The Belt and Road Initiative at 9: Time to Reckon and Reposition

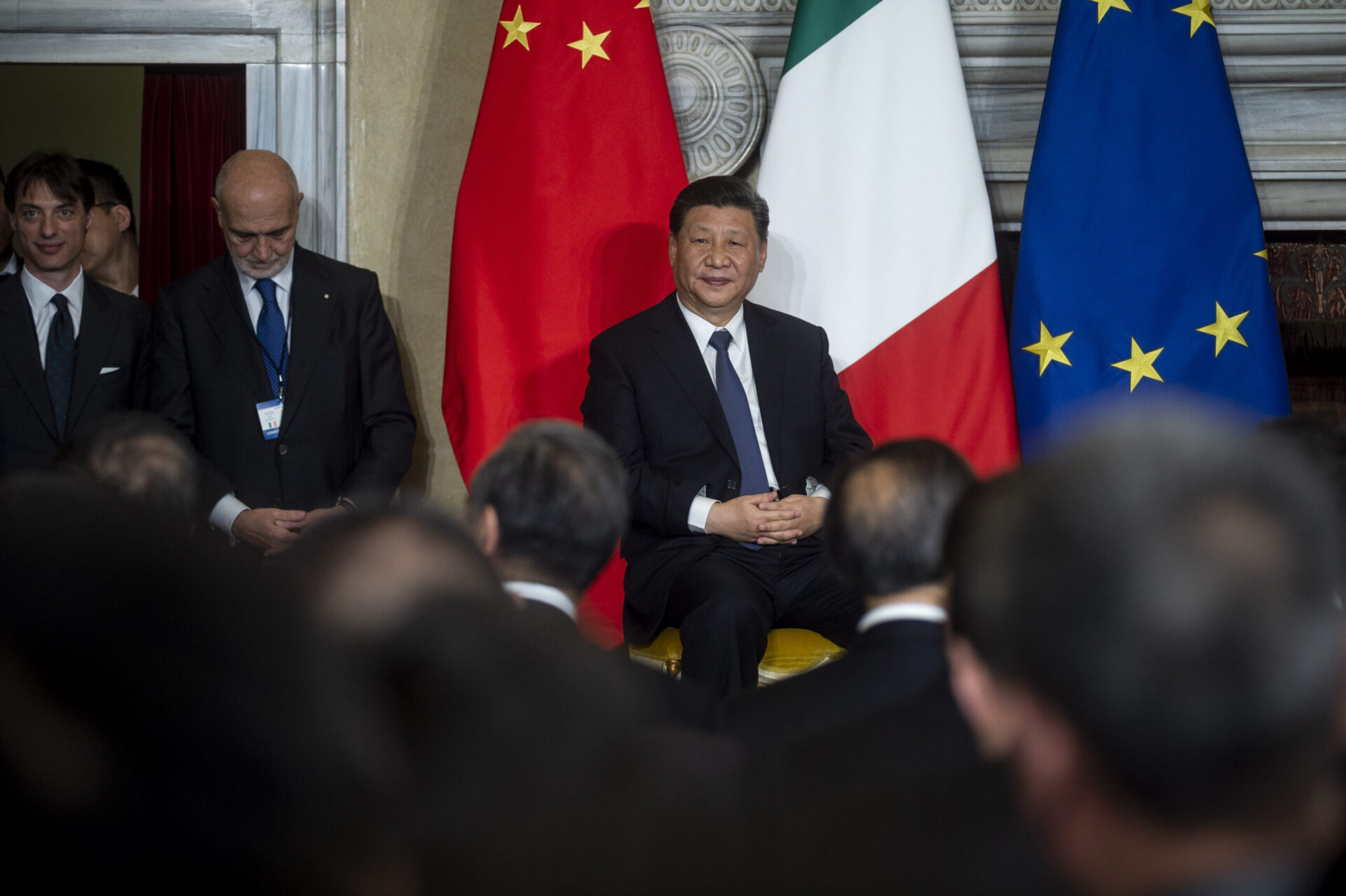

Chinese President Xi Jinping meets Italian Premier Giuseppe Conte (not in picture) to sign trade agreements on the Belt and Road Initiative, on March 23, 2019 in Rome, Italy.

Photo: Antonio Masiello/Getty Images

China’s Belt and Road Initiative (BRI) is now nine years old. A transnational infrastructure program financed mainly in bilateral loans from China’s state-owned banks and other entities, the BRI has reached nearly a trillion dollars of total financing ($932 billion) between 2013 to the first half of 2022. Seventy percent of it has gone to the hard infrastructure sectors such as roads, railways, ports, airports, power stations and transmission lines.

Chinese President Xi Jinping dubs the BRI as the “Project of the Century” — it’s a central platform for China’s global engagement and conduct of foreign policy, and China’s second opening to the world, after Deng Xiaoping’s famous 1978 “Reform and Open Up.” China’s finance is welcomed in low-income and emerging-market economies that need infrastructure development. For some, BRI is China’s effort to connect with the world and a way to showcase China’s development experience to low-income countries. But others see BRI as a form of new colonialism; China is accused of conducting “debt-trap diplomacy,” although careful research finds such allegations having no credible base.

