and its institutions have been elevated.

The results could be a business environment more accommodating to selective non-state players in certain sectors, or to those working closely with state-associated entities. At present, the continuation of strict “zero-COVID” measures serves to worsen China’s economic outlook and market sentiment, dampening the overall business environment.

A Nightmare Come True for Some?

The Report confirmed some of the concerns of foreign investors. According to surveys by the European Union Chamber of Commerce in China and the American Chamber of Commerce in China, some multinationals foresee that China’s business environment will worsen due to persistent COVID-19 policies, deteriorating China-U.S. relations, and regulatory tightening.

Evidently, strict “zero-COVID” policies disrupt business operations and dampen future investment. The survey suggests that travel restrictions make it hard for European companies to attract talent and retain existing staff, while American companies are concerned about their essential staff under travel restriction and remote working conditions, which may cause unexpected production delays and affect supply chain management.

The surveys further highlighted that “zero-COVID” policies and their uncertain implementations may result in postponement and relocation in firms’ investment.

Deteriorating China-U.S. Relations Could Worsen the Business Environment

In early October, the U.S. Commerce Department released its latest and strictest export control on the exports of advanced computing and semiconductor manufacturing items to China. Mutual hostility and increasingly confrontational sentiment could make it impossible for firms in affected sectors to operate in China. A side effect could be more state-driven industrial and technology policies in China, which creates further uncertainty for foreign and domestic non-state businesses.

Finally, a more proactive state could mean a tightened and more discriminative regulatory environment for non-state players. According to a different survey by the American Chamber of Commerce in China, firms’ top three concerns include inconsistencies in regulatory interpretations, unclear laws, and uncertainties in enforcement. 40% of respondents were pessimistic about China’s regulatory environment, 16 percentage points higher than a year before.

Uncertainties Remain

Now that Xi Jinping has secured another five-year term, we expect China’s leadership will continue pushing forward its major development agenda formulated in the past decade, including common prosperity, dual circulation, and carbon neutrality. In the short-run, there will be more focused efforts to stimulate the economy, which has been under growing downward pressure.

In the past few weeks, the government has released documents supporting domestic non-state enterprises and foreign businesses. It remains to be seen how these are translated into workable policies and how effective these would be.

Several essential questions remain. First, when will the “zero-COVID” policies be reversed? Second, how will the state and its enterprises interact with the market and various non-state players? And last, what is the future of China’s external economic environment, as strategic competition with the United States drags on? Answers to these will provide additional insights to comprehend China’s business environment in the coming years.