Supply Chain Strategies Are Likely to Lead to More Deglobalization

Multiple container ships are docked at Container Terminal Altenwerder at Hamburg Port on October 3, 2022 in Hamburg, Germany.

Photo: Gregor Fischer/Getty Images)

Businesses have been facing shocks on multiple fronts these days, from COVID-19 and inflation to the conflict in Ukraine and other escalating geopolitical tensions. COVID and the Russian invasion of Ukraine particularly turned global supply chains upside down and intensified disenchantment with the trend toward globalization that has dominated world commerce for decades.

In the face of these challenges, business leaders are urgently seeking ways to bolster supply chain resilience. Often, the first port of call has been to increase the level of stock in company warehouses. This has led to a dramatic rise in inventory levels across the globe and higher operating costs, especially given current global inflation. But while it is often a useful, short-term tactic, other solutions can be more sustainable for the long term.

In our work with industrial clients around the world, we have examined many different approaches that companies are taking and studied how they can be combined into resilient, longer-term supply chain strategies. Based on this corporate input, we’ve put together an overview of essential strategies available to companies, how they interact, and the implications of choosing one over another.

The key to success is ensuring that new supply chains are more robust than the ones they replace. And the more companies approach supply chain decision-making intentionally and holistically, the more likely they will develop long-term sustainability.

Trade Troubles and Consumer Interests

First, some context on pressures facing the supply chain: After decades of globalization and economic liberalization, continued trade growth can no longer be taken for granted. The global financial crisis of 2007 through 2009 left many suppliers with payment issues. While the financial system ultimately recovered, global trade remains down by eight percentage points from its peak in 2008. On top of slowing global trade came the introduction of trade sanctions between the United States and China, followed by COVID-19 and the challenges of maintaining supply when much of the world economy was shuttered.

This series of shocks has led many to question globalization itself. Consumer attitudes in the electronics industry reveal that in countries such as France, Germany, and India, most consumers now believe “the world is too globalized.” While those in China and the U.S. remain more positive about globalization, it is by a margin of just 4% and 6%, respectively.

The experiences of the past two years have also led consumers to take much stronger interest than before in questions about the origin of products. Interest in these matters is up 29% in the United States, for example. When buying electronics, 65% of consumers focus on domestic brands and 74% on locally produced devices. This is especially the case when issues of quality and trust are involved.

Additional Geopolitical Pressures

Recent events are also raising questions about companies’ continued dependence on China and its lengthy supply routes. The share of trade in China’s economy is on the decline, falling from a high of 35% before the financial crisis to less than 20% today.

Russia’s invasion of Ukraine could prove the biggest test of all. The conflict has already pushed up prices of oil and gas significantly. Low fuel prices have correlated historically with periods of high economic growth. The recent surge in commodity prices is adding to a dangerous inflationary spiral.

Even if peace comes soon, sourcing commodities or components from Russia and Ukraine will remain out of the question for the foreseeable future.

Ways Forward

In response to these challenges, companies are looking for ways to bolster supply chains so they might ride out future storms. Ultimately, the last few years have shown us that companies can be more flexible and adaptive than expected.

Build up inventory. The quickest and simplest way to increase resilience is to increase inventory. This acts as a buffer against disruption — but it comes at a cost. Economists have suggested the recent rise in inventory costs is equivalent to 1% of global gross domestic product (GDP). Currently, this is a price many companies view as worth paying, but there is a long-term question of whether the strategy is sustainable.

Regionalizing the supply chain. Regionalization allows companies to view the supply map as a series of interconnected but largely independent ecosystems. It has led companies to source commodities, such as textiles, wood products, and metals, closer to their customer base, from locations such as India, Mexico, Poland and Vietnam. The impact of regionalization by numerous firms has had such a big impact that it has increased the GDPs of these countries.

Regionalization helps limit the risk of disruptions affecting all regions simultaneously. It also provides companies with the opportunity to potentially cut emissions and up their game in applying the sustainability criteria of environmental, social, and governance (ESG) programs.

Nearshoring supply and production. Relocating production and supply closer to home gives companies greater control. Like regionalization, it also potentially decreases the carbon footprints of supply chains.

There are numerous recent examples of nearshoring. For example, one U.S. toymaker recently announced it would invest $50 million in a manufacturing plant in North America, after years of manufacturing most of its goods in Asia. Likewise, in December 2020, a major U.S. computer chipmaker announced it would invest hundreds of millions of dollars in domestic production facilities.

