Conflict-Fueled Surge in Food Prices to Hit Poorer Nations Hardest

A woman sells strawberries in Mahalla el-Kubra, Egypt. Rising food prices fueled by Russia's invasion of Ukraine—particularly high wheat prices—will hit countries like Egypt the hardest.

Photo: Carsten Koall/Getty Images

Global food prices are poised to keep climbing even after jumping to a record in February, placing the heaviest burden on vulnerable populations while adding to headwinds for the global economic recovery.

Food commodity prices rose 23.1% last year, the fastest pace in more than a decade, according to inflation-adjusted figures from the United Nations Food and Agriculture Organization. February’s reading was the highest since 1961 for the gauge tracking prices for meat, dairy, cereals, oils, and sugar.

Now, the crisis in Ukraine and sanctions on Russia are upending shipments and possibly production for two of the world’s largest agricultural producers. The two countries account for nearly 30% of world wheat exports and 18% of corn, most of which is shipped through Black Sea ports that are now closed. Wheat futures traded in Chicago, the global benchmark, recently rose to a record.

Lower-Income Households Are Impacted Most

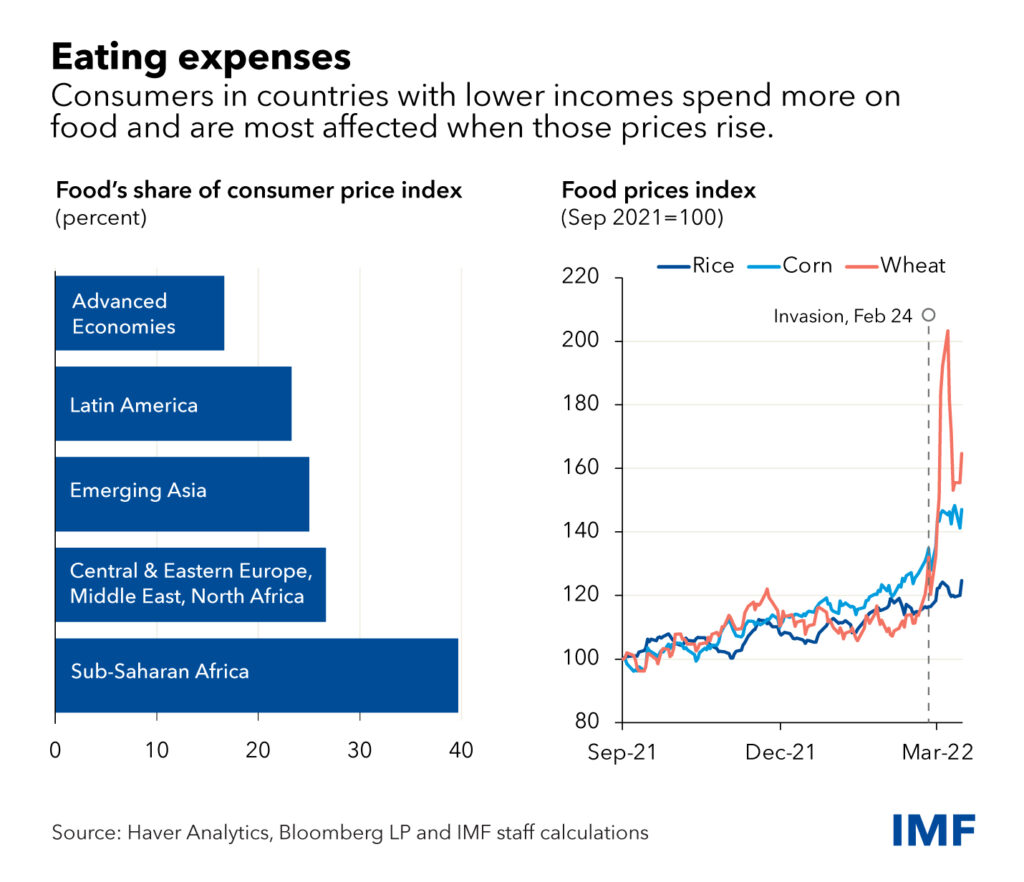

The below chart shows how price shocks will have a worldwide impact, especially on poor households for whom food is a higher share of expenses. Food costs account for 17% of consumer spending in advanced economies, but 40% in sub-Saharan Africa. Though this region is highly import-dependent for wheat, the grain constitutes only a minor share of the total caloric needs.

Differences in diet are also significant. In Europe, where bread is deeply embedded in many aspects of its culture, wheat makes up about a quarter of diets. In Southeast Asia, wheat accounts for only 7% versus 42% for rice, for which price increases so far have been relatively contained. Country-level averages, however, mask substantial differences within nations as poor households tend to eat more cereals but less meat, vegetables, and fruits compared with middle-income households.

Will the US and China Intervene?

Finally, disruption may be even greater for countries with close trade links to Russia and Ukraine, including in Eastern Europe, the Caucasus, and Central Asia. High wheat prices will weigh even more on economies in the Middle East and North Africa, such as Egypt, which are especially reliant on Russian exports.

Looking forward, reduced fertilizer supplies and higher oil prices will increase costs for harvesting, transporting and processing food. Policymakers must prevent those pressures from fueling food insecurity by avoiding protectionism and increasing social assistance for the poorest.

The world may also call upon the two largest economies if the situation worsens. In the United States, where about 40% of corn production goes to ethanol, policymakers could reassess that use. And China, which holds more than half of global wheat and corn reserves, could consider releasing supplies to lower prices.

A version of this article originally appeared in the IMF Blog.