What Is BRI’s Future?

Two sets of issues will reposition the initiative for the coming years. The first is of technical nature relating to recent experiences in project implementation. The second is macro in scope, concerning the exposure and impact of China’s official lending toward debtor countries and the sovereign debt restructuring.

With regard to BRI project implementation, questions have been raised around all phases of BRI-financed projects. There has been concern that projects have been selected under political interference, and costs were found to be outsized relative to expected benefits.

There are suggestions that low-carbon green finance options should be prioritized, project preparation should allocate sufficient time for local community consultation to assess and mitigate the project’s environmental and social impacts, and foreign contractors (Chinese mostly) need to fully engage local contractors and employ local laborers during construction.

Open, Green and Clean?

The BRI has offered some practical measures to address some of the project design and implementation concerns. The project-level concerns started to be taken up before the COVID-19 pandemic. The open, green, and clean policy is in the BRI’s updated guidelines. The BRI program focuses on quality and stipulates zero tolerance to corruption. The Ministry of Finance introduced (jointly with 28 other nations) BRI green finance guidelines and a BRI debt sustainability framework. In September 2021, President Xi pledged that China would no longer finance coal projects in its overseas investments.

China has also worked with others on multilateral processes for BRI implementation. The Ministry of Foreign Affairs leads an international advisory council on BRI implementation monitoring. The Ministry of Ecology and Environment convenes the BRI International Green Coalition Council of world experts from developing and developed countries to advise on green infrastructure finance.

The Ministry of Finance sponsors the multilateral cooperation center for development finance, which is tasked to finance project preparation, capacity development and knowledge-sharing in BRI-participating countries. But continuing effort will be needed to strengthen the institutional effectiveness of multilateral processes.

Macro Challenges Are Crowding In

At macro level, however, the confluence of factors such as pandemic, the Russia-Ukraine conflict, the worsening global economic scenario, and China’s economic downturn is compounding the challenge of repositioning the future of the BRI. Two broad issues are the exposure of China’s overseas loan portfolio toward debt countries and China’s participation in the multilateral platform for sovereign debt restructuring.

The scale of China’s lending has increased. There was a surge of financing when the BRI was announced in 2013, but the volumes of BRI lending appear to have been in decline since 2017. The BRI now increasingly emphasizes “high-quality investment,” including through greater use of project finance, risk mitigation tools and green finance. And also there appears to be a change of destination.

One estimate suggests that the share of China’s total credit portfolio to borrowing countries in distress has increased from about 5% in 2010 to 60% at present.

With these changes, the precise magnitude of China’s overseas lending remains unsettled. China does not provide details on the direct lending activities of its Belt and Road initiatives, and China’s lending and credit relationships are opaque.

China’s Credit Lending Remains Opaque

Research estimates suggest that about half of China’s lending to developing countries is not recorded in the main international databases.

The debt sustainability assessment (DSA) that IMF and the World Bank conduct for low-income countries is based on the accuracy of the countries’ external debt profile. The DSA benchmarks the determination of debt-restructuring scenarios. The mismeasurement of external debt thus has potentially significant consequences for developing countries that borrowed heavily from Chinese official creditors.

With the risk of systemic debt crisis looming, the authorities’ willingness to report their data is essential for coordinated debt restructuring to go forward.

The Russia-Ukraine conflict significantly increases the exposure of China’s overseas loan portfolio toward debtor countries with an increasing risk profile. It is estimated that close to 20% of China’s overseas lending during the past two decades are accounted for by Russia, Ukraine and Belarus.

Large Amount of Distressed Debt

Further, almost 60% of low-income countries are now in distress or at high risk. Chinese official creditors now hold a large amount of potentially distressed debt. One estimate suggests that the share of China’s total credit portfolio to borrowing countries in distress has increased from about 5% in 2010 to 60% at present.

China has become the most important player in international sovereign debt renegotiations. Recent research finds that restructuring of Chinese debts are surprisingly frequent. Chinese lenders only grant limited debt relief. And China’s approach today follows the practices of the Western creditors in the 1980s and 1990s: to reschedule the same debts repetitively, which has caused the continuing problem of debt overhang.

China has been adapting its debt restructuring practices. It has contributed to the G-20 Debt Services Suspension Initiative. Now, China participates in the G-20 Common Framework for Debt Treatment for low-income countries.

The Process of Sovereign Debt Restructuring Likely to Be Long

Zambia is the first case where China and France co-chaired the Official Creditors Committee, which has resulted in Zambia obtaining the IMF’s assistance package. On the premise that ensuing debt renegotiations proceed effectively, Zambia will be looked to as a template for China and other creditors to work jointly for other low-income countries seeking debt relief.

Similarly for emerging market countries, how Sri Lanka’s debt restructuring proceeds will be a good practice to adopt for other countries.

China is most likely to take part in the process, especially as the sample cases of Zambia and others provide necessary space for China to exert its influence as a major official creditor but not a member of the Paris Club.

It is almost certain that the BRI as a brand name for China to continue supporting infrastructure finance in low-income and emerging market economies will stay. Its geopolitical value is singularly important for China. But the technical and macro issues discussed above will lead to a repositioning of the BRI’s scale and mode of operations.