Making the Best Decisions

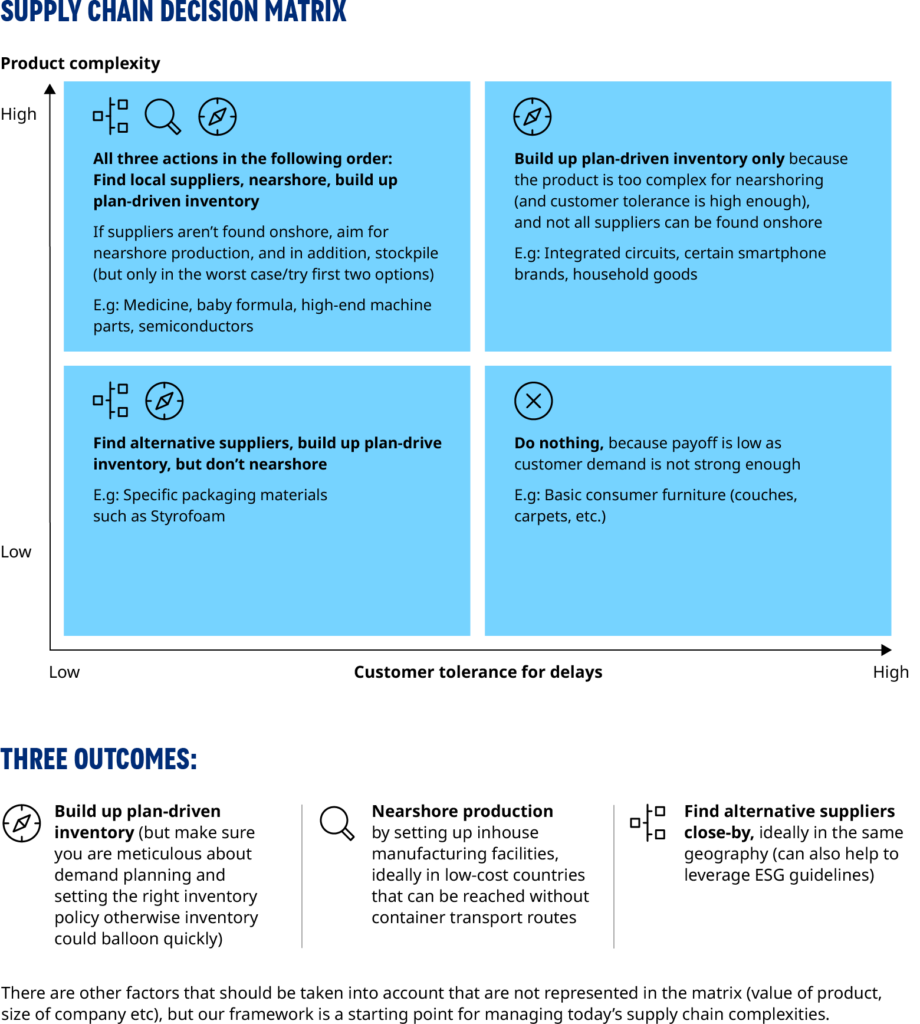

Chief operations officers recognize that future supply strategies need to be more flexible and resilient — but reshaping supply chains can be a complex and time-consuming task. To help speed the process, leaders can use a decision-making matrix to assist in thinking through these challenging decisions.

The matrix helps identify the most optimal combination of sourcing and warehouse management approaches for a company’s circumstances. It focuses on two key dimensions: the complexity of the product and the customers’ demand for the timeliness of supply. This produces four quadrants with distinctive characteristics. For each, the framework identifies which approaches can be combined to greatest effect.

Not every circumstance warrants such investment. For example, products of low complexity, where timely supply is less important, are unlikely to justify such interventions.

Longer-Term Strategy

While speed is of the essence in developing short-term tactical responses to supply-chain challenges, strategy is necessarily longer-term in nature. Companies need to incorporate tactical measures to ensure increased resilience during the implementation phase. But implementation itself is likely to consist of multiple stages, especially when the new approach entails both nearshoring production and localizing supply.

Assessing these short- and long-term possibilities isn’t easy. But companies that can find the right mix of responses can build a supply chain that proves resilient over the long haul.