Latin America Is Becoming China’s Backyard

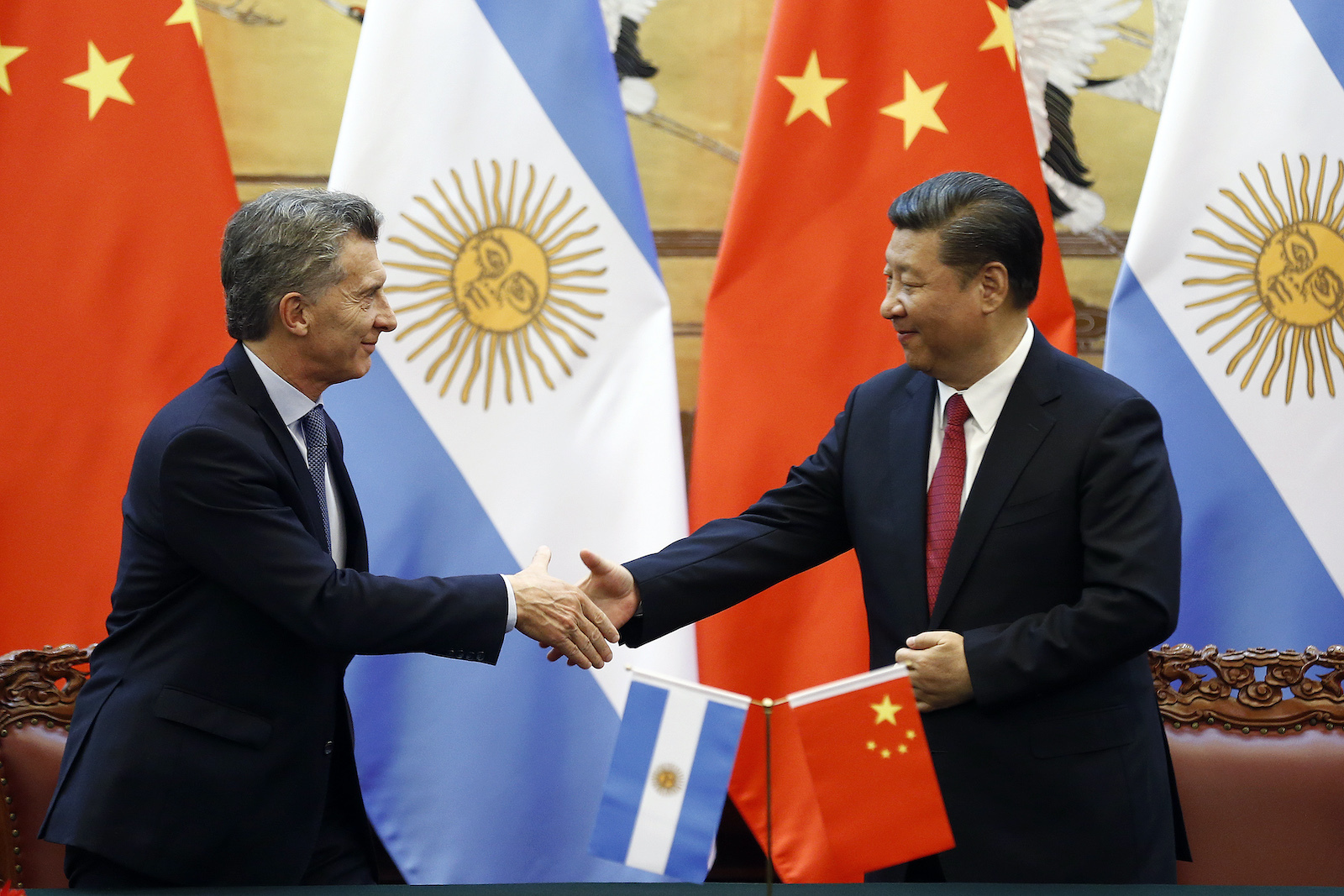

Chinese President Xi Jinping and Argentina's President Mauricio Macri attend a signing ceremony at the Great Hall of the People on May 17, 2017 in Beijing, China. Macri was on a state visit to China after attending the Belt and Road Forum.

Photo: Damir Sagolj/Pool/Getty Images

Growing economic needs, Chinese ambition, and hard cash are giving China a stronger and stronger foothold in Latin America. The underlying reasons for China’s success include China’s domestic demand for Latin American agriculture and mining and raw materials, and the U.S.’s inability to take a concerted interest in the region, along with the political turmoil in Washington. The old idea, enshrined in the Monroe Doctrine, that Latin America is “America’s backyard,” over which it could dominate, has been relegated to the dustbin of history.

