Airline Fleets Are Back in Growth Mode with a Focus on Sustainability

Air travel is returning to its pre-pandemic levels as travelers are increasingly vaccinated and grow tired of the pandemic.

Photo: Pexels

After two years of the pandemic, rising COVID-19 case counts no longer deter travel-hungry consumers. In advanced economies, the dissemination of vaccines and boosters has made the public more comfortable — even enough to forgo wearing masks onboard planes. In the United States, air passenger traffic through the Transportation Security Administration checkpoints at the nation’s airports peaked at 93% of pre-pandemic levels on March 20 and has remained above 90% ever since.

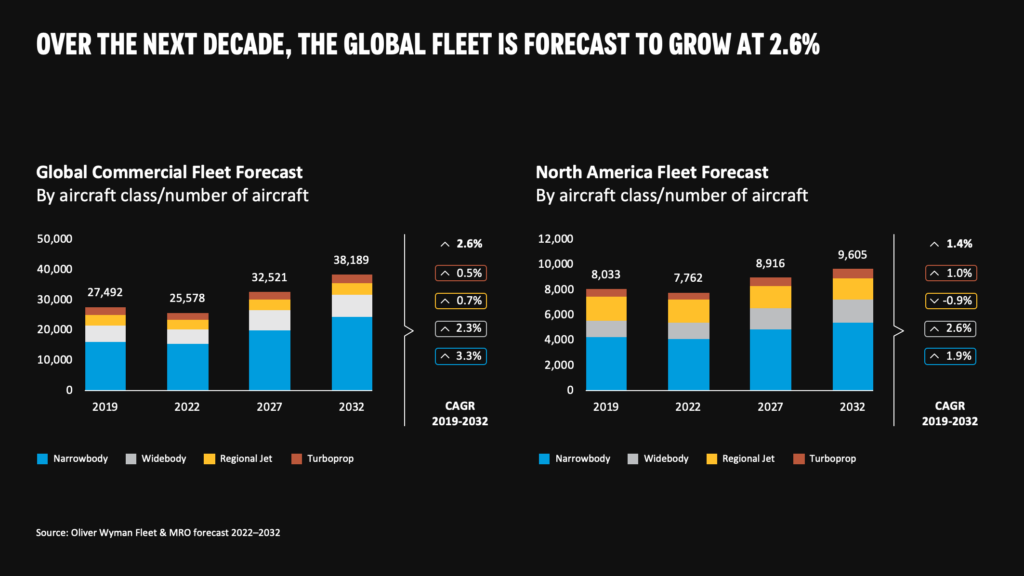

The aviation industry is slowly returning to historical growth patterns. That includes the global aviation fleet and spending on its upkeep, which are both expanding again. Oliver Wyman’s Global Fleet and MRO Forecast predicts the number of aircraft in the fleet will grow from its current 25,578 to 38,189 a decade from now. The North American fleet alone will grow from 7,762 to 9,605 — 99% of where the fleet stood pre-COVID.

Sustainability and Narrowbodies Rule

Fueling this fleet growth is a push by aerospace manufacturers to increase production, particularly of narrowbody aircraft. By mid-decade, aerospace production will exceed the peak reached in 2018, dominated by narrowbodies. The share of narrowbodies in the global fleet will grow from 58% today to 64% by 2032.

In pursuit of these younger, more efficient airliners, more than 40% of the North American fleet is expected to be retired over the next decade.

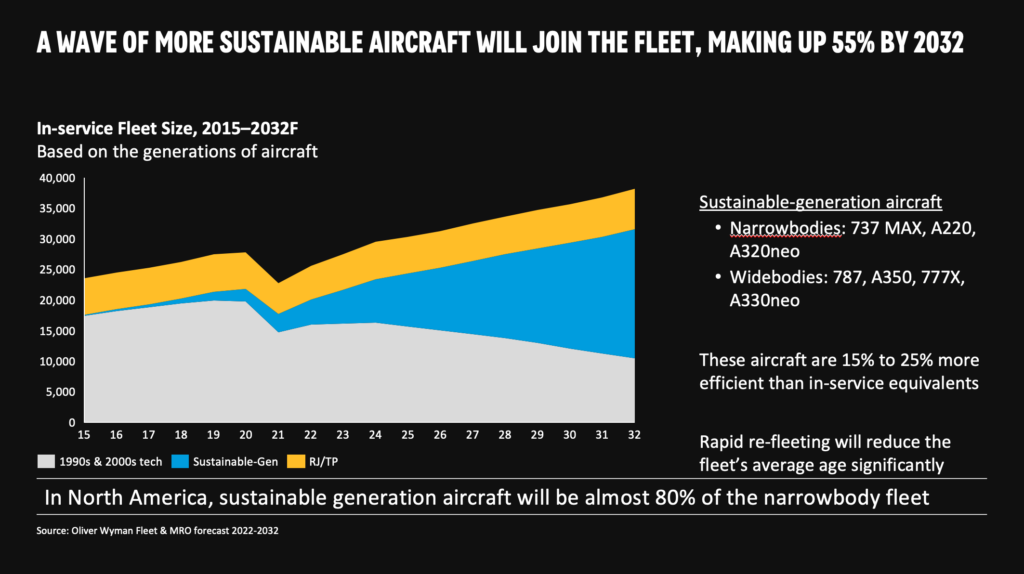

Additionally, airlines want to “refleet” to incorporate newer sustainable-generation aircraft that burn fuel more efficiently and accommodate higher percentages of non-carbon sustainable aviation fuel (SAF) — the tools the industry will eventually use to cut its greenhouse gas emissions. These new sustainable-generation aircraft are anywhere from 15% to 25% more efficient than the aircraft they will replace.

In pursuit of these younger, more efficient airliners, more than 40% of the North American fleet is expected to be retired over the next decade. By the end of the 10 years, eight of 10 new narrowbodies in the North American fleet will be sustainable-generation.

Global spending on maintenance, repair, and overhaul (MRO) will reach $126 billion by 2032, up from more than $79 billion this year. At a compound annual growth of about 2.6%, that’s back to where it used to be before we ever heard of COVID-19. Spring will come close to matching 2019 (pre-COVID-19 levels) in 2023. That said, both the size pf the fleet and MRO spending will reach these levels a couple of year after they were projected to pre-COVID.

Labor, Inflation and Sustainability

No doubt, COVID took its bite. Between 2020 and 2030, more than $160 billion in MRO spending was lost to the effects of the pandemic. And the bumpy ride hasn’t ended yet for the industry, although COVID is no longer necessarily the main perpetrator. Looking forward, 85% of the more than 150 senior aviation executives Oliver Wyman surveyed identified difficulty finding workers as their biggest headache. Already labor shortages are causing delays and flight cancellations, and that squeeze is expected to get tighter as demand and the fleet continue to grow.

The second biggest obstacle to growth and efficient operations, cited by the executives, is the rising cost of doing business. Inflation is pushing up the cost of parts, aircraft, and fuel. Inflation stems from the very fast rebound global economies experienced coming out of COVID. The U.S. had an economic growth rate in 2021 of well over 5% — higher than any year in recent history with the unemployment rate falling below 4% and good paying jobs being created. Of course, the recent invasion of Ukraine and sanctions on Russia are putting more pressure on the already tight supplies of oil, titanium, and many other raw materials critical to aviation.

A new challenge has made its way onto the list of top concerns of aviation executives — sustainability imperatives. It would be fair to say that many of the executives weren’t entirely sure how decarbonization would affect their business, but almost all of the managers surveyed recognized sustainability as a top priority moving forward.