Russia’s Invasion of Ukraine Impacts Foreign Investment

Russia’s attacks on Ukraine will impact foreign direct investment in the country, according to Investment Monitor. In 2020, Ukraine was the 10th-largest recipient of foreign direct investment (FDI) in central and eastern Europe, and the 56th recipient globally.

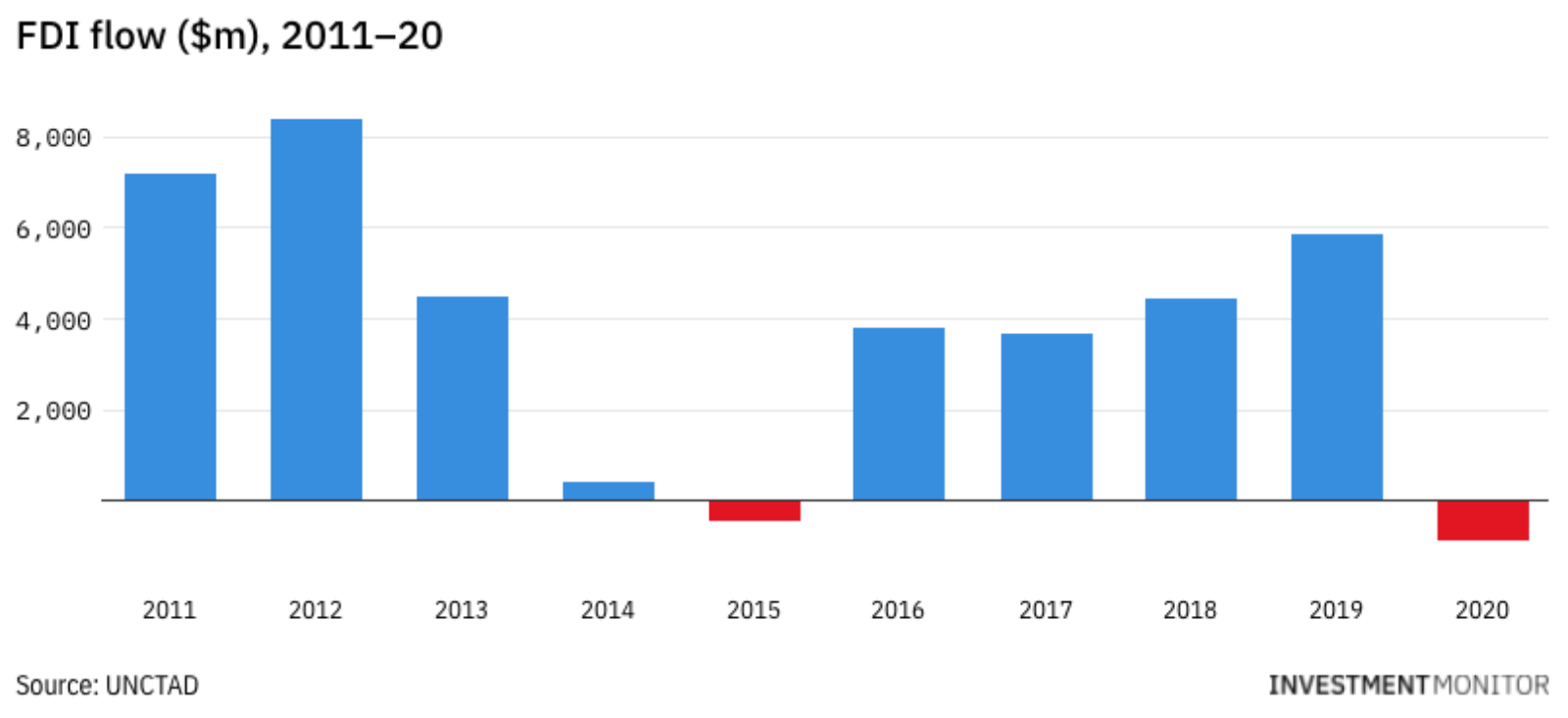

The U.S., U.K. and Germany are key investors in the country, and more than half of those investments are in software, renewable energy and logistics. FDI to Ukraine took a hit in 2014 when Russia invaded Crimea and slowly trended upward until the COVID-19 crisis.

After the drop in investment caused by the COVID-19 pandemic, global FDI was worth an estimated $852 billion in the first half of 2021. But the recovery has been uneven. Most foreign investment to Ukraine has gone to its western regions, with German automotive companies being the biggest investors.