The Monroe Doctrine Has Been Replaced

It is hard not to be impressed by the extent of China’s growing economic footprint in the region. Last year, China’s trade with Latin America reached $450 billion compared to $180 billion in 2010. According to the World Economic Forum, “on the current trajectory, LAC-China trade is expected to exceed $700 billion by 2035, more than twice as much as in 2020.”

As a result, China is now the largest trading partner for many South American countries, including Peru, Chile and Argentina. This is a particularly impressive feat, considering that at the beginning of the century in 2000, Chinese trade with the region was only 2%.

Chinese trade with the region is boosted by commerce in the natural resources and raw materials that the Asian giant needs for its growing economic footprint and agricultural goods — such as soybeans needed to assure sustenance for its massive population.

It’s Not Just Trade

Diplomatic, cultural, military, financial and investment ties are everywhere. Twenty of 33 nations in Latin America and the Caribbean have joined China’s Belt and Road Initiative. Some of the signing ceremonies were accompanied by pomp and circumstance, such as Argentine President Alberto Fernández’s visit to China earlier this year, when he attended the Beijing Winter Olympics and held a grand signing ceremony with President Xi Jinping.

The BRI partnership opens the door not only to greater trade but also investment, as among other things, the agreement makes it easier for “Chinese banks and companies … to fund and build roads, power plants, ports, railways, 5G networks, and fiber-optic cables around the world.” Chinese investments in the region have also grown rapidly, especially in strategic sectors such as mining and power generation. In 2020, direct foreign investments from China in the region amounted to $17 billion, with most of it focused on a few countries such as Brazil, Argentina and Mexico.

China has also become a leading lender to the major oil-producing countries of the region, such as Venezuela and Ecuador. Chinese investment has focused on extractive industries, but according to the IMF, is “increasingly tilted towards manufacturing and services industries such as transport, electricity, financial services and information and communication technology (ICT).”

COVID Diplomacy

Beyond trade and investment, China has engaged in aggressive diplomacy in the region at a time when U.S. leaders have been looking elsewhere. During the COVID pandemic, China rushed to provide many countries in the region with Chinese-made vaccines against the coronavirus as well as PPE equipment. President Xi has also been a frequent visitor to the region, making 11 trips to Latin America since 2012, compared to one trip from former President Donald Trump and none for President Biden.

Beyond trade and investment, China has engaged in aggressive diplomacy in the region at a time when U.S. leaders have been looking elsewhere.

While China has stepped in to bring needed investment and trade to the region, its presence comes at a price. The Chinese regime doesn’t prioritize democracy or civil rights, and investment is often at the expense of poor environmental, labor and human rights standards. A report from The Collective on Chinese Financing and Investments, Human Rights and the Environment found that “many of the projects backed by China are also some of the most egregious violators of human rights and environmental law. They neglect the needs of local and Indigenous communities and contribute to deforestation and pollution.”

While China has the economic muscle and strategic desire to maintain a presence in the long run, it also has challenges in the region. A major one is the pandemic-created awareness that new supply chains need to be diversified, and geographic proximity of suppliers is not as insignificant as believed.

US Nearshoring Is a Counter to Chinese Dominance

There is a new bipartisan desire in the U.S. Congress and the White House to expand U.S. investments in the region to potentially grow manufacturing supply chains closer to the U.S. mainland. And, Latin governments are picking up on it: Just listen to Caribbean governments explain to U.S. manufacturers the attractiveness of locating their next factory just a four-day ship’s travel away from Miami. Such a decision would help to boost U.S. investments in the region and create a new economic interdependence.

U.S. regulators are increasingly focused on slowing China’s technological expansion, with new laws now both restricting exports and imports. This places new pressure on Latin governments to exercise caution as to which technologies they buy from China.

The U.S. could do more to enhance and use the advantages of its close cultural ties with the region, developed over decades of closeness and the large number of Latin American immigrants in the U.S. Leveraging the economic, cultural and language power of Latinos from Los Angeles to Miami is a win-win situation, a phrase popular with Chinese government officials.

The US Needs to Look Beyond Immigration

There is a growing chorus of voices in the United States warning about the need to have a more robust response to China’s presence in the region, but a thoughtful U.S. agenda for the region is sorely lacking. Ask any Latin American government official, and you’ll find a tired exasperation with languid responses from U.S. government counterparts to both threats and opportunities in the region.

The U.S. focus on Latin America needs to move beyond a preoccupation with immigration to look at creating new forms of trade and investment that take the current relationship up to a new level. Chief among these is how to position the U.S. trade relationship in areas such as renewable energies, strategic minerals, such as Lithium, and information technologies. Focusing on these growing and innovative sectors will open new